- Singapore

- /

- Industrial REITs

- /

- SGX:O5RU

AIMS APAC REIT (SGX:O5RU) Stock's Been Sliding But Fundamentals Look Decent: Will The Market Correct The Share Price In The Future?

It is hard to get excited after looking at AIMS APAC REIT's (SGX:O5RU) recent performance, when its stock has declined 7.8% over the past three months. However, stock prices are usually driven by a company’s financials over the long term, which in this case look pretty respectable. Specifically, we decided to study AIMS APAC REIT's ROE in this article.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

Check out our latest analysis for AIMS APAC REIT

How Do You Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for AIMS APAC REIT is:

8.4% = S$81m ÷ S$961m (Based on the trailing twelve months to June 2020).

The 'return' is the profit over the last twelve months. One way to conceptualize this is that for each SGD1 of shareholders' capital it has, the company made SGD0.08 in profit.

What Is The Relationship Between ROE And Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

AIMS APAC REIT's Earnings Growth And 8.4% ROE

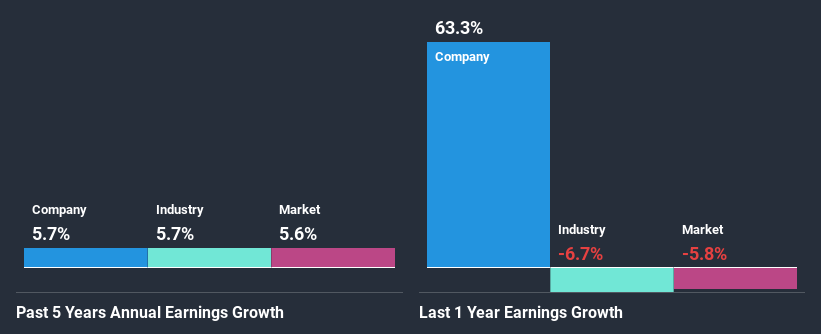

At first glance, AIMS APAC REIT's ROE doesn't look very promising. Although a closer study shows that the company's ROE is higher than the industry average of 5.5% which we definitely can't overlook. Consequently, this likely laid the ground for the decent growth of 5.7% seen over the past five years by AIMS APAC REIT. That being said, the company does have a slightly low ROE to begin with, just that it is higher than the industry average. So there might well be other reasons for the earnings to grow. For example, it is possible that the broader industry is going through a high growth phase, or that the company has a low payout ratio.

We then performed a comparison between AIMS APAC REIT's net income growth with the industry, which revealed that the company's growth is similar to the average industry growth of 5.7% in the same period.

Earnings growth is an important metric to consider when valuing a stock. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). Doing so will help them establish if the stock's future looks promising or ominous. Has the market priced in the future outlook for O5RU? You can find out in our latest intrinsic value infographic research report.

Is AIMS APAC REIT Efficiently Re-investing Its Profits?

AIMS APAC REIT has a high three-year median payout ratio of 88%. This means that it has only 12% of its income left to reinvest into its business. However, it's not unusual to see a REIT with such a high payout ratio mainly due to statutory requirements. Despite this, the company's earnings grew moderately as we saw above.

Besides, AIMS APAC REIT has been paying dividends for at least ten years or more. This shows that the company is committed to sharing profits with its shareholders. Our latest analyst data shows that the future payout ratio of the company over the next three years is expected to be approximately 100%. Regardless, AIMS APAC REIT's ROE is speculated to decline to 6.5% despite there being no anticipated change in its payout ratio.

Conclusion

Overall, we feel that AIMS APAC REIT certainly does have some positive factors to consider. Especially the substantial growth in earnings backed by a decent ROE. Despite the company reinvesting only a small portion of its profits, it still has managed to grow its earnings so that is appreciable. With that said, on studying the latest analyst forecasts, we found that while the company has seen growth in its past earnings, analysts expect its future earnings to shrink. To know more about the company's future earnings growth forecasts take a look at this free report on analyst forecasts for the company to find out more.

If you decide to trade AIMS APAC REIT, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SGX:O5RU

AIMS APAC REIT

Managed by the Manager, AIMS APAC REIT (“AA REIT”) is a real estate investment trust listed on the Mainboard of the SGX-ST since 2007.

Established dividend payer with moderate growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion