- Singapore

- /

- Marine and Shipping

- /

- SGX:5LY

Marco Polo Marine (SGX:5LY) Net Profit Margin Hits 47.6%, Challenging Cautious Market Narrative

Reviewed by Simply Wall St

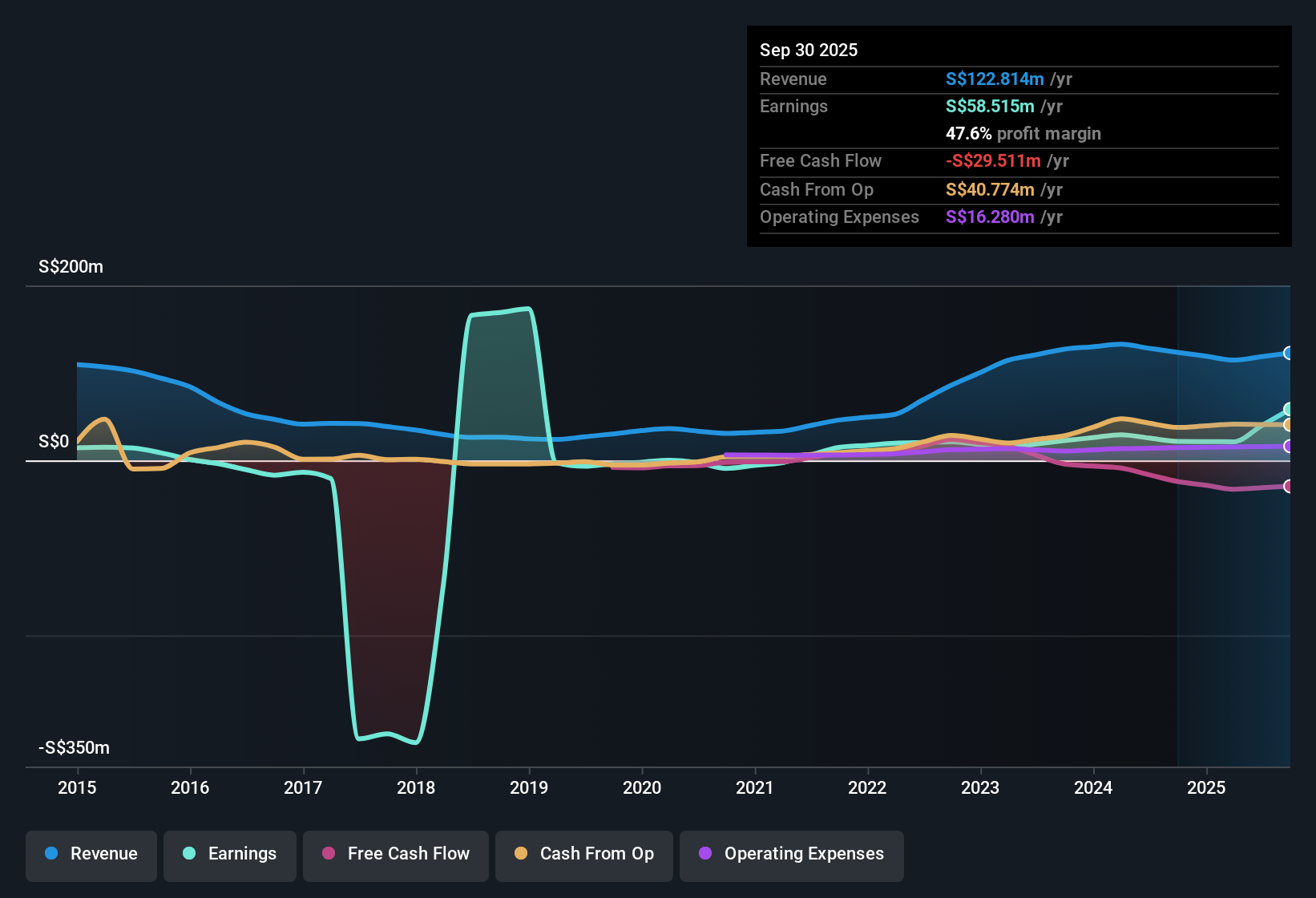

Marco Polo Marine (SGX:5LY) just released its FY 2025 first half results, reporting revenue of 52.688 million SGD and net income of 10.642 million SGD, with basic EPS at 0.0028 SGD. In context, the company has seen revenue shift from 61.571 million SGD in the first half of FY 2024 to 61.959 million SGD in the second half, before dipping to its latest figure. EPS moved from 0.0029 SGD to 0.00288 SGD over those same periods. Healthy profit margins continue to be a defining feature of these results, setting a high bar for investor expectations around operational strength.

See our full analysis for Marco Polo Marine.Next up, we will see how these results measure up against the community narratives on Simply Wall St and where the data might challenge popular market stories.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Profit Margins Jump to 47.6%

- Marco Polo Marine’s net profit margins increased to 47.6% for the trailing twelve months, up from last year’s 17.6%, as reported net income reached 58.5 million SGD on total revenue of 122.8 million SGD.

- This change strongly supports claims that operational improvements and cost controls have distinguished the business from peers,

- as consensus narrative notes, margins are now significantly higher than industry averages and

- the robust profit growth stands in contrast to typical sector cyclicality, underlining management’s execution on both core and new business lines.

For a side-by-side view of how the company’s decisive margin growth shapes analyst consensus, take a deeper dive into the full narrative. 📊 Read the full Marco Polo Marine Consensus Narrative.

Discounted Valuation Versus Peers

- The company is trading at a Price-to-Earnings ratio of 7.5x, noticeably below the Asian Shipping industry average, and the current share price of 0.117 SGD remains well under the DCF fair value estimate of 0.29 SGD.

- What is notable is the continued discount even as profitability rises, highlighting a tension in the consensus narrative between strong underlying performance and market pricing:

- while the robust net profit and margin expansion would typically prompt a valuation premium,

- the stock’s price lags peer multiples and its own fair value estimate, suggesting investors remain cautious about future earnings or risk factors that are not yet visible in the top-line figures.

Revenue Growth Outpaces Market but Profit Sustainability in Question

- Revenue growth is forecast at 23% per year, expected to outpace the broader Singapore market, but consensus expects average annual earnings to decline by 23% over the next three years.

- Critics highlight in the consensus narrative that, despite strong recent revenue expansion,

- the high proportion of non-cash earnings and projected decline in earnings per share mean headline growth may not translate into sustained profit,

- forcing investors to weigh margin improvements against the significant difference between short-term momentum and anticipated profit pressure.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Marco Polo Marine's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite impressive margin gains, Marco Polo Marine faces skepticism about sustaining profits. Consensus forecasts indicate declining earnings over the coming years.

If you want steadier opportunities, check out stable growth stocks screener (2075 results) to discover companies that have proven they can consistently deliver reliable results across changing markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:5LY

Marco Polo Marine

Operates as an integrated marine logistic company in Singapore, Indonesia, Taiwan, Thailand, Malaysia, and internationally.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026