SBS Transit Ltd's (SGX:S61) dividend is being reduced to S$0.025 on the 26th of May. However, the dividend yield of 2.8% is still a decent boost to shareholder returns.

Check out our latest analysis for SBS Transit

SBS Transit's Payment Has Solid Earnings Coverage

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. Prior to this announcement, SBS Transit's dividend was comfortably covered by both cash flow and earnings. This means that a large portion of its earnings are being retained to grow the business.

The next year is set to see EPS grow by 26.4%. Assuming the dividend continues along recent trends, we think the payout ratio could be 46% by next year, which is in a pretty sustainable range.

Dividend Volatility

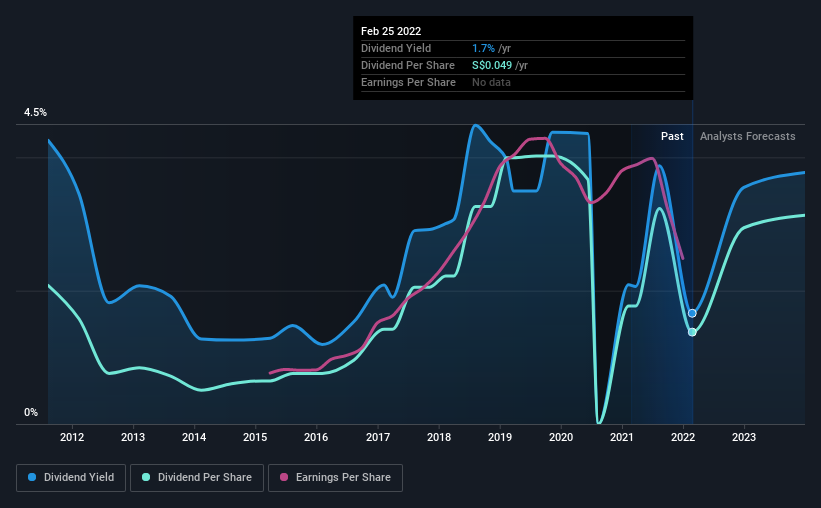

The company's dividend history has been marked by instability, with at least 1 cut in the last 10 years. Since 2012, the dividend has gone from S$0.074 to S$0.049. Doing the maths, this is a decline of about 4.0% per year. A company that decreases its dividend over time generally isn't what we are looking for.

The Dividend Looks Likely To Grow

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. SBS Transit has seen EPS rising for the last five years, at 10% per annum. Earnings are on the uptrend, and it is only paying a small portion of those earnings to shareholders.

SBS Transit Looks Like A Great Dividend Stock

Overall, we think that SBS Transit could be a great option for a dividend investment, although we would have preferred if the dividend wasn't cut this year. By reducing the dividend, pressure will be taken off the balance sheet, which could help the dividend to be consistent in the future. All in all, this checks a lot of the boxes we look for when choosing an income stock.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. Taking the debate a bit further, we've identified 1 warning sign for SBS Transit that investors need to be conscious of moving forward. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:S61

SBS Transit

Provides bus and rail public transportation services, and consultancy services relating to land transport in Singapore.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives