- Singapore

- /

- Transportation

- /

- SGX:S61

SBS Transit Ltd's (SGX:S61) CEO Compensation Is Looking A Bit Stretched At The Moment

Key Insights

- SBS Transit will host its Annual General Meeting on 24th of April

- CEO Jeffrey Sim's total compensation includes salary of S$384.0k

- The overall pay is 611% above the industry average

- Over the past three years, SBS Transit's EPS grew by 11% and over the past three years, the total shareholder return was 12%

Under the guidance of CEO Jeffrey Sim, SBS Transit Ltd (SGX:S61) has performed reasonably well recently. As shareholders go into the upcoming AGM on 24th of April, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. However, some shareholders may still be hesitant of being overly generous with CEO compensation.

See our latest analysis for SBS Transit

Comparing SBS Transit Ltd's CEO Compensation With The Industry

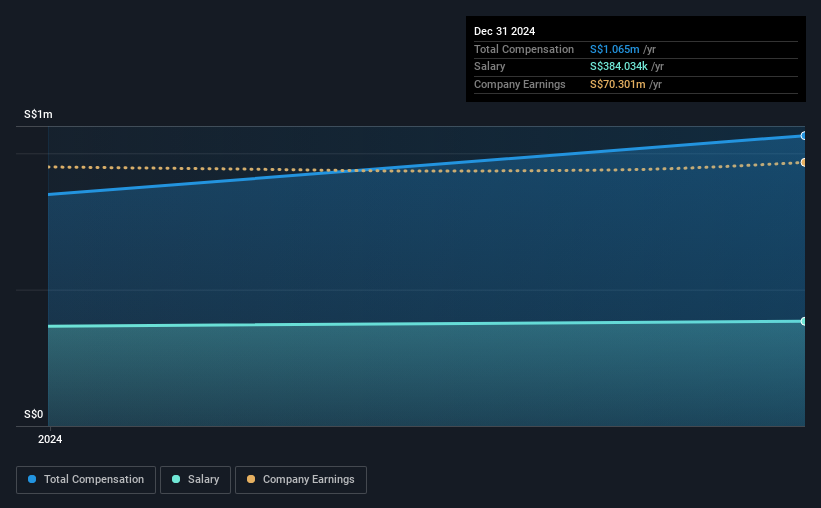

According to our data, SBS Transit Ltd has a market capitalization of S$915m, and paid its CEO total annual compensation worth S$1.1m over the year to December 2024. That's a notable increase of 25% on last year. While we always look at total compensation first, our analysis shows that the salary component is less, at S$384k.

On comparing similar companies from the Singapore Transportation industry with market caps ranging from S$525m to S$2.1b, we found that the median CEO total compensation was S$150k. Accordingly, our analysis reveals that SBS Transit Ltd pays Jeffrey Sim north of the industry median.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | S$384k | S$366k | 36% |

| Other | S$681k | S$483k | 64% |

| Total Compensation | S$1.1m | S$849k | 100% |

On an industry level, roughly 82% of total compensation represents salary and 18% is other remuneration. SBS Transit sets aside a smaller share of compensation for salary, in comparison to the overall industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

SBS Transit Ltd's Growth

SBS Transit Ltd's earnings per share (EPS) grew 11% per year over the last three years. It achieved revenue growth of 2.1% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's good to see a bit of revenue growth, as this suggests the business is able to grow sustainably. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has SBS Transit Ltd Been A Good Investment?

With a total shareholder return of 12% over three years, SBS Transit Ltd shareholders would, in general, be reasonably content. But they would probably prefer not to see CEO compensation far in excess of the median.

To Conclude...

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. However, if the board proposes to increase the compensation, some shareholders might have questions given that the CEO is already being paid higher than the industry.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. In our study, we found 2 warning signs for SBS Transit you should be aware of, and 1 of them is a bit unpleasant.

Important note: SBS Transit is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:S61

SBS Transit

Provides bus and rail public transportation services, and consultancy services relating to land transport in Singapore.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives