PNE Industries' (SGX:BDA) Dividend Will Be S$0.02

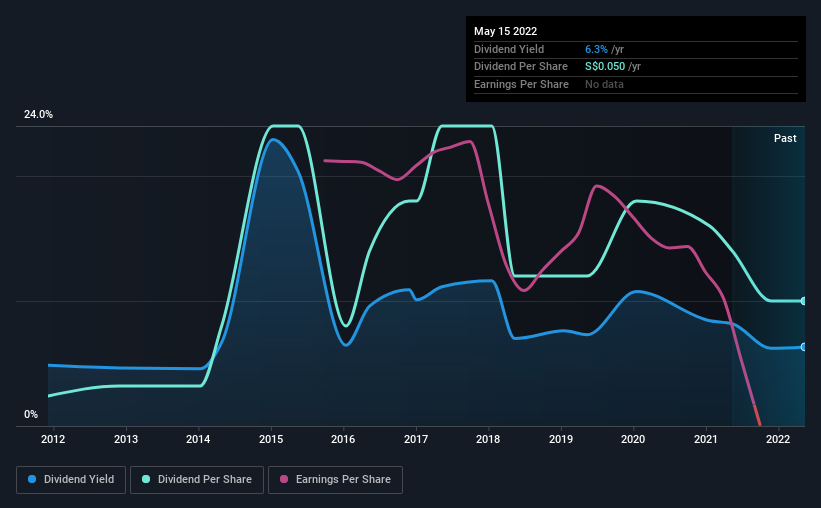

PNE Industries Ltd's (SGX:BDA) investors are due to receive a payment of S$0.02 per share on 10th of June. This makes the dividend yield 6.3%, which will augment investor returns quite nicely.

See our latest analysis for PNE Industries

PNE Industries' Distributions May Be Difficult To Sustain

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. PNE Industries isn't generating any profits, and it is paying out a very high proportion of the cash it is earning. This makes us feel that the dividend will be hard to maintain.

Over the next year, EPS might fall by 20.2% based on recent performance. This will push the company into unprofitability, which means the managers will have to choose between suspending the dividend, or paying it out of cash reserves.

Dividend Volatility

Although the company has a long dividend history, it has been cut at least once in the last 10 years. Since 2012, the first annual payment was S$0.012, compared to the most recent full-year payment of S$0.05. This works out to be a compound annual growth rate (CAGR) of approximately 15% a year over that time. It is great to see strong growth in the dividend payments, but cuts are concerning as it may indicate the payout policy is too ambitious.

Dividend Growth Potential Is Shaky

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. Earnings per share has been sinking by 20% over the last five years. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future.

We're Not Big Fans Of PNE Industries' Dividend

Overall, while some might be pleased that the dividend wasn't cut, we think this may help PNE Industries make more consistent payments in the future. The company isn't making enough to be paying as much as it is, and the other factors don't look particularly promising either. Considering all of these factors, we wouldn't rely on this dividend if we wanted to live on the income.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Case in point: We've spotted 3 warning signs for PNE Industries (of which 2 shouldn't be ignored!) you should know about. Is PNE Industries not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:BDA

PNE Industries

Manufactures, assembles, and trades in electrical and electronic products primarily in Romania, the Netherlands, Europe, Malaysia, Singapore, and the People’s Republic of China.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026