- Singapore

- /

- Marine and Shipping

- /

- SGX:L02

Manhattan Resources' (SGX:L02) Robust Earnings Are Not All Good News For Shareholders

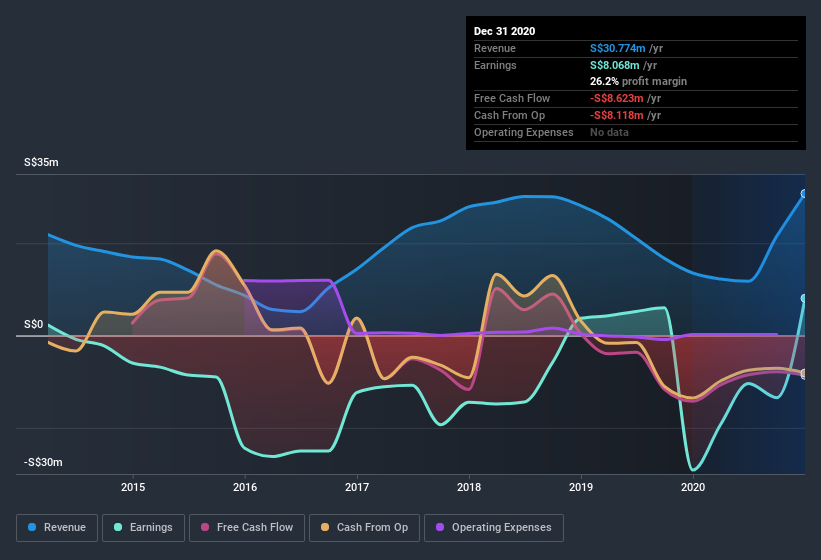

Despite posting strong earnings, Manhattan Resources Limited's (SGX:L02) stock didn't move much over the last week. We looked deeper into the numbers and found that shareholders might be concerned with some underlying weaknesses.

View our latest analysis for Manhattan Resources

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. As it happens, Manhattan Resources issued 163% more new shares over the last year. That means its earnings are split among a greater number of shares. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. Check out Manhattan Resources' historical EPS growth by clicking on this link.

How Is Dilution Impacting Manhattan Resources' Earnings Per Share? (EPS)

Three years ago, Manhattan Resources lost money. Therefore, one can observe that the dilution is having a fairly profound effect on shareholder returns.

If Manhattan Resources' EPS can grow over time then that drastically improves the chances of the share price moving in the same direction. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Manhattan Resources.

The Power Of Non-Operating Revenue

Most companies divide classify their revenue as either 'operating revenue', which comes from normal operations, and other revenue, which could include government grants, for example. Generally speaking, operating revenue is a more reliable guide to the sustainable revenue generating capacity of the business. However, we note that when non-operating revenue increases suddenly, it will sometimes generate an unsustainable boost to profit. As well as the aforementioned dilution, Manhattan Resources saw a spike in non-operating revenue, over the last year. In fact, our data indicates that non-operating revenue increased from -S$14.1k to S$21.6m. The high levels of non-operating revenue are problematic because if (and when) they do not repeat, then overall revenue (and profitability) of the firm will fall. In order to better understand a company's profit result, it can sometimes help to consider whether the result would be very different without a sudden increase in non-operating revenue.

Our Take On Manhattan Resources' Profit Performance

In the last year Manhattan Resources' non-operating revenue really gave it a boost, but not in a way that is necessarily going to be sustained. On top of that, the dilution means that its earnings per share performance is worse than its profit performance. For all the reasons mentioned above, we think that, at a glance, Manhattan Resources' statutory profits could be considered to be low quality, because they are likely to give investors an overly positive impression of the company. So while earnings quality is important, it's equally important to consider the risks facing Manhattan Resources at this point in time. To that end, you should learn about the 3 warning signs we've spotted with Manhattan Resources (including 2 which are significant).

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you’re looking to trade Manhattan Resources, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SGX:L02

Metis Energy

An investment holding company, operates as a renewable energy company.

Moderate risk with worrying balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion