- Singapore

- /

- Tech Hardware

- /

- SGX:B69

These 4 Measures Indicate That Broadway Industrial Group (SGX:B69) Is Using Debt Reasonably Well

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Broadway Industrial Group Limited (SGX:B69) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Broadway Industrial Group

What Is Broadway Industrial Group's Net Debt?

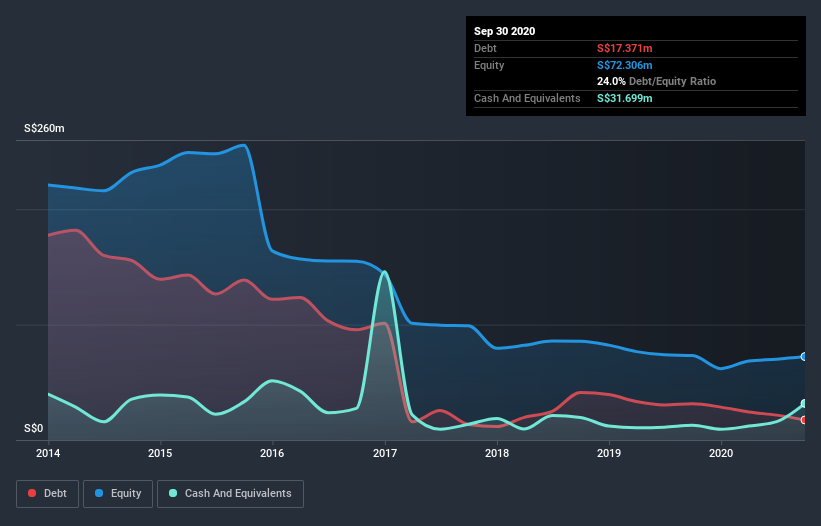

The image below, which you can click on for greater detail, shows that Broadway Industrial Group had debt of S$17.4m at the end of September 2020, a reduction from S$31.4m over a year. But it also has S$31.7m in cash to offset that, meaning it has S$14.3m net cash.

A Look At Broadway Industrial Group's Liabilities

According to the last reported balance sheet, Broadway Industrial Group had liabilities of S$113.2m due within 12 months, and liabilities of S$8.51m due beyond 12 months. Offsetting this, it had S$31.7m in cash and S$42.7m in receivables that were due within 12 months. So its liabilities total S$47.4m more than the combination of its cash and short-term receivables.

This deficit is considerable relative to its market capitalization of S$70.2m, so it does suggest shareholders should keep an eye on Broadway Industrial Group's use of debt. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution. While it does have liabilities worth noting, Broadway Industrial Group also has more cash than debt, so we're pretty confident it can manage its debt safely.

Although Broadway Industrial Group made a loss at the EBIT level, last year, it was also good to see that it generated S$5.4m in EBIT over the last twelve months. There's no doubt that we learn most about debt from the balance sheet. But it is Broadway Industrial Group's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. Broadway Industrial Group may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Happily for any shareholders, Broadway Industrial Group actually produced more free cash flow than EBIT over the last year. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Summing up

While Broadway Industrial Group does have more liabilities than liquid assets, it also has net cash of S$14.3m. The cherry on top was that in converted 743% of that EBIT to free cash flow, bringing in S$40m. So we don't have any problem with Broadway Industrial Group's use of debt. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. To that end, you should be aware of the 2 warning signs we've spotted with Broadway Industrial Group .

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you’re looking to trade Broadway Industrial Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Broadway Industrial Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SGX:B69

Broadway Industrial Group

An investment holding company, manufactures and sells precision-machined components and sub-assemblies in Thailand, the People's Republic of China, Vietnam, Singapore, and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success