Amid heightened global trade tensions following the announcement of unexpected tariffs by the Trump administration, Asian markets are navigating a period of significant uncertainty. Despite these challenges, certain investment opportunities continue to emerge, particularly within the realm of penny stocks. While often seen as relics from past market eras, penny stocks—typically representing smaller or newer companies—still hold potential for growth when paired with strong financials and solid fundamentals.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Rojana Industrial Park (SET:ROJNA) | THB4.62 | THB9.33B | ✅ 3 ⚠️ 3 View Analysis > |

| Interlink Telecom (SET:ITEL) | THB1.16 | THB1.61B | ✅ 4 ⚠️ 5 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.325 | SGD131.72M | ✅ 4 ⚠️ 2 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.174 | SGD34.66M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD1.90 | SGD7.5B | ✅ 5 ⚠️ 0 View Analysis > |

| YesAsia Holdings (SEHK:2209) | HK$2.70 | HK$1.11B | ✅ 4 ⚠️ 3 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$3.69 | HK$42.26B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.07 | HK$675.12M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$0.96 | HK$1.6B | ✅ 4 ⚠️ 2 View Analysis > |

| Xiamen Hexing Packaging Printing (SZSE:002228) | CN¥2.81 | CN¥3.26B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,193 stocks from our Asian Penny Stocks screener.

Let's uncover some gems from our specialized screener.

DISA (Catalist:532)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: DISA Limited is an investment holding company involved in the technology sector across Singapore, China, Hong Kong, and the United States with a market capitalization of SGD21.01 million.

Operations: The company's revenue is derived entirely from its technology segment, amounting to SGD8.08 million.

Market Cap: SGD21.01M

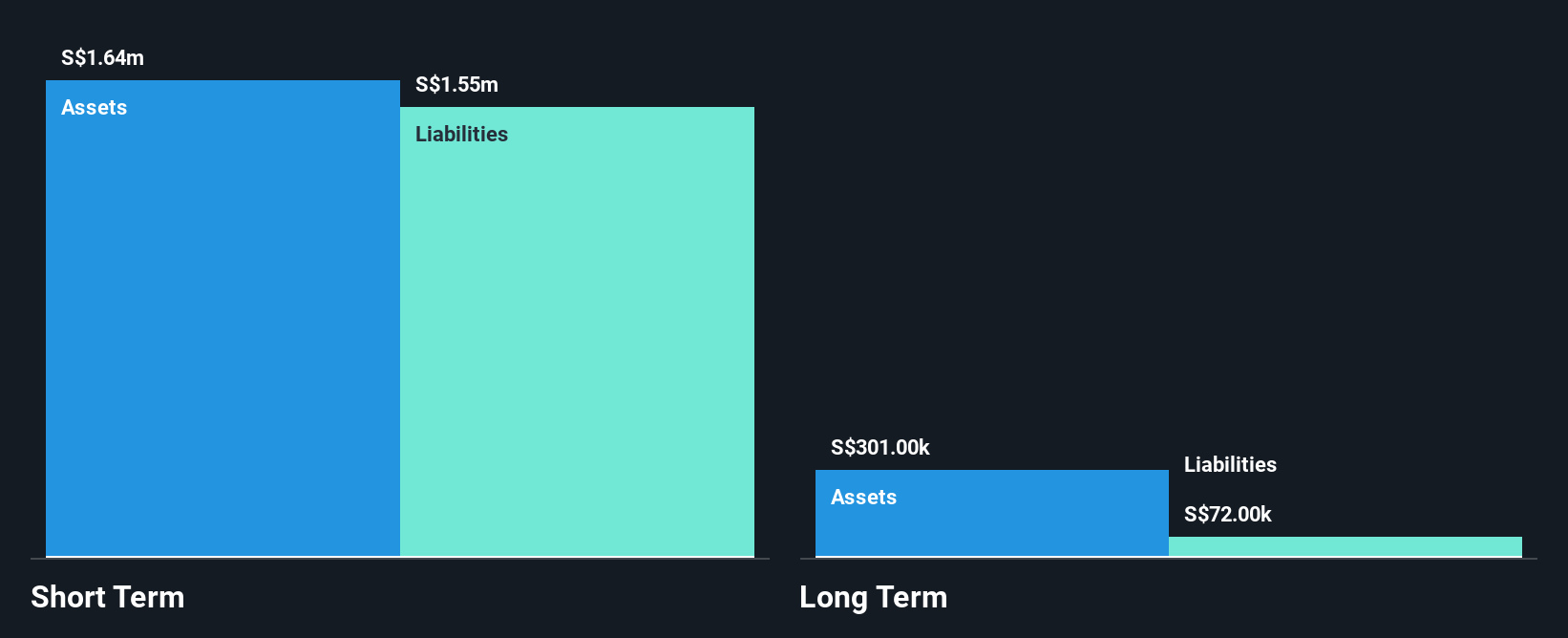

DISA Limited, with a market cap of SGD21.01 million, operates in the technology sector across multiple regions. Despite being unprofitable, DISA reported half-year revenue of SGD4.18 million, showing slight growth from the previous year. The company benefits from an experienced management team and board but faces challenges with a negative return on equity and high share price volatility. DISA is debt-free and has short-term assets exceeding liabilities; however, it has less than a year of cash runway at current free cash flow rates. Shareholders have not faced significant dilution recently despite financial challenges.

- Click to explore a detailed breakdown of our findings in DISA's financial health report.

- Explore historical data to track DISA's performance over time in our past results report.

Wing Tai Properties (SEHK:369)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Wing Tai Properties Limited is an investment holding company that focuses on the investment, development, and management of properties across Hong Kong, the United Kingdom, China, Singapore, and internationally with a market cap of HK$2.05 billion.

Operations: The company's revenue is derived from Property Development (HK$335.7 million), Property Investment and Management (HK$570.9 million), and Hospitality Investment and Management (HK$85.4 million).

Market Cap: HK$2.05B

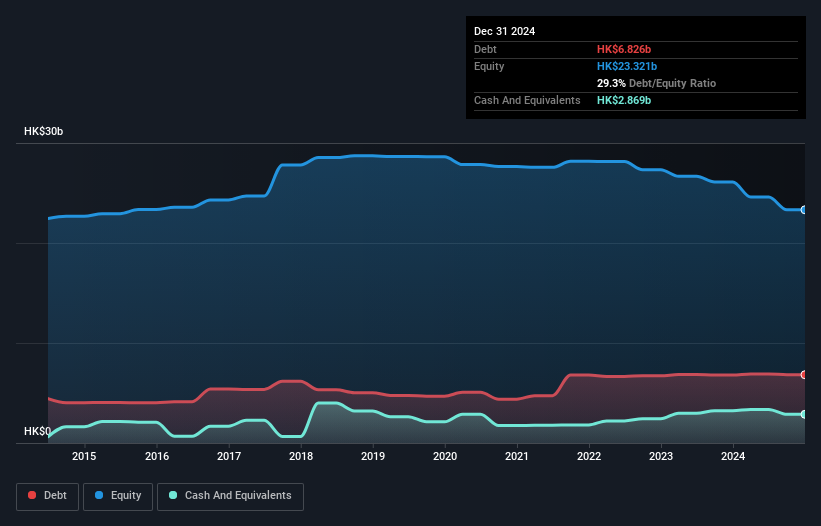

Wing Tai Properties, with a market cap of HK$2.05 billion, has shown resilience despite financial challenges. The company reported HK$1.03 billion in sales for 2024 but faced a significant net loss of HK$2.49 billion, indicating ongoing profitability issues and negative return on equity (-11.05%). While its debt-to-equity ratio remains satisfactory at 17%, operating cash flow covers only 2.6% of its debt, suggesting liquidity concerns. Recent amendments to company bylaws aim to enhance operational flexibility and regulatory compliance, while the proposed dividend reduction reflects cautious capital management amidst increasing losses over the past five years (47.7% annually).

- Navigate through the intricacies of Wing Tai Properties with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into Wing Tai Properties' future.

DaChan Food (Asia) (SEHK:3999)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: DaChan Food (Asia) Limited, with a market cap of HK$680.85 million, operates in the manufacture and sale of livestock feeds, poultry and chilled meats, and processed foods across the People’s Republic of China, Japan, and the Asia Pacific region.

Operations: The company's revenue is derived from Meat Products (CN¥2.07 billion), Livestock Feeds (CN¥2.57 billion), Processed Food - Export (CN¥315.56 million), and Processed Food - Mainland China (CN¥2.26 billion).

Market Cap: HK$680.85M

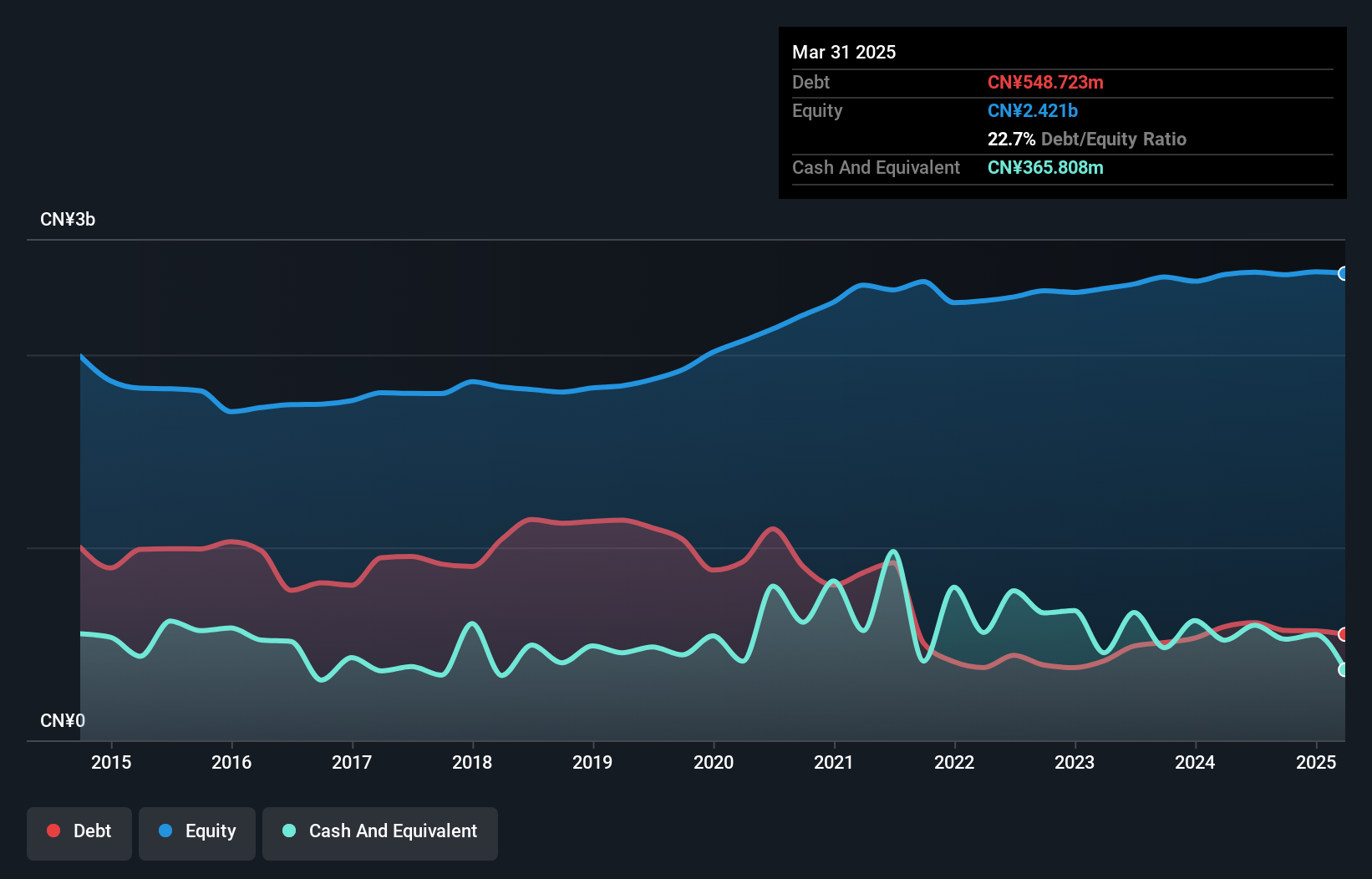

DaChan Food (Asia) Limited, with a market cap of HK$680.85 million, reported CN¥5.83 billion in sales for 2024, down from the previous year but achieved a net income increase to CN¥58.83 million. The company has seen its debt-to-equity ratio decrease significantly over five years to 23.3%, and its earnings growth of 25.1% last year surpassed industry averages, although long-term profit trends remain negative with a decline of 23.7% annually over five years. Despite low return on equity at 3.5%, DaChan maintains high-quality earnings and effectively covers interest payments with EBIT at five times coverage, reflecting stable financial management amidst volatility.

- Click here and access our complete financial health analysis report to understand the dynamics of DaChan Food (Asia).

- Review our historical performance report to gain insights into DaChan Food (Asia)'s track record.

Seize The Opportunity

- Click here to access our complete index of 1,193 Asian Penny Stocks.

- Looking For Alternative Opportunities? The latest GPUs need a type of rare earth metal called Dysprosium and there are only 20 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3999

DaChan Food (Asia)

Manufactures and sells livestock feeds, poultry and chilled meats, and processed foods in the People’s Republic of China, Japan, and rest of the Asia Pacific.

Flawless balance sheet with low risk.

Market Insights

Community Narratives