Zhongmin Baihui Retail Group Ltd.'s (SGX:5SR) Popularity With Investors Under Threat As Stock Sinks 48%

Zhongmin Baihui Retail Group Ltd. (SGX:5SR) shareholders that were waiting for something to happen have been dealt a blow with a 48% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 35% in that time.

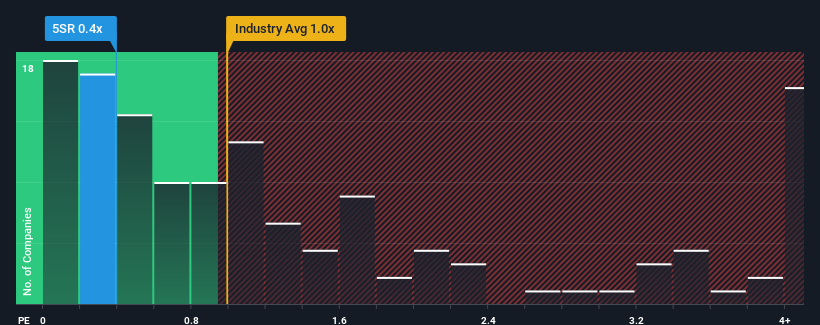

Even after such a large drop in price, you could still be forgiven for feeling indifferent about Zhongmin Baihui Retail Group's P/S ratio of 0.4x, since the median price-to-sales (or "P/S") ratio for the Multiline Retail industry in Singapore is also close to 0.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Zhongmin Baihui Retail Group

How Has Zhongmin Baihui Retail Group Performed Recently?

As an illustration, revenue has deteriorated at Zhongmin Baihui Retail Group over the last year, which is not ideal at all. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

Although there are no analyst estimates available for Zhongmin Baihui Retail Group, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Zhongmin Baihui Retail Group's Revenue Growth Trending?

In order to justify its P/S ratio, Zhongmin Baihui Retail Group would need to produce growth that's similar to the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 7.7%. This means it has also seen a slide in revenue over the longer-term as revenue is down 21% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

In contrast to the company, the rest of the industry is expected to grow by 12% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

In light of this, it's somewhat alarming that Zhongmin Baihui Retail Group's P/S sits in line with the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

What Does Zhongmin Baihui Retail Group's P/S Mean For Investors?

With its share price dropping off a cliff, the P/S for Zhongmin Baihui Retail Group looks to be in line with the rest of the Multiline Retail industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

The fact that Zhongmin Baihui Retail Group currently trades at a P/S on par with the rest of the industry is surprising to us since its recent revenues have been in decline over the medium-term, all while the industry is set to grow. When we see revenue heading backwards in the context of growing industry forecasts, it'd make sense to expect a possible share price decline on the horizon, sending the moderate P/S lower. If recent medium-term revenue trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Zhongmin Baihui Retail Group (2 are potentially serious) you should be aware of.

If you're unsure about the strength of Zhongmin Baihui Retail Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Zhongmin Baihui Retail Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:5SR

Zhongmin Baihui Retail Group

An investment holding company, owns, operates, and manages a chain of department stores and supermarkets in the People’s Republic of China.

Proven track record with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026