- Singapore

- /

- Telecom Services and Carriers

- /

- SGX:CJLU

NetLink NBN Trust (SGX:CJLU) Stock's On A Decline: Are Poor Fundamentals The Cause?

NetLink NBN Trust (SGX:CJLU) has had a rough three months with its share price down 7.6%. We decided to study the company's financials to determine if the downtrend will continue as the long-term performance of a company usually dictates market outcomes. In this article, we decided to focus on NetLink NBN Trust's ROE.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. Put another way, it reveals the company's success at turning shareholder investments into profits.

View our latest analysis for NetLink NBN Trust

How Is ROE Calculated?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for NetLink NBN Trust is:

4.0% = S$99m ÷ S$2.5b (Based on the trailing twelve months to September 2024).

The 'return' is the profit over the last twelve months. One way to conceptualize this is that for each SGD1 of shareholders' capital it has, the company made SGD0.04 in profit.

Why Is ROE Important For Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

NetLink NBN Trust's Earnings Growth And 4.0% ROE

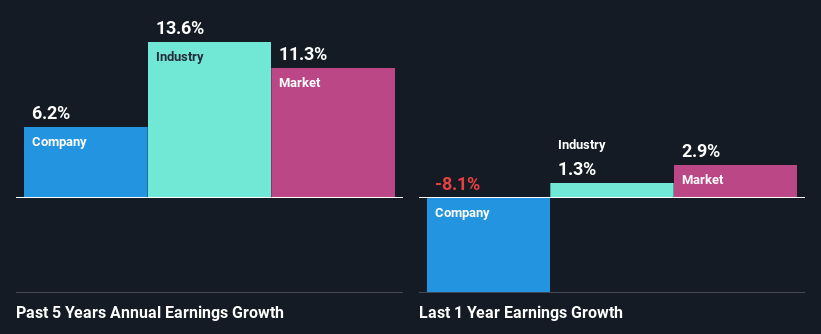

It is quite clear that NetLink NBN Trust's ROE is rather low. Not just that, even compared to the industry average of 11%, the company's ROE is entirely unremarkable. NetLink NBN Trust was still able to see a decent net income growth of 6.2% over the past five years. Therefore, the growth in earnings could probably have been caused by other variables. For example, it is possible that the company's management has made some good strategic decisions, or that the company has a low payout ratio.

We then compared NetLink NBN Trust's net income growth with the industry and found that the company's growth figure is lower than the average industry growth rate of 14% in the same 5-year period, which is a bit concerning.

Earnings growth is an important metric to consider when valuing a stock. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). This then helps them determine if the stock is placed for a bright or bleak future. Is NetLink NBN Trust fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is NetLink NBN Trust Using Its Retained Earnings Effectively?

NetLink NBN Trust's high three-year median payout ratio of 210% suggests that the company is paying out more to its shareholders than what it is making. However, this hasn't really hampered its ability to grow as we saw earlier. It would still be worth keeping an eye on that high payout ratio, if for some reason the company runs into problems and business deteriorates.

Additionally, NetLink NBN Trust has paid dividends over a period of seven years which means that the company is pretty serious about sharing its profits with shareholders. Upon studying the latest analysts' consensus data, we found that the company is expected to keep paying out approximately 193% of its profits over the next three years. Therefore, the company's future ROE is also not expected to change by much with analysts predicting an ROE of 4.7%.

Conclusion

Overall, we would be extremely cautious before making any decision on NetLink NBN Trust. Although the company has shown a fair bit of growth in earnings, yet the low ROE and the low rate of reinvestment makes us skeptical about the continuity of that growth, especially when or if the business comes to face any threats. On studying current analyst estimates, we found that analysts expect the company to continue its recent growth streak. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if NetLink NBN Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:CJLU

NetLink NBN Trust

An investment holding company, owns, designs, builds, and operates the passive fibre network infrastructure for residential homes and non-residential premises, and non-building address point (NBAP) connections in mainland Singapore and its connected islands.

Mediocre balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion