- Singapore

- /

- Semiconductors

- /

- SGX:5DD

Micro-Mechanics (SGX:5DD) Net Margin Jumps to 19%, Challenging Bearish Profit Decline Narratives

Reviewed by Simply Wall St

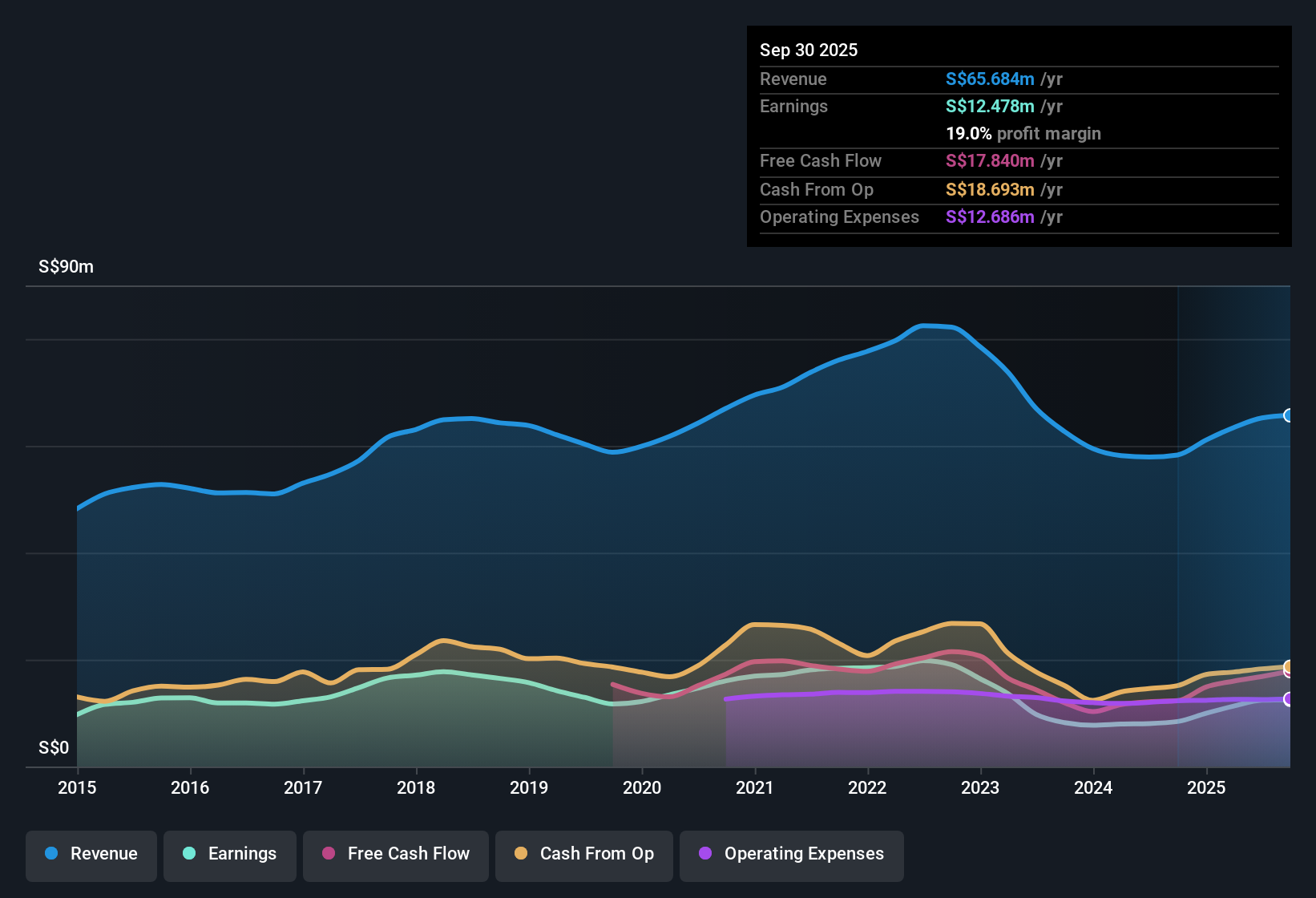

Micro-Mechanics (Holdings) (SGX:5DD) delivered a net profit margin of 19%, outpacing last year’s 14.4% and driving earnings growth of 48.3% year over year. While the company’s five-year trend had seen average yearly declines of 15.1%, this latest surge marks a sharp turnaround, and the quality of earnings has been highlighted as high. Investors will be weighing the rapid rise in profits and improved margins against ongoing concerns about dividend sustainability and uncertain growth prospects going forward.

See our full analysis for Micro-Mechanics (Holdings).With the headline results in focus, it is time to see how these figures match up with the market’s current narratives and expectations for Micro-Mechanics. The next section puts the numbers to the test against the stories investors are watching closely.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Defy Five-Year Downtrend

- The net profit margin jumped to 19% this year, reversing five years of average annual declines of 15.1% and surpassing last year’s 14.4%.

- Recent margin improvements lend weight to arguments that the business can support resilient earnings quality. However, after such a long stretch of declining profits, the sudden jump may not be as easily repeatable as bullish investors hope.

- Bulls highlight the significant profit margin increase as a sign Micro-Mechanics can benefit from semiconductor sector tailwinds. Still, the five-year historical average suggests the business remains exposed to artificial cycle swings.

- Bears would likely caution that a single strong year does not erase a multi-year trend, especially as the sector remains cyclically sensitive.

Dividend Sustainability Remains a Key Watchpoint

- Despite stronger profits, risks flagged in the results include persistent doubt about how sustainable Micro-Mechanics' dividends will be moving forward.

- The narrative underscores that, while attractive dividend yields appeal to investors seeking steady income, uncertainty about forward earnings and top-line growth raises questions about the streak continuing.

- It is notable that elevated margin performance increases available distributable profit today. However, with historical declines and growth uncertainties highlighted, critics could argue payout ratios may be hard to maintain if profitability falters.

- Supporters may point to the year's surge as evidence that management can deliver, but must acknowledge that flagged risks remain unaddressed by a single earnings recovery.

Discount to Peers May Signal Long-Term Opportunity

- Micro-Mechanics trades at a price-to-earnings ratio of 19.8x, below both the Asian semiconductor industry average of 39.2x and the peer group average of 24.4x. Its share price of SGD 1.78 is also below the DCF fair value estimate of SGD 2.26.

- On prevailing fundamental grounds, the apparent valuation gap could be seen as an entry point for investors who believe recent earnings improvements can be sustained over several cycles, but only if the company can break away from historical underperformance.

- Those focused on valuation may see current pricing as a hedge against sector swings due to the discount against both peers and industry averages.

- Nevertheless, the historical pattern of annual declines and flagged risks to future earnings means that the market may be demanding a discount for reasons not yet fully addressed by recent results.

For a deeper dive into how sector discounts and quality trends shape market narratives going forward, track the full consensus storyline for Micro-Mechanics by reading the detailed narrative linked below. 📊 Read the full Micro-Mechanics (Holdings) Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Micro-Mechanics (Holdings)'s growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While Micro-Mechanics delivered a profit surge this year, concerns linger around inconsistent long-term growth and whether strong results can be maintained across market cycles.

For investors seeking steadier opportunities, search for companies with a track record of consistent performance by checking out stable growth stocks screener (2101 results) before making your next move.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:5DD

Micro-Mechanics (Holdings)

Designs, manufactures, and markets precision parts and tools for the wafer-fabrication, assembly, and testing processes of the semiconductor industry.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion