- Singapore

- /

- Retail Distributors

- /

- SGX:AWI

We Think That There Are More Issues For Thakral (SGX:AWI) Than Just Sluggish Earnings

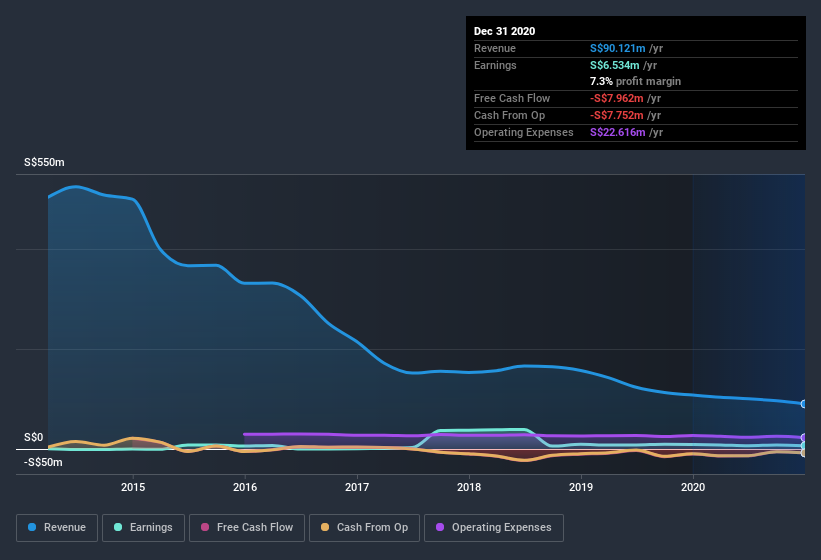

The subdued market reaction suggests that Thakral Corporation Ltd's (SGX:AWI) recent earnings didn't contain any surprises. We think that investors are worried about some weaknesses underlying the earnings.

See our latest analysis for Thakral

How Do Unusual Items Influence Profit?

To properly understand Thakral's profit results, we need to consider the S$1.5m gain attributed to unusual items. We can't deny that higher profits generally leave us optimistic, but we'd prefer it if the profit were to be sustainable. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. And that's as you'd expect, given these boosts are described as 'unusual'. Thakral had a rather significant contribution from unusual items relative to its profit to December 2020. All else being equal, this would likely have the effect of making the statutory profit a poor guide to underlying earnings power.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Thakral.

Our Take On Thakral's Profit Performance

As we discussed above, we think the significant positive unusual item makes Thakral's earnings a poor guide to its underlying profitability. For this reason, we think that Thakral's statutory profits may be a bad guide to its underlying earnings power, and might give investors an overly positive impression of the company. In further bad news, its earnings per share decreased in the last year. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. Every company has risks, and we've spotted 2 warning signs for Thakral you should know about.

This note has only looked at a single factor that sheds light on the nature of Thakral's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

When trading Thakral or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Thakral might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SGX:AWI

Thakral

An investment holding company, markets and distributes beauty, fragrance, and lifestyle products in Singapore, India, rest of South Asia, the People’s Republic of China, North America, Australia, Japan, and internationally.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success