- Singapore

- /

- Retail Distributors

- /

- SGX:BPF

Top Dividend Stocks To Consider In November 2024

Reviewed by Simply Wall St

As global markets experience broad-based gains with U.S. indexes nearing record highs, investors are keeping a keen eye on economic indicators such as jobless claims and home sales that continue to drive positive sentiment. Amidst this backdrop of cautious optimism and geopolitical tensions, dividend stocks remain an attractive option for those seeking income stability and potential growth in their investment portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.33% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.56% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.51% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.67% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.38% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.86% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.49% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.10% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.85% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.90% | ★★★★★★ |

Click here to see the full list of 1978 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

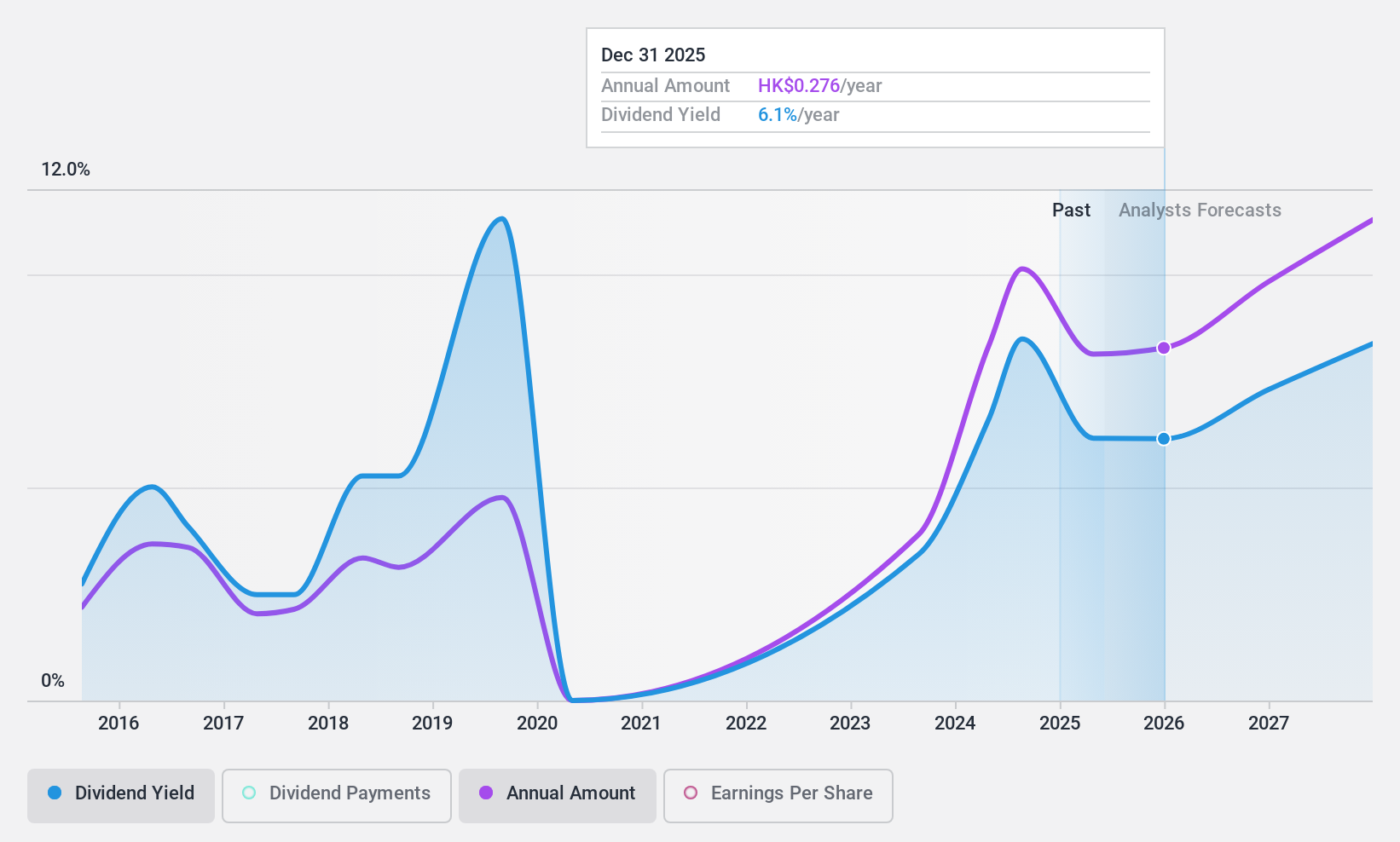

361 Degrees International (SEHK:1361)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: 361 Degrees International Limited is an investment holding company that manufactures and trades sporting goods in the People’s Republic of China, with a market cap of HK$7.94 billion.

Operations: The company's revenue segments include CN¥2.18 billion from Kids and CN¥7.13 billion from Adults.

Dividend Yield: 8.5%

361 Degrees International's dividend yield of 8.47% ranks in the top 25% among Hong Kong dividend payers, yet its dividends have been volatile and not well-covered by cash flows, with a high cash payout ratio of 162%. Despite trading at a significant discount to estimated fair value and recent earnings growth, the sustainability of its dividends remains questionable. Recent sales growth across core brands and e-commerce channels indicates positive momentum but doesn't alleviate concerns over dividend reliability.

- Unlock comprehensive insights into our analysis of 361 Degrees International stock in this dividend report.

- Our expertly prepared valuation report 361 Degrees International implies its share price may be lower than expected.

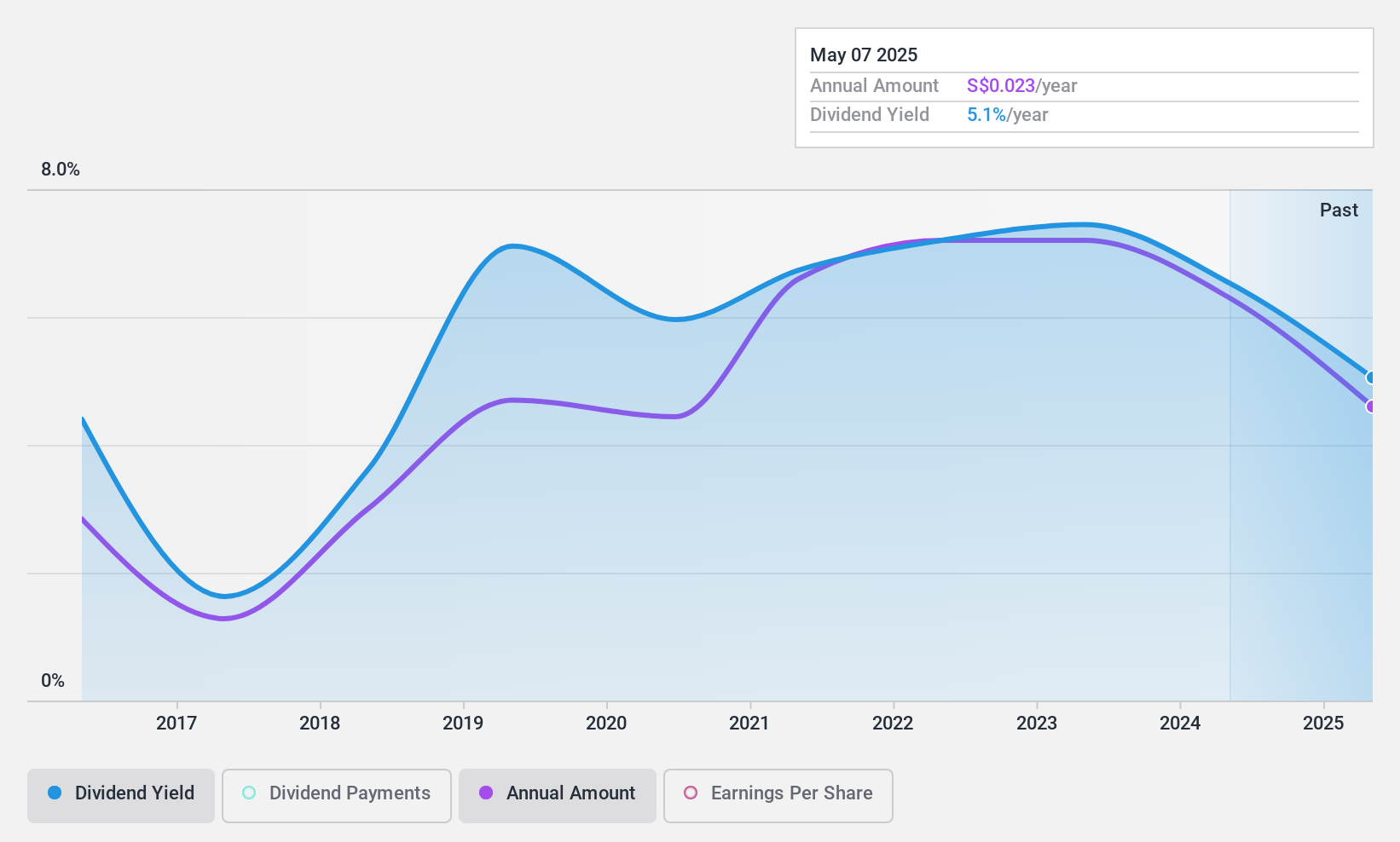

YHI International (SGX:BPF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: YHI International Limited is an investment holding company that, along with its subsidiaries, distributes automotive and industrial products across Singapore, Malaysia, China, Hong Kong, Taiwan, Australia, New Zealand and other international markets; it has a market cap of SGD140.02 million.

Operations: YHI International Limited generates revenue through its segments, including Distribution - ASEAN (SGD119.40 million), Distribution - Other (SGD33.31 million), Manufacturing - ASEAN (SGD55.05 million), Distribution - Oceania (SGD140.24 million), Distribution - North East Asia (SGD17.99 million), and Manufacturing - North East Asia excluding rental income (SGD57.20 million).

Dividend Yield: 6.5%

YHI International's dividend yield is in the top 25% of Singapore's market, supported by a reasonable payout ratio of 68.9% and a low cash payout ratio of 43.3%, indicating dividends are well-covered by earnings and cash flows. However, its dividend history has been volatile over the past decade. Recent disruptions due to a warehouse fire could temporarily impact operations, though inventory losses are mostly insured and recovery efforts are underway.

- Delve into the full analysis dividend report here for a deeper understanding of YHI International.

- According our valuation report, there's an indication that YHI International's share price might be on the cheaper side.

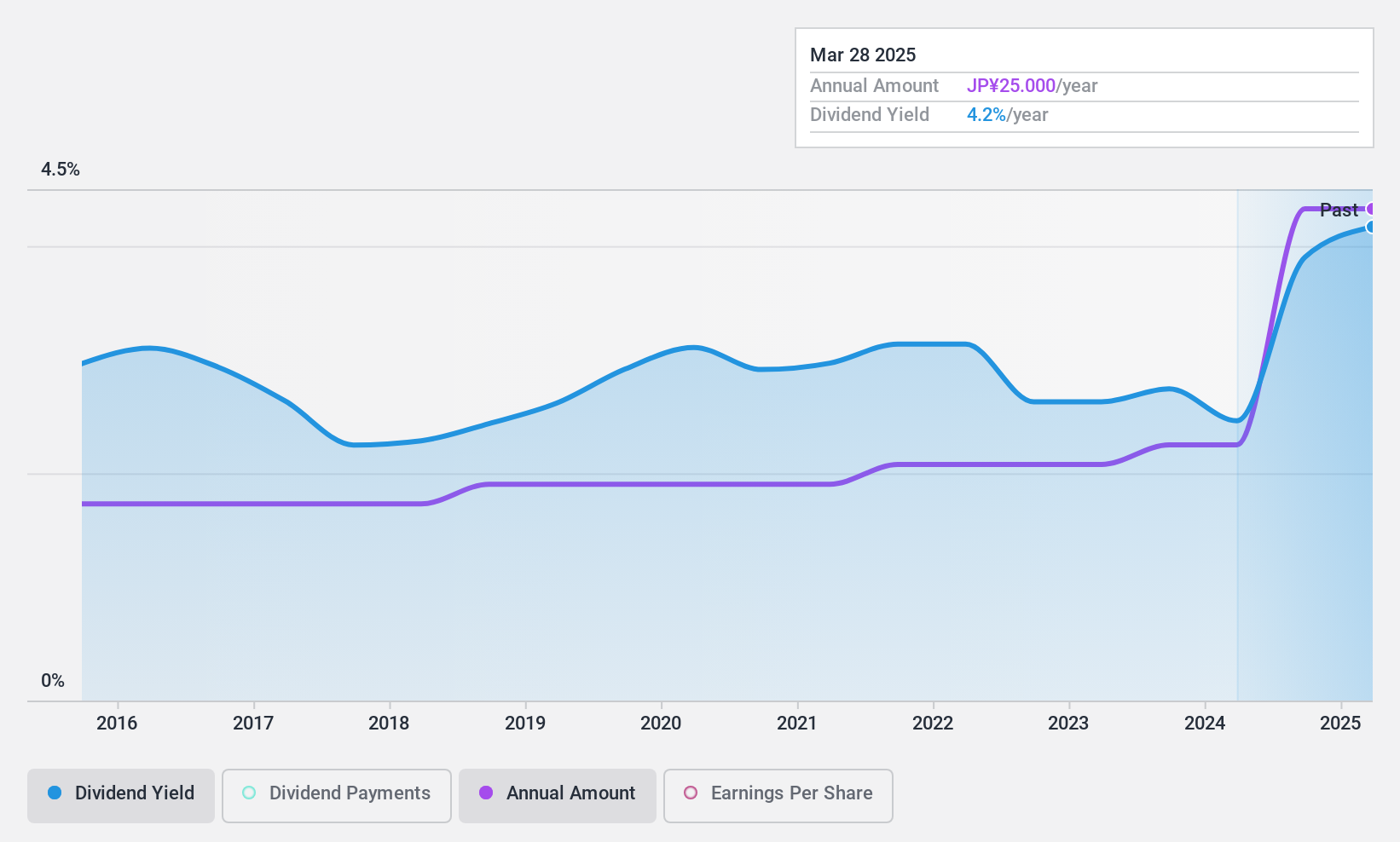

Japan Pulp and Paper (TSE:8032)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Japan Pulp and Paper Company Limited operates in the manufacture, import, export, distribution, wholesale, and sale of papers, paperboards, pulp, and paper-related products across Japan and international markets with a market cap of ¥80.44 billion.

Operations: Japan Pulp and Paper Company Limited's revenue segments include Domestic Wholesale at ¥207.04 billion, Overseas Wholesale at ¥265.27 billion, Paper Processing at ¥56.13 billion, Environmental Raw Materials at ¥29.68 billion, and Real Estate Rental at ¥4.24 billion.

Dividend Yield: 3.8%

Japan Pulp and Paper's dividend yield is among the top 25% in Japan, with recent payments doubling to ¥125.00 per share from last year. The company's dividends have been stable and growing over the past decade, backed by a low payout ratio of 4.2% and a cash payout ratio of 10.2%, ensuring coverage by earnings and cash flows despite high debt levels. Payments commence December 2, 2024.

- Click here and access our complete dividend analysis report to understand the dynamics of Japan Pulp and Paper.

- The valuation report we've compiled suggests that Japan Pulp and Paper's current price could be quite moderate.

Next Steps

- Click through to start exploring the rest of the 1975 Top Dividend Stocks now.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:BPF

YHI International

An investment holding company, together with its subsidiaries, distributes automotive and industrial products in Singapore, Malaysia, China, Hong Kong, Australia, New Zealand, Germany, the United States, and internationally.

Excellent balance sheet with slight risk.

Market Insights

Community Narratives