We Think Shareholders Are Less Likely To Approve A Large Pay Rise For Aztech Global Ltd.'s (SGX:8AZ) CEO For Now

Key Insights

- Aztech Global will host its Annual General Meeting on 11th of April

- CEO Michael Mun's total compensation includes salary of S$1.01m

- The total compensation is 2,212% higher than the average for the industry

- Over the past three years, Aztech Global's EPS fell by 3.0% and over the past three years, the total shareholder return was 4.0%

The anaemic share price growth at Aztech Global Ltd. (SGX:8AZ) over the past few years has probably not impressed shareholders and may be due to earnings not growing over that period. These concerns will be at the front of shareholders' minds as they go into the AGM coming up on 11th of April. It would also be an opportunity for them to influence management through exercising their voting power on company resolutions, including CEO and executive remuneration, which could impact on firm performance in the future. From the data that we gathered, we think that shareholders should hold off on a raise on CEO compensation until performance starts to show some improvement.

See our latest analysis for Aztech Global

How Does Total Compensation For Michael Mun Compare With Other Companies In The Industry?

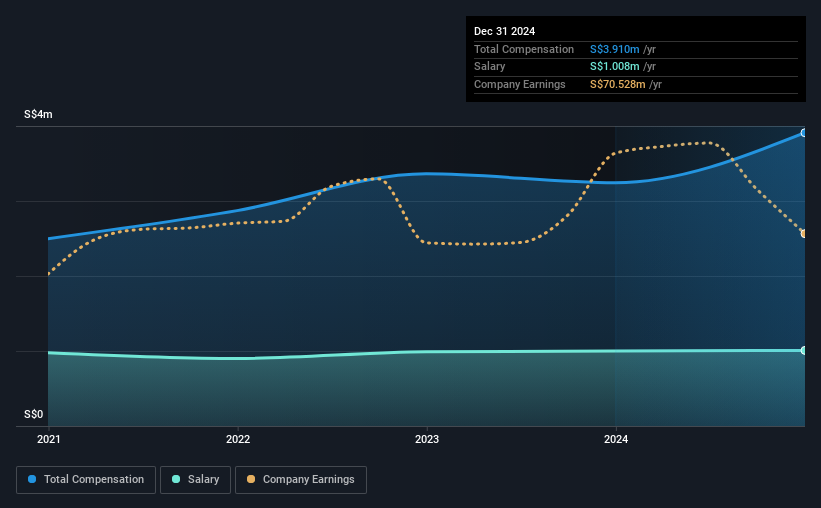

According to our data, Aztech Global Ltd. has a market capitalization of S$594m, and paid its CEO total annual compensation worth S$3.9m over the year to December 2024. Notably, that's an increase of 21% over the year before. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at S$1.0m.

On comparing similar companies from the Singapore Electronic industry with market caps ranging from S$267m to S$1.1b, we found that the median CEO total compensation was S$169k. This suggests that Michael Mun is paid more than the median for the industry. Furthermore, Michael Mun directly owns S$418m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | S$1.0m | S$1.0m | 26% |

| Other | S$2.9m | S$2.2m | 74% |

| Total Compensation | S$3.9m | S$3.2m | 100% |

Talking in terms of the industry, salary represented approximately 69% of total compensation out of all the companies we analyzed, while other remuneration made up 31% of the pie. In Aztech Global's case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

A Look at Aztech Global Ltd.'s Growth Numbers

Over the last three years, Aztech Global Ltd. has shrunk its earnings per share by 3.0% per year. In the last year, its revenue is down 31%.

Its a bit disappointing to see that the company has failed to grow its EPS. And the fact that revenue is down year on year arguably paints an ugly picture. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future .

Has Aztech Global Ltd. Been A Good Investment?

Aztech Global Ltd. has generated a total shareholder return of 4.0% over three years, so most shareholders wouldn't be too disappointed. Although, there's always room to improve. As a result, investors in the company might be reluctant about agreeing to increase CEO pay in the future, before seeing an improvement on their returns.

To Conclude...

The flat share price growth combined with the the fact that earnings have failed to grow makes us wonder whether the share price will have any further strong momentum. The upcoming AGM will provide shareholders the opportunity to revisit the company’s remuneration policies and evaluate if the board’s judgement and decision-making is aligned with that of the company’s shareholders.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 1 warning sign for Aztech Global that investors should think about before committing capital to this stock.

Important note: Aztech Global is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:8AZ

Aztech Global

Engages in the research, development, design, engineering, manufacture, and sale of IoT devices, data-communication products, and LED lighting products in Singapore, North America, China, Europe, Oceania, rest of ASEAN countries, and internationally.

Flawless balance sheet and fair value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion