- Singapore

- /

- Telecom Services and Carriers

- /

- SGX:CJLU

Is NetLink NBN Trust's (SGX:CJLU) Stock Price Struggling As A Result Of Its Mixed Financials?

NetLink NBN Trust (SGX:CJLU) has had a rough month with its share price down 1.0%. It is possible that the markets have ignored the company's differing financials and decided to lean-in to the negative sentiment. Fundamentals usually dictate market outcomes so it makes sense to study the company's financials. In this article, we decided to focus on NetLink NBN Trust's ROE.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

Check out our latest analysis for NetLink NBN Trust

How To Calculate Return On Equity?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for NetLink NBN Trust is:

2.8% = S$79m ÷ S$2.9b (Based on the trailing twelve months to September 2020).

The 'return' refers to a company's earnings over the last year. That means that for every SGD1 worth of shareholders' equity, the company generated SGD0.03 in profit.

What Has ROE Got To Do With Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

A Side By Side comparison of NetLink NBN Trust's Earnings Growth And 2.8% ROE

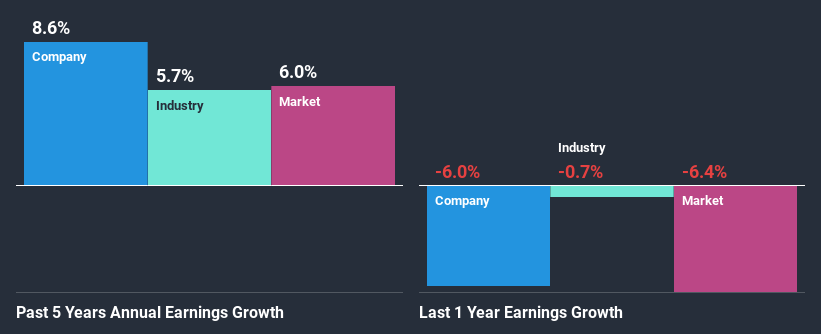

It is quite clear that NetLink NBN Trust's ROE is rather low. Even compared to the average industry ROE of 9.8%, the company's ROE is quite dismal. Although, we can see that NetLink NBN Trust saw a modest net income growth of 8.6% over the past five years. Therefore, the growth in earnings could probably have been caused by other variables. For instance, the company has a low payout ratio or is being managed efficiently.

As a next step, we compared NetLink NBN Trust's net income growth with the industry, and pleasingly, we found that the growth seen by the company is higher than the average industry growth of 6.4%.

Earnings growth is an important metric to consider when valuing a stock. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). This then helps them determine if the stock is placed for a bright or bleak future. Is CJLU fairly valued? This infographic on the company's intrinsic value has everything you need to know.

Is NetLink NBN Trust Efficiently Re-investing Its Profits?

NetLink NBN Trust's high three-year median payout ratio of 250% suggests that the company is paying out more to its shareholders than what it is making. Still the company's earnings have grown respectably. Although, the high payout ratio is certainly something we would keep an eye on if the company is not able to keep up its growth, or if business deteriorates.

Besides, NetLink NBN Trust has been paying dividends over a period of three years. This shows that the company is committed to sharing profits with its shareholders. Our latest analyst data shows that the future payout ratio of the company over the next three years is expected to be approximately 205%. However, NetLink NBN Trust's ROE is predicted to rise to 3.6% despite there being no anticipated change in its payout ratio.

Conclusion

Overall, we have mixed feelings about NetLink NBN Trust. While no doubt its earnings growth is pretty substantial, its ROE and earnings retention is quite poor. So while the company has managed to grow its earnings in spite of this, we are unconvinced if this growth could extend, especially during troubled times. That being so, a study of the latest analyst forecasts show that the company is expected to see a slowdown in its future earnings growth. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

When trading NetLink NBN Trust or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if NetLink NBN Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SGX:CJLU

NetLink NBN Trust

An investment holding company, owns, designs, builds, and operates the passive fibre network infrastructure for residential homes and non-residential premises, and non-building address point (NBAP) connections in mainland Singapore and its connected islands.

Mediocre balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion