If You Like EPS Growth Then Check Out Azeus Systems Holdings (SGX:BBW) Before It's Too Late

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Azeus Systems Holdings (SGX:BBW). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for Azeus Systems Holdings

Azeus Systems Holdings's Improving Profits

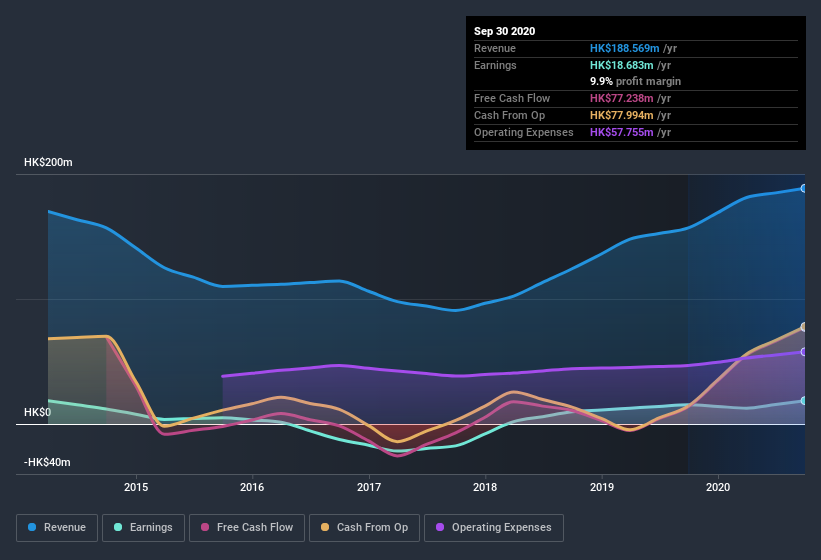

In the last three years Azeus Systems Holdings's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. As a result, I'll zoom in on growth over the last year, instead. Azeus Systems Holdings boosted its trailing twelve month EPS from HK$0.52 to HK$0.62, in the last year. That's a 21% gain; respectable growth in the broader scheme of things.

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. On the one hand, Azeus Systems Holdings's EBIT margins fell over the last year, but on the other hand, revenue grew. So it seems the future my hold further growth, especially if EBIT margins can stabilize.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Since Azeus Systems Holdings is no giant, with a market capitalization of S$54m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Azeus Systems Holdings Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So we're pleased to report that Azeus Systems Holdings insiders own a meaningful share of the business. In fact, they own 36% of the shares, making insiders a very influential shareholder group. I'm reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. Of course, Azeus Systems Holdings is a very small company, with a market cap of only S$54m. That means insiders only have HK$19m worth of shares, despite the large proportional holding. That might not be a huge sum but it should be enough to keep insiders motivated!

It means a lot to see insiders invested in the business, but I find myself wondering if remuneration policies are shareholder friendly. A brief analysis of the CEO compensation suggests they are. I discovered that the median total compensation for the CEOs of companies like Azeus Systems Holdings with market caps under HK$1.6b is about HK$3.0m.

The CEO of Azeus Systems Holdings only received HK$618k in total compensation for the year ending . That looks like modest pay to me, and may hint at a certain respect for the interests of shareholders. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Is Azeus Systems Holdings Worth Keeping An Eye On?

As I already mentioned, Azeus Systems Holdings is a growing business, which is what I like to see. The fact that EPS is growing is a genuine positive for Azeus Systems Holdings, but the pretty picture gets better than that. Boasting both modest CEO pay and considerable insider ownership, I'd argue this one is worthy of the watchlist, at least. Don't forget that there may still be risks. For instance, we've identified 1 warning sign for Azeus Systems Holdings that you should be aware of.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading Azeus Systems Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SGX:BBW

Azeus Systems Holdings

An investment holding company, provides IT products and services in Hong Kong, rest of Asia, the United Kingdom, rest of Europe, Australia, New Zealand, North America, South America, the Middle East, and Africa.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives