Investors Could Be Concerned With Willas-Array Electronics (Holdings)'s (SGX:BDR) Returns On Capital

To find a multi-bagger stock, what are the underlying trends we should look for in a business? In a perfect world, we'd like to see a company investing more capital into its business and ideally the returns earned from that capital are also increasing. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. Although, when we looked at Willas-Array Electronics (Holdings) (SGX:BDR), it didn't seem to tick all of these boxes.

What is Return On Capital Employed (ROCE)?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. To calculate this metric for Willas-Array Electronics (Holdings), this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.065 = HK$45m ÷ (HK$1.7b - HK$1.0b) (Based on the trailing twelve months to December 2020).

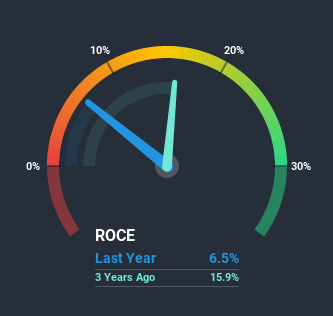

Therefore, Willas-Array Electronics (Holdings) has an ROCE of 6.5%. Ultimately, that's a low return and it under-performs the Electronic industry average of 9.1%.

Check out our latest analysis for Willas-Array Electronics (Holdings)

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you're interested in investigating Willas-Array Electronics (Holdings)'s past further, check out this free graph of past earnings, revenue and cash flow.

The Trend Of ROCE

When we looked at the ROCE trend at Willas-Array Electronics (Holdings), we didn't gain much confidence. To be more specific, ROCE has fallen from 14% over the last five years. However it looks like Willas-Array Electronics (Holdings) might be reinvesting for long term growth because while capital employed has increased, the company's sales haven't changed much in the last 12 months. It may take some time before the company starts to see any change in earnings from these investments.

Another thing to note, Willas-Array Electronics (Holdings) has a high ratio of current liabilities to total assets of 59%. This can bring about some risks because the company is basically operating with a rather large reliance on its suppliers or other sorts of short-term creditors. While it's not necessarily a bad thing, it can be beneficial if this ratio is lower.

In Conclusion...

To conclude, we've found that Willas-Array Electronics (Holdings) is reinvesting in the business, but returns have been falling. And with the stock having returned a mere 27% in the last five years to shareholders, you could argue that they're aware of these lackluster trends. So if you're looking for a multi-bagger, the underlying trends indicate you may have better chances elsewhere.

Willas-Array Electronics (Holdings) does have some risks, we noticed 3 warning signs (and 1 which is potentially serious) we think you should know about.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

If you’re looking to trade Willas-Array Electronics (Holdings), open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Willas-Array Electronics (Holdings) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SGX:BDR

Willas-Array Electronics (Holdings)

An investment holding company, distributes and trades in electronic components for industrial, audio and video, telecommunication, home appliances, lighting, electronic manufacturing, and automotive markets.

Moderate risk with mediocre balance sheet.

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

The global leader in cash handling

Wolters Kluwer - A Fundamental and Historical Valuation

METHODE ELECTRONICS (MEI): A Short Circuit or Just a Blown Fuse?

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

I'm exiting the positions at great return! WRLG got great competent management. But, 100k oz gold too small in today environment. They might looking for M/A opportunity in the future, or they might get take over by Aris Mining, I don't know. But, Frank Giustra stated he's believed in multi-assets, so that's my speculation. Anyhow, I want to be aggressive in today's gold price. I'm buying Lahontan Gold LG with this as exchange. Higher upside, more leverage. WRLG CEO is BOD's of LG, that's something. This will be my last update on WRLG, good luck!