- Singapore

- /

- Communications

- /

- SGX:N01

Why Nera Telecommunications' (SGX:N01) Earnings Are Weaker Than They Seem

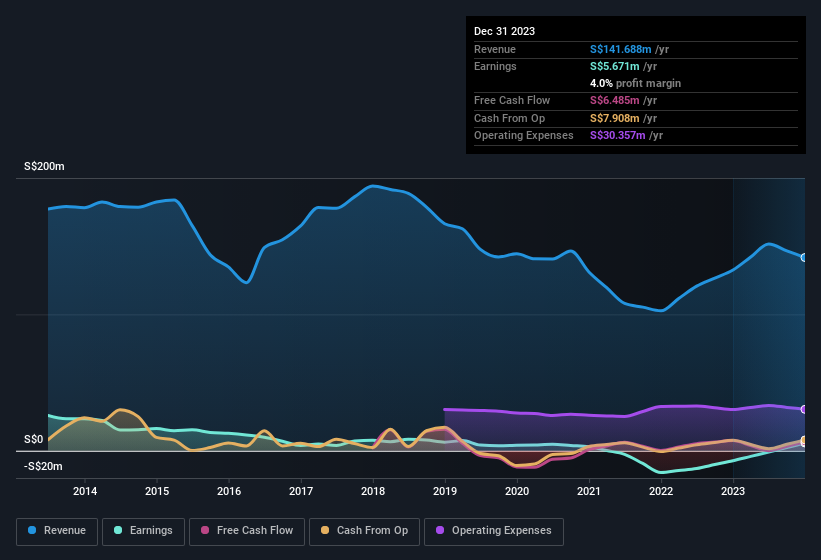

Despite posting strong earnings, Nera Telecommunications Ltd's (SGX:N01) stock didn't move much over the last week. We think that investors might be worried about the foundations the earnings are built on.

View our latest analysis for Nera Telecommunications

The Impact Of Unusual Items On Profit

To properly understand Nera Telecommunications' profit results, we need to consider the S$5.8m gain attributed to unusual items. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. And that's as you'd expect, given these boosts are described as 'unusual'. We can see that Nera Telecommunications' positive unusual items were quite significant relative to its profit in the year to December 2023. As a result, we can surmise that the unusual items are making its statutory profit significantly stronger than it would otherwise be.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Nera Telecommunications.

An Unusual Tax Situation

Just as we noted the unusual items, we must inform you that Nera Telecommunications received a tax benefit which contributed S$2.0m to the bottom line. This is meaningful because companies usually pay tax rather than receive tax benefits. The receipt of a tax benefit is obviously a good thing, on its own. And since it previously lost money, it may well simply indicate the realisation of past tax losses. However, our data indicates that tax benefits can temporarily boost statutory profit in the year it is booked, but subsequently profit may fall back. Assuming the tax benefit is not repeated every year, we could see its profitability drop noticeably, all else being equal. So while we think it's great to receive a tax benefit, it does tend to imply an increased risk that the statutory profit overstates the sustainable earnings power of the business.

Our Take On Nera Telecommunications' Profit Performance

In the last year Nera Telecommunications received a tax benefit, which boosted its profit in a way that might not be much more sustainable than turning prime farmland into gas fields. Furthermore, it also benefitted from a positive unusual item, which boosted the profit result even higher. On reflection, the above-mentioned factors give us the strong impression that Nera Telecommunications'underlying earnings power is not as good as it might seem, based on the statutory profit numbers. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. For example, Nera Telecommunications has 4 warning signs (and 1 which shouldn't be ignored) we think you should know about.

Our examination of Nera Telecommunications has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

Valuation is complex, but we're here to simplify it.

Discover if Nera Telecommunications might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:N01

Nera Telecommunications

Designs, engineers, distributes, sells, services, installs, and maintains telecommunication systems and products in transmission networks and satellite communications and information technology networks.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success