Top Dividend Stocks To Consider Isewan Terminal Service And 2 Others

Reviewed by Simply Wall St

In a week marked by volatility and geopolitical tensions, global markets have been navigating through mixed signals, with U.S. corporate earnings and AI competition fears impacting stock performance. As investors seek stability amid fluctuating indices and economic shifts, dividend stocks offer a potential source of steady income, making them an attractive option for those looking to balance their portfolios in uncertain times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Totech (TSE:9960) | 3.81% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.32% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.06% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.90% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.47% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.57% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 3.96% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.01% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.68% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.96% | ★★★★★★ |

Click here to see the full list of 1974 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

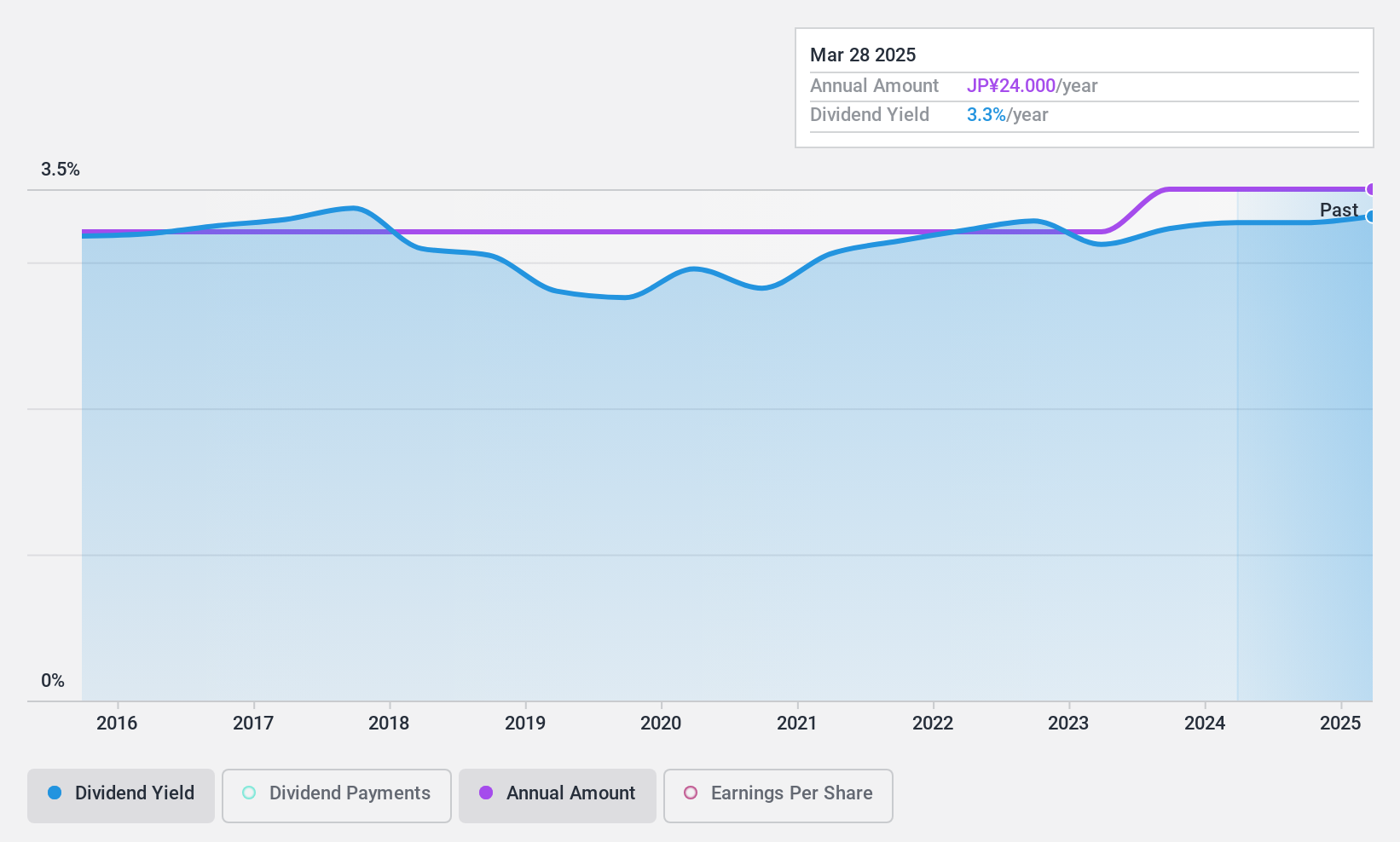

Isewan Terminal Service (NSE:9359)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Isewan Terminal Service Co., Ltd., along with its subsidiaries, offers a range of logistics services both in Japan and internationally, with a market cap of ¥18.39 billion.

Operations: Isewan Terminal Service Co., Ltd. generates revenue primarily from its Logistics Business segment, which accounts for ¥53.89 billion.

Dividend Yield: 3.2%

Isewan Terminal Service offers a stable dividend profile with a low payout ratio of 25.6%, indicating dividends are well covered by earnings and cash flows. Over the past decade, its dividends have grown consistently and remained reliable, though the yield of 3.17% is below Japan's top quartile of payers. The stock's price-to-earnings ratio at 8x suggests it may be undervalued compared to the broader Japanese market average of 13.5x.

- Delve into the full analysis dividend report here for a deeper understanding of Isewan Terminal Service.

- Our comprehensive valuation report raises the possibility that Isewan Terminal Service is priced higher than what may be justified by its financials.

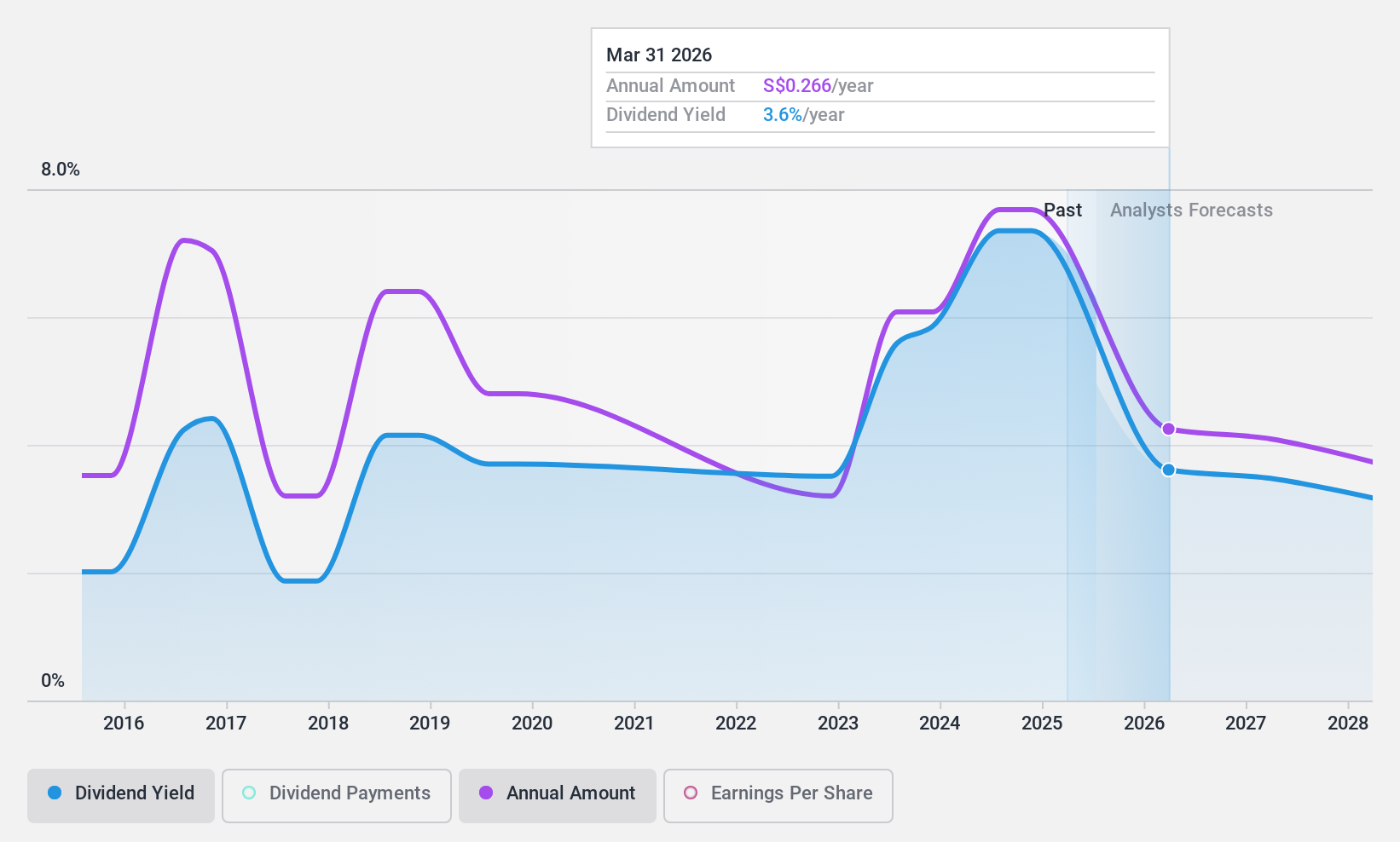

Singapore Airlines (SGX:C6L)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Singapore Airlines Limited, along with its subsidiaries, offers passenger and cargo air transportation services under the Singapore Airlines and Scoot brands across various regions including East Asia, the Americas, Europe, Southwest Pacific, West Asia, and Africa; it has a market cap of SGD19.09 billion.

Operations: Singapore Airlines Limited generates revenue from its Full Service Carrier (SGD16.52 billion), Low-Cost Carrier (SGD2.41 billion), and Engineering Services (SGD1.16 billion) segments.

Dividend Yield: 7.5%

Singapore Airlines' dividend profile shows a mixed picture. While the payout ratio of 86% indicates dividends are covered by earnings, and a cash payout ratio of 47.8% suggests strong cash flow coverage, the dividend has been volatile over the past decade. The recent interim dividend of SGD 0.10 per share reflects ongoing shareholder returns despite declining earnings forecasts. The company's investment in premium cabin upgrades could impact future financial flexibility for sustaining dividends at current levels.

- Unlock comprehensive insights into our analysis of Singapore Airlines stock in this dividend report.

- Our valuation report unveils the possibility Singapore Airlines' shares may be trading at a discount.

