- Singapore

- /

- Infrastructure

- /

- SGX:S59

SIA Engineering (SGX:S59): Earnings Growth Accelerates, Challenges Cautious Dividend Narratives

Reviewed by Simply Wall St

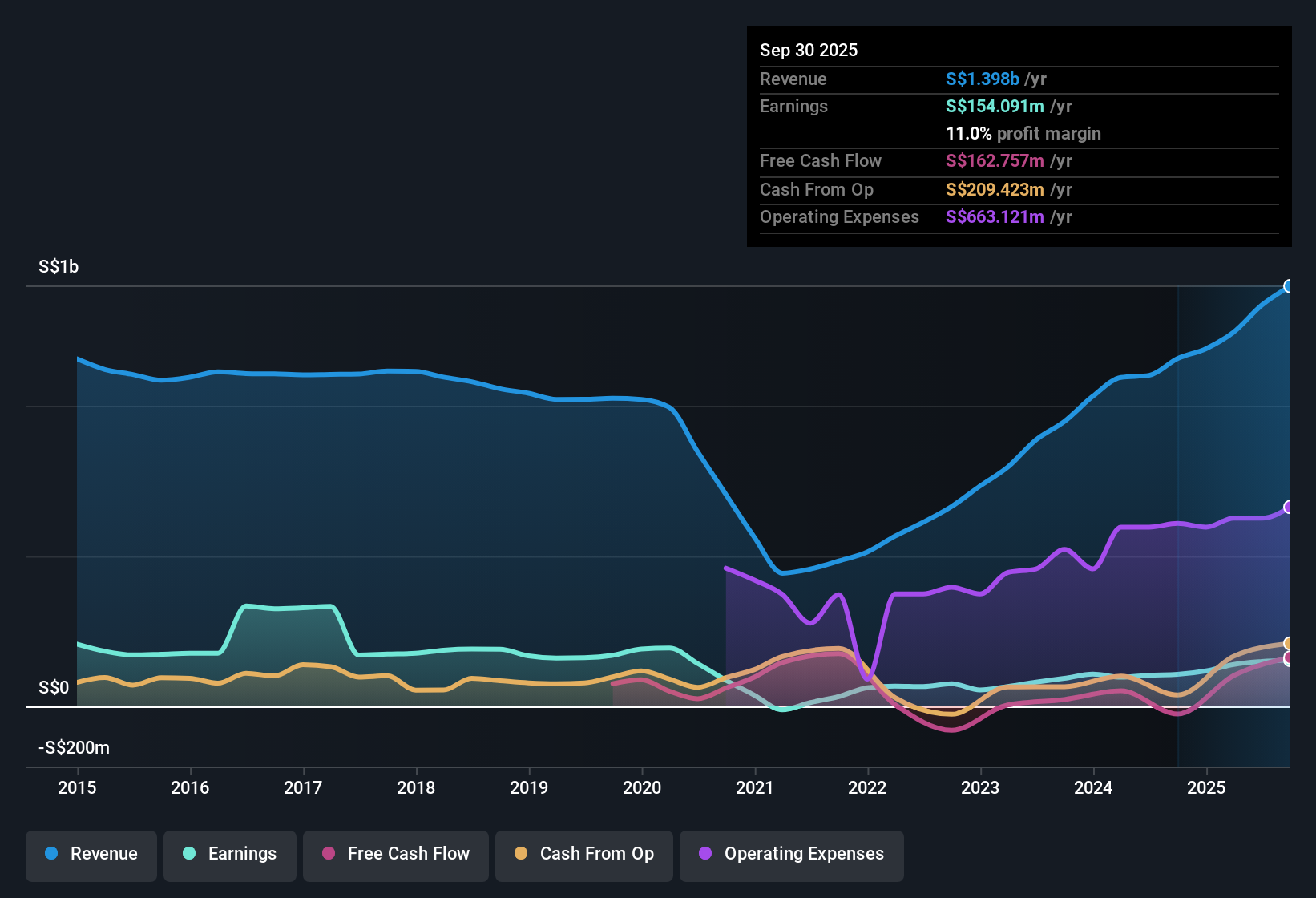

SIA Engineering (SGX:S59) just posted standout earnings, with adjusted net income growing at a breakneck 44.6% over the last year. This accelerates from a robust 29% annual growth measured over the past five years. Margins also ticked higher, with profitability climbing from 9.2% to 11%, and the company continues to deliver high quality earnings.

See our full analysis for SIA Engineering.Next up, we will weigh these headline numbers against the most widely followed investment narratives to see which perspectives hold up and which could be shaken by these results.

Curious how numbers become stories that shape markets? Explore Community Narratives

Growth Forecasts Outpace the Singapore Market

- Forward-looking projections show SIA Engineering's earnings are expected to grow at 9.4% per year and revenue at 6.1% per year, both ahead of the broader Singapore market averages.

- What stands out is that the bullish case gains traction with these forecasts for above-market growth, which:

- strongly supports arguments that the company’s track record of 29% annualized earnings growth over five years could continue, underpinned by improving margins.

- contrasts with sectors where recovery is slower and reinforces recent management commentary about SIA Engineering’s strategic advantages in partnership expansion and cost management.

Premium Valuation Versus Peers and Industry

- SIA Engineering trades at a Price-To-Earnings ratio of 25.5x, well above its peer average of 17.9x and the broader Asian Infrastructure industry at 14.1x, placing its shares at a premium despite robust growth numbers.

- Prevailing market analysis notes investors are willing to pay up for SIA Engineering’s mix of profitability and growth:

- however, the valuation gap suggests that expectations are high and further upside may be limited unless earnings continue to outpace sector averages.

- this price premium also serves as a reality check, challenging those who expect automatic multiples expansion and implying that future share price gains may require further operational surprises.

Dividend Sustainability Remains a Key Watch Point

- The latest filings point to continued investor concerns over dividend sustainability, even as SIA Engineering posts consistent profit and revenue gains.

- Diving into the risks flagged by analysts, questions around dividends remain prominent:

- because despite headline earnings growth and margin improvement, management has not explicitly signaled a stronger dividend trajectory.

- some critics highlight how elevated payout ratios or pressure to maintain distributions could constrain capital flexibility if growth moderates from recent highs.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on SIA Engineering's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite impressive earnings growth, SIA Engineering’s premium valuation and caution around dividend sustainability may leave investors questioning the upside from current levels.

If you’re concerned about paying up for uncertain dividend streams, discover stronger income opportunities through these 1991 dividend stocks with yields > 3% and keep your portfolio’s yield on track.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:S59

SIA Engineering

Engages in the provision of maintenance, repair, and overhaul (MRO) services in Singapore, Philippines, Japan, Malaysia, Cambodia, and the United States of America.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion