These 4 Measures Indicate That Willas-Array Electronics (Holdings) (SGX:BDR) Is Using Debt Reasonably Well

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Willas-Array Electronics (Holdings) Limited (SGX:BDR) makes use of debt. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Willas-Array Electronics (Holdings)

What Is Willas-Array Electronics (Holdings)'s Debt?

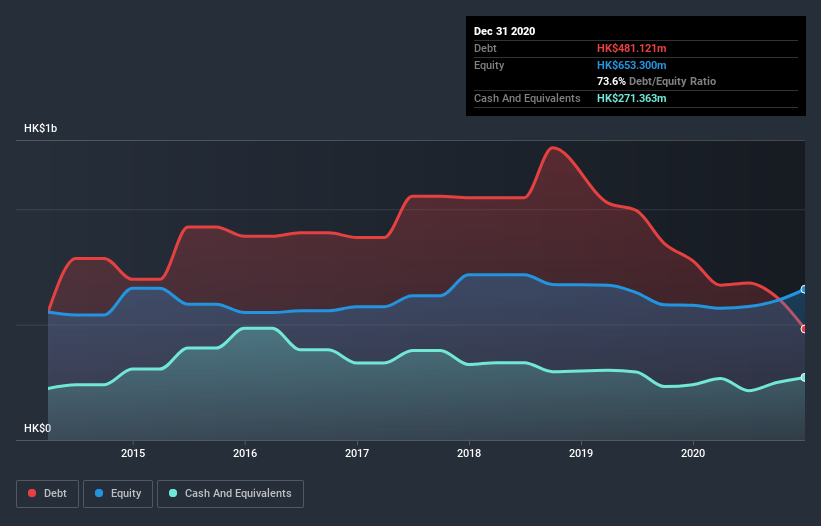

As you can see below, Willas-Array Electronics (Holdings) had HK$481.1m of debt at December 2020, down from HK$777.0m a year prior. However, it also had HK$271.4m in cash, and so its net debt is HK$209.8m.

A Look At Willas-Array Electronics (Holdings)'s Liabilities

According to the last reported balance sheet, Willas-Array Electronics (Holdings) had liabilities of HK$1.02b due within 12 months, and liabilities of HK$46.8m due beyond 12 months. Offsetting this, it had HK$271.4m in cash and HK$961.4m in receivables that were due within 12 months. So it actually has HK$162.1m more liquid assets than total liabilities.

This surplus strongly suggests that Willas-Array Electronics (Holdings) has a rock-solid balance sheet (and the debt is of no concern whatsoever). With this in mind one could posit that its balance sheet means the company is able to handle some adversity.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

While Willas-Array Electronics (Holdings)'s debt to EBITDA ratio (3.5) suggests that it uses some debt, its interest cover is very weak, at 2.2, suggesting high leverage. It seems clear that the cost of borrowing money is negatively impacting returns for shareholders, of late. However, the silver lining was that Willas-Array Electronics (Holdings) achieved a positive EBIT of HK$45m in the last twelve months, an improvement on the prior year's loss. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Willas-Array Electronics (Holdings) will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it is important to check how much of its earnings before interest and tax (EBIT) converts to actual free cash flow. Happily for any shareholders, Willas-Array Electronics (Holdings) actually produced more free cash flow than EBIT over the last year. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Our View

The good news is that Willas-Array Electronics (Holdings)'s demonstrated ability to convert EBIT to free cash flow delights us like a fluffy puppy does a toddler. But we must concede we find its interest cover has the opposite effect. Looking at the bigger picture, we think Willas-Array Electronics (Holdings)'s use of debt seems quite reasonable and we're not concerned about it. After all, sensible leverage can boost returns on equity. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 3 warning signs for Willas-Array Electronics (Holdings) you should be aware of, and 2 of them don't sit too well with us.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

When trading Willas-Array Electronics (Holdings) or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Willas-Array Electronics (Holdings) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SGX:BDR

Willas-Array Electronics (Holdings)

An investment holding company, distributes and trades in electronic components for industrial, audio and video, telecommunication, home appliances, lighting, electronic manufacturing, and automotive markets.

Moderate risk with mediocre balance sheet.

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

The Real Power Behind Alphabet’s Growth

RELX: The Quiet Compounder Powering Law, Science, and Risk Intelligence

Why CVS’s Valuation Signals Opportunity

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026