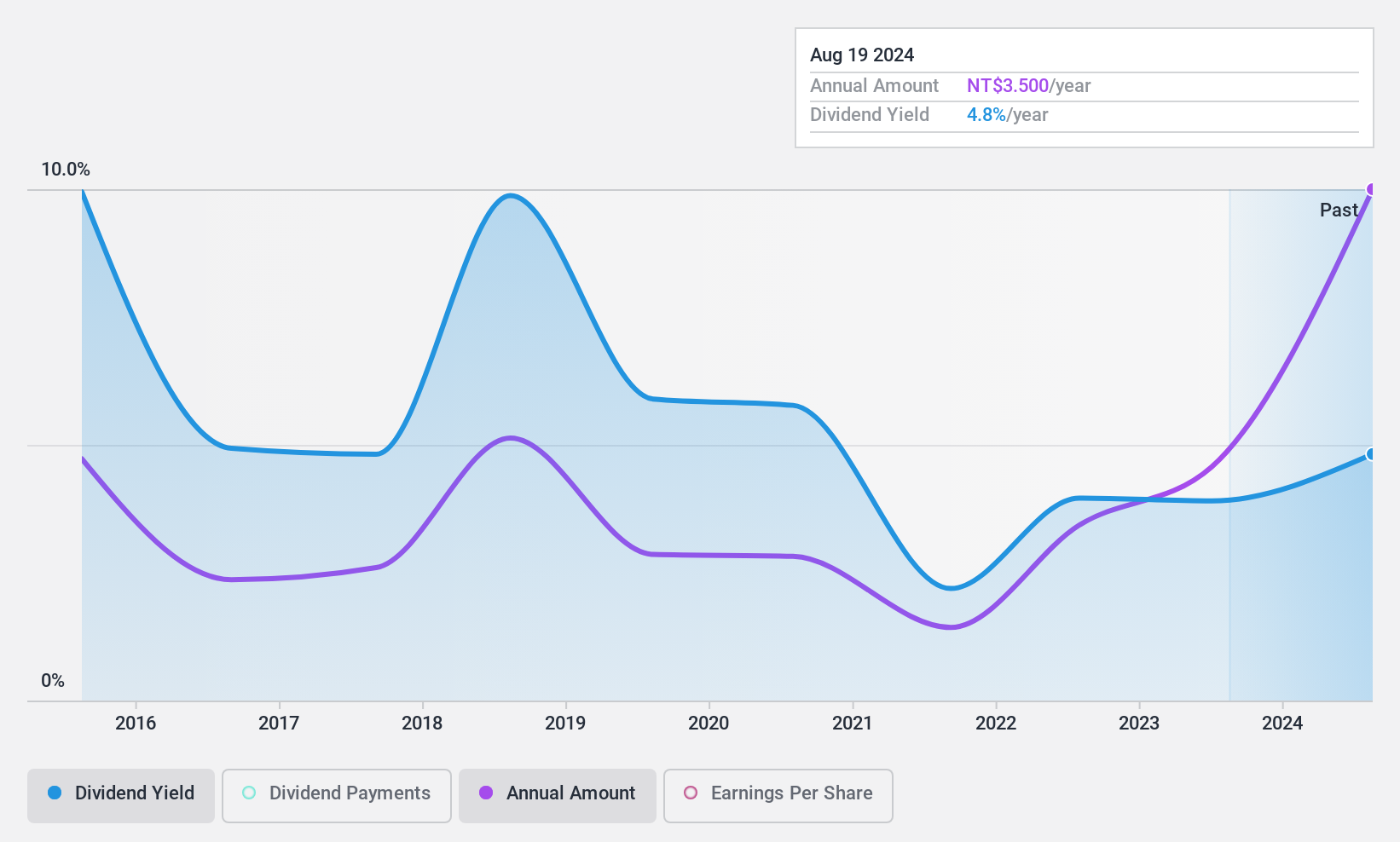

Advancetek EnterpriseLtd (TWSE:1442)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Advancetek Enterprise Co., Ltd. operates in Taiwan, focusing on the construction, rental, and sale of residential and commercial buildings, with a market cap of approximately NT$30.73 billion.

Operations: Advancetek Enterprise Co., Ltd.'s revenue is derived from its activities in the construction, rental, and sale of residential and commercial properties in Taiwan.

Dividend Yield: 4.2%

Advancetek Enterprise Ltd. demonstrates a strong earnings coverage for dividends with a payout ratio of 35.5% and cash flow coverage at 17.4%, indicating well-covered dividend payments. Despite substantial revenue growth, the company's dividend history has been unreliable and volatile over the past decade, which may concern investors seeking stability. Recent financial results show significant improvement in sales and net income, though high debt levels might affect future dividend sustainability.

- Click here and access our complete dividend analysis report to understand the dynamics of Advancetek EnterpriseLtd.

- In light of our recent valuation report, it seems possible that Advancetek EnterpriseLtd is trading behind its estimated value.

Turning Ideas Into Actions

- Get an in-depth perspective on all 1974 Top Dividend Stocks by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:C6L

Singapore Airlines

Together with subsidiaries, provides passenger and cargo air transportation services under the Singapore Airlines and Scoot brands in East Asia, Europe, South West Pacific, the Americas, West Asia and Africa, and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives