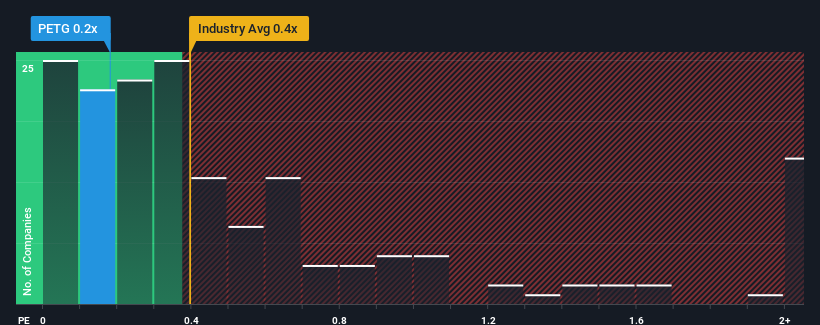

It's not a stretch to say that Petrol d.d.'s (LJSE:PETG) price-to-sales (or "P/S") ratio of 0.2x right now seems quite "middle-of-the-road" for companies in the Specialty Retail industry in Slovenia, where the median P/S ratio is around 0.4x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Petrol d.d

What Does Petrol d.d's P/S Mean For Shareholders?

For instance, Petrol d.d's receding revenue in recent times would have to be some food for thought. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Petrol d.d will help you shine a light on its historical performance.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Petrol d.d would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 29% decrease to the company's top line. Even so, admirably revenue has lifted 116% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 7.4% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it interesting that Petrol d.d is trading at a fairly similar P/S compared to the industry. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

What Does Petrol d.d's P/S Mean For Investors?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We didn't quite envision Petrol d.d's P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

You need to take note of risks, for example - Petrol d.d has 2 warning signs (and 1 which is potentially serious) we think you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LJSE:PETG

Petrol d.d

Through its subsidiaries, sells petroleum and other energy products, merchandise and services, and energy and solutions in Slovenia, Croatia, Austria, Bosnia, Herzegovina, Serbia, Montenegro, Romania, Macedonia, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives