- Singapore

- /

- Tech Hardware

- /

- SGX:B69

Broadway Industrial Group Limited's (SGX:B69) Shares Climb 38% But Its Business Is Yet to Catch Up

Broadway Industrial Group Limited (SGX:B69) shares have continued their recent momentum with a 38% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 93% in the last year.

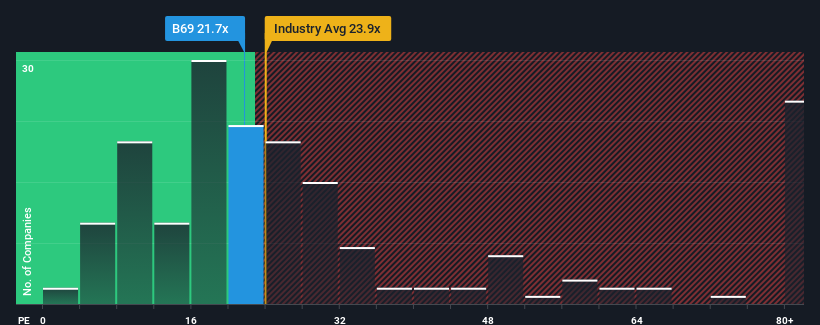

Since its price has surged higher, given close to half the companies in Singapore have price-to-earnings ratios (or "P/E's") below 11x, you may consider Broadway Industrial Group as a stock to avoid entirely with its 21.7x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

For instance, Broadway Industrial Group's receding earnings in recent times would have to be some food for thought. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Broadway Industrial Group

Is There Enough Growth For Broadway Industrial Group?

The only time you'd be truly comfortable seeing a P/E as steep as Broadway Industrial Group's is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered a frustrating 54% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 73% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 12% shows it's an unpleasant look.

With this information, we find it concerning that Broadway Industrial Group is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

The Bottom Line On Broadway Industrial Group's P/E

The strong share price surge has got Broadway Industrial Group's P/E rushing to great heights as well. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Broadway Industrial Group currently trades on a much higher than expected P/E since its recent earnings have been in decline over the medium-term. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the high P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Before you settle on your opinion, we've discovered 4 warning signs for Broadway Industrial Group that you should be aware of.

Of course, you might also be able to find a better stock than Broadway Industrial Group. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Broadway Industrial Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:B69

Broadway Industrial Group

An investment holding company, manufactures and sells precision-machined components and sub-assemblies in Thailand, the People's Republic of China, Vietnam, Singapore, and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives