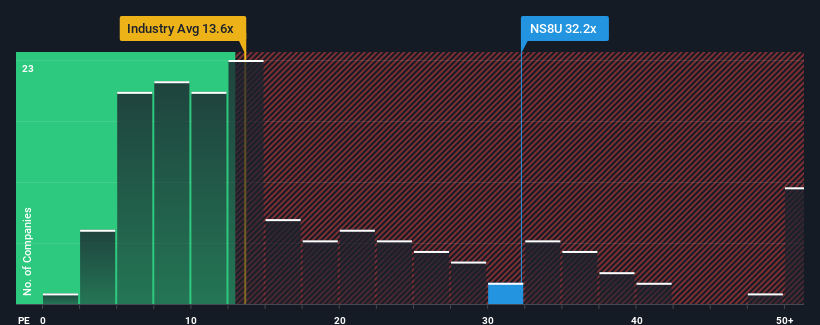

When close to half the companies in Singapore have price-to-earnings ratios (or "P/E's") below 11x, you may consider Hutchison Port Holdings Trust (SGX:NS8U) as a stock to avoid entirely with its 32.2x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

While the market has experienced earnings growth lately, Hutchison Port Holdings Trust's earnings have gone into reverse gear, which is not great. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

View our latest analysis for Hutchison Port Holdings Trust

Does Growth Match The High P/E?

In order to justify its P/E ratio, Hutchison Port Holdings Trust would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 38%. The last three years don't look nice either as the company has shrunk EPS by 79% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 33% per annum as estimated by the three analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 9.9% per annum, which is noticeably less attractive.

With this information, we can see why Hutchison Port Holdings Trust is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Hutchison Port Holdings Trust's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 3 warning signs for Hutchison Port Holdings Trust (1 is concerning!) that you should be aware of.

You might be able to find a better investment than Hutchison Port Holdings Trust. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Hutchison Port Holdings Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:NS8U

Hutchison Port Holdings Trust

Invests in, develops, operates, and manages deep-water container ports in Guangdong Province of the People’s Republic of China, Hong Kong, and Macau.

Solid track record with mediocre balance sheet.

Market Insights

Community Narratives