Key Things To Understand About Willas-Array Electronics (Holdings)'s (SGX:BDR) CEO Pay Cheque

Alvin Hon became the CEO of Willas-Array Electronics (Holdings) Limited (SGX:BDR) in 2014, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also assess whether Willas-Array Electronics (Holdings) pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

See our latest analysis for Willas-Array Electronics (Holdings)

Comparing Willas-Array Electronics (Holdings) Limited's CEO Compensation With the industry

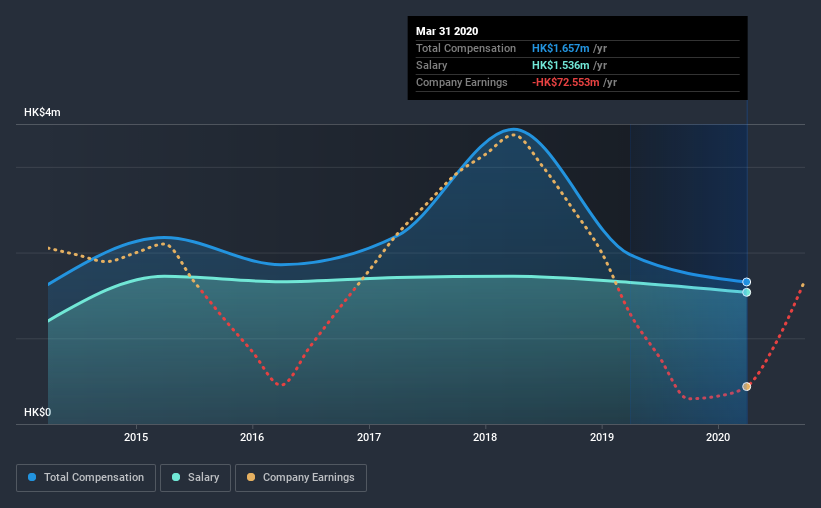

Our data indicates that Willas-Array Electronics (Holdings) Limited has a market capitalization of S$41m, and total annual CEO compensation was reported as HK$1.7m for the year to March 2020. We note that's a decrease of 16% compared to last year. Notably, the salary which is HK$1.54m, represents most of the total compensation being paid.

In comparison with other companies in the industry with market capitalizations under S$265m, the reported median total CEO compensation was HK$3.2m. In other words, Willas-Array Electronics (Holdings) pays its CEO lower than the industry median. What's more, Alvin Hon holds S$156k worth of shares in the company in their own name.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | HK$1.5m | HK$1.7m | 93% |

| Other | HK$121k | HK$323k | 7% |

| Total Compensation | HK$1.7m | HK$2.0m | 100% |

On an industry level, roughly 40% of total compensation represents salary and 60% is other remuneration. It's interesting to note that Willas-Array Electronics (Holdings) pays out a greater portion of remuneration through salary, compared to the industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Willas-Array Electronics (Holdings) Limited's Growth

Over the last three years, Willas-Array Electronics (Holdings) Limited has shrunk its earnings per share by 59% per year. In the last year, its revenue changed by just 0.5%.

The decline in EPS is a bit concerning. And the flat revenue is seriously uninspiring. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Willas-Array Electronics (Holdings) Limited Been A Good Investment?

With a three year total loss of 43% for the shareholders, Willas-Array Electronics (Holdings) Limited would certainly have some dissatisfied shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

As previously discussed, Alvin is compensated less than what is normal for CEOs of companies of similar size, and which belong to the same industry. While we are quite underwhelmed with EPS growth, the shareholder returns over the past three years have also failed to impress us. We can't say the CEO compensation is high, but shareholders will be cold to a bump at this stage, considering negative investor returns.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. That's why we did our research, and identified 3 warning signs for Willas-Array Electronics (Holdings) (of which 2 are concerning!) that you should know about in order to have a holistic understanding of the stock.

Switching gears from Willas-Array Electronics (Holdings), if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you’re looking to trade Willas-Array Electronics (Holdings), open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Willas-Array Electronics (Holdings) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SGX:BDR

Willas-Array Electronics (Holdings)

An investment holding company, distributes and trades in electronic components for industrial, audio and video, telecommunication, home appliances, lighting, electronic manufacturing, and automotive markets.

Moderate risk with mediocre balance sheet.

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

The global leader in cash handling

Wolters Kluwer - A Fundamental and Historical Valuation

METHODE ELECTRONICS (MEI): A Short Circuit or Just a Blown Fuse?

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

I'm exiting the positions at great return! WRLG got great competent management. But, 100k oz gold too small in today environment. They might looking for M/A opportunity in the future, or they might get take over by Aris Mining, I don't know. But, Frank Giustra stated he's believed in multi-assets, so that's my speculation. Anyhow, I want to be aggressive in today's gold price. I'm buying Lahontan Gold LG with this as exchange. Higher upside, more leverage. WRLG CEO is BOD's of LG, that's something. This will be my last update on WRLG, good luck!