- Hong Kong

- /

- Interactive Media and Services

- /

- SEHK:1917

Discovering Opportunities: Doumob And 2 Other Global Penny Stocks

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by mixed performances across major indices and cautious monetary policies, investors are increasingly seeking opportunities beyond traditional growth stocks. Penny stocks, though sometimes considered niche, continue to offer intriguing prospects for those willing to explore smaller or newer companies with strong financial foundations. In this article, we will highlight three global penny stocks that stand out for their potential to combine value and growth in today's evolving market conditions.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.48 | HK$915.41M | ✅ 4 ⚠️ 1 View Analysis > |

| LexinFintech Holdings (NasdaqGS:LX) | $3.61 | $666.32M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.89 | A$444.16M | ✅ 4 ⚠️ 3 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.50 | HK$2.07B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.06 | SGD429.61M | ✅ 4 ⚠️ 2 View Analysis > |

| Deleum Berhad (KLSE:DELEUM) | MYR1.20 | MYR481.86M | ✅ 4 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.35 | SGD13.18B | ✅ 5 ⚠️ 1 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.68 | $395.3M | ✅ 4 ⚠️ 2 View Analysis > |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.52 | MYR2.59B | ✅ 5 ⚠️ 0 View Analysis > |

Click here to see the full list of 3,579 stocks from our Global Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Doumob (SEHK:1917)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Doumob (SEHK:1917) is an investment holding company that offers online advertising services in the People's Republic of China, with a market cap of HK$225.40 million.

Operations: The company generates revenue primarily from Marketing Services, amounting to CN¥49.66 million.

Market Cap: HK$225.4M

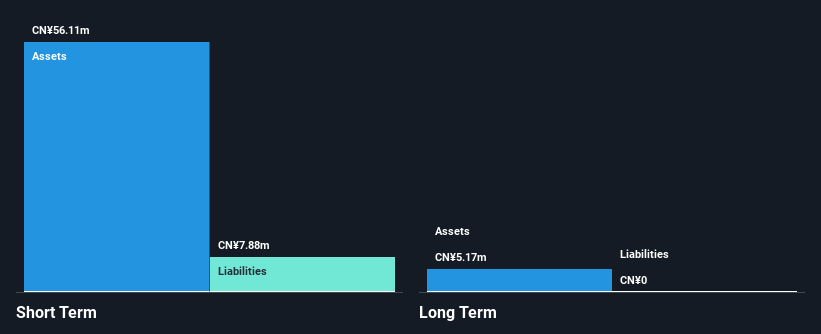

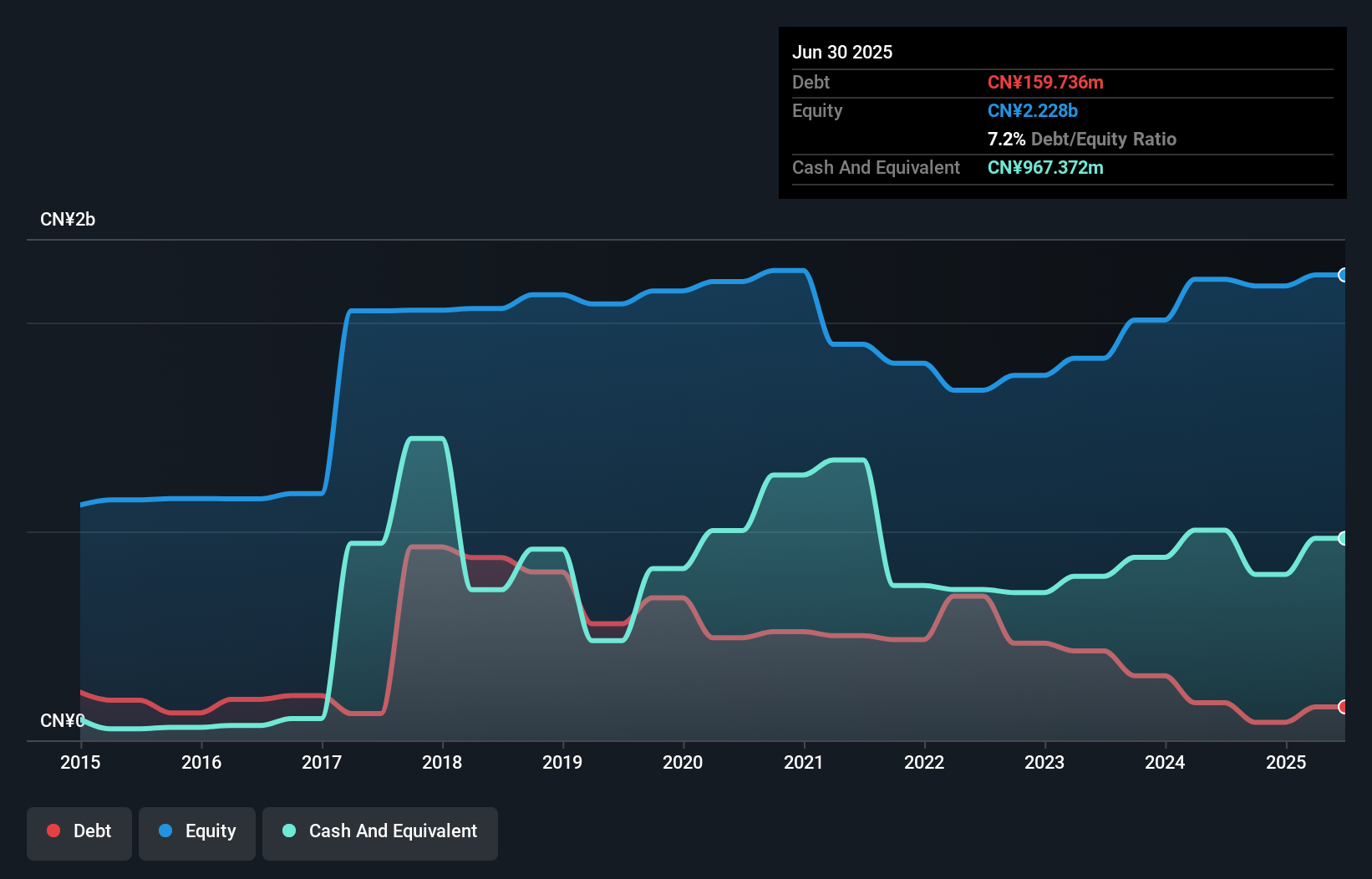

Doumob, an investment holding company in China, has a market cap of HK$225.40 million and generates revenue primarily from marketing services amounting to CN¥49.66 million. Despite being unprofitable, Doumob has no long-term liabilities and is debt-free with sufficient cash runway for over three years based on current free cash flow. The company's board is experienced with an average tenure of 5.8 years, although the management team is relatively new with only one year of average tenure. Recent earnings reported a net loss increase to CN¥11.85 million for the half-year ended June 2025 compared to the previous year.

- Get an in-depth perspective on Doumob's performance by reading our balance sheet health report here.

- Understand Doumob's track record by examining our performance history report.

Jutal Offshore Oil Services (SEHK:3303)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Jutal Offshore Oil Services Limited is an investment holding company that fabricates facilities and provides integrated services for the oil and gas, new energy, and refining and chemical industries, with a market cap of HK$1.30 billion.

Operations: The company's revenue comprises CN¥883.16 million from the fabrication of facilities and provision of integrated services for the oil and gas industries, and CN¥339.88 million from similar activities in the new energy and refining and chemical sectors.

Market Cap: HK$1.3B

Jutal Offshore Oil Services Limited, with a market cap of HK$1.30 billion, has demonstrated financial stability despite recent challenges. The company reported a significant drop in revenue to CN¥428.27 million for the half-year ended June 2025 compared to the previous year, impacting net income and profit margins. However, it maintains a strong balance sheet with short-term assets exceeding both short and long-term liabilities and more cash than total debt. The management team is seasoned with an average tenure of 5.6 years, while shareholders have not faced meaningful dilution recently, suggesting prudent capital management practices amidst industry volatility.

- Unlock comprehensive insights into our analysis of Jutal Offshore Oil Services stock in this financial health report.

- Learn about Jutal Offshore Oil Services' historical performance here.

Petchsrivichai Enterprise (SET:PCE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Petchsrivichai Enterprise Public Company Limited is engaged in the production and distribution of crude palm kernel oil both in Thailand and internationally, with a market capitalization of THB6.99 billion.

Operations: There are no reported revenue segments for Petchsrivichai Enterprise Public Company Limited.

Market Cap: THB6.99B

Petchsrivichai Enterprise, with a market cap of THB6.99 billion, faces challenges in profitability and revenue growth. Recent earnings show a decline in quarterly sales to THB6.92 billion from THB8.79 billion year-over-year, with net income also decreasing significantly. Despite these challenges, the company maintains financial resilience with short-term assets exceeding both short and long-term liabilities and satisfactory debt levels indicated by a net debt to equity ratio of 0.4%. However, the dividend yield of 5.91% is not well covered by free cash flows, highlighting potential sustainability concerns amidst industry pressures.

- Click here and access our complete financial health analysis report to understand the dynamics of Petchsrivichai Enterprise.

- Explore Petchsrivichai Enterprise's analyst forecasts in our growth report.

Summing It All Up

- Gain an insight into the universe of 3,579 Global Penny Stocks by clicking here.

- Searching for a Fresh Perspective? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1917

Doumob

An investment holding company, provides online advertising services in the People's Republic of China.

Flawless balance sheet with very low risk.

Market Insights

Community Narratives