- Singapore

- /

- Aerospace & Defense

- /

- SGX:S63

SGX Stocks Estimated To Be Undervalued In August 2024

Reviewed by Simply Wall St

The Singapore market has been navigating through a period of economic adjustments, highlighted by significant corporate decisions such as Mastercard's recent workforce reduction. In this environment, identifying undervalued stocks can offer potential opportunities for investors seeking to capitalize on market inefficiencies.

Top 5 Undervalued Stocks Based On Cash Flows In Singapore

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| LHN (SGX:41O) | SGD0.325 | SGD0.41 | 20.9% |

| Singapore Technologies Engineering (SGX:S63) | SGD4.56 | SGD9.00 | 49.4% |

| Winking Studios (Catalist:WKS) | SGD0.29 | SGD0.55 | 47.5% |

| Digital Core REIT (SGX:DCRU) | US$0.60 | US$0.84 | 29.0% |

| Seatrium (SGX:5E2) | SGD1.42 | SGD2.82 | 49.6% |

Here we highlight a subset of our preferred stocks from the screener.

Seatrium (SGX:5E2)

Overview: Seatrium Limited offers engineering solutions to the offshore, marine, and energy industries and has a market cap of SGD4.83 billion.

Operations: Revenue segments for Seatrium Limited include Ship Chartering at SGD24.71 million and Rigs & Floaters, Repairs & Upgrades, Offshore Platforms, and Specialised Shipbuilding at SGD8.39 billion.

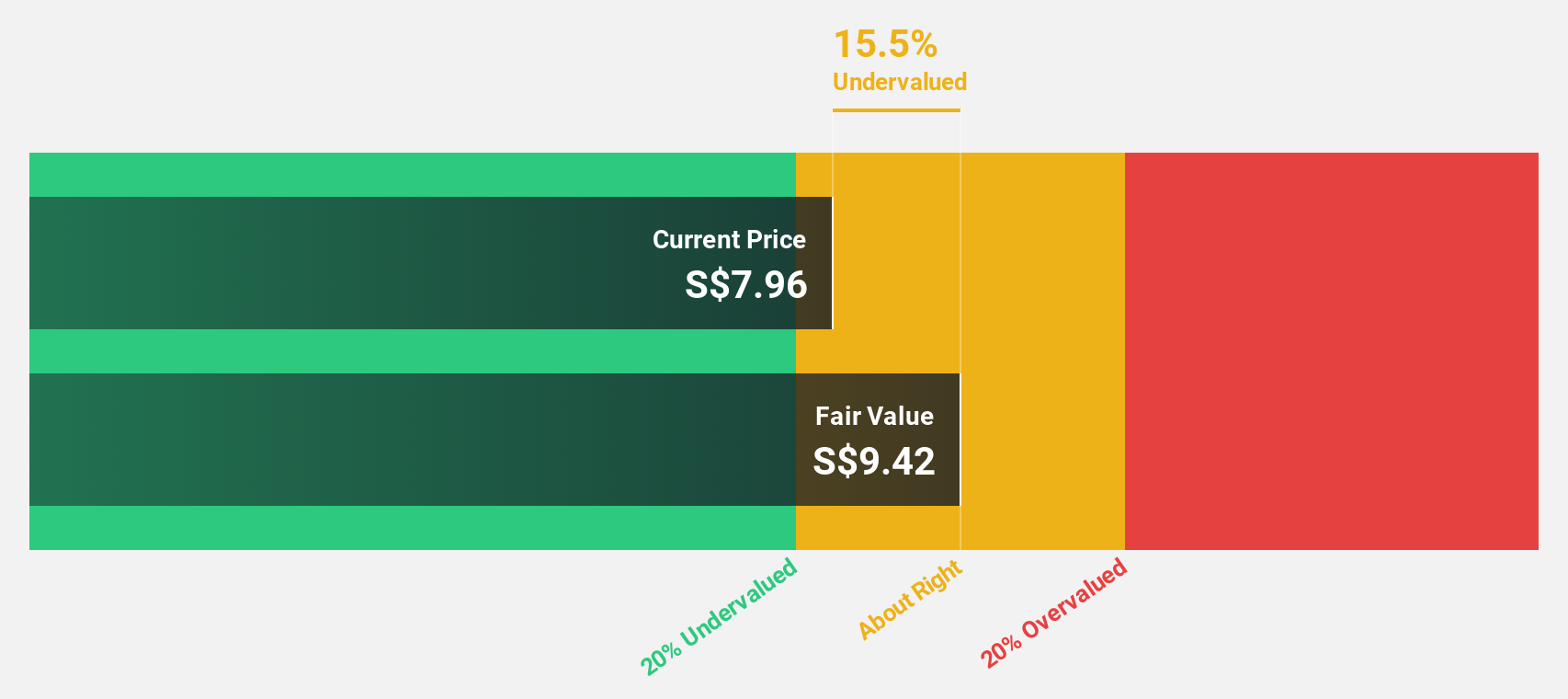

Estimated Discount To Fair Value: 49.6%

Seatrium Limited, trading at S$1.42, is significantly undervalued with an estimated fair value of S$2.82. Analysts forecast earnings growth of 72.47% per year and expect the company to become profitable within three years. Recent achievements include the early delivery of a jackup rig and a net income turnaround to S$35.97 million for H1 2024 from a loss last year, despite ongoing regulatory investigations potentially impacting future operations.

- Insights from our recent growth report point to a promising forecast for Seatrium's business outlook.

- Delve into the full analysis health report here for a deeper understanding of Seatrium.

Digital Core REIT (SGX:DCRU)

Overview: Digital Core REIT (SGX: DCRU) is a leading pure-play data centre REIT listed in Singapore, sponsored by Digital Realty, with a market cap of $780.27 million.

Operations: The company's revenue segment primarily comprises commercial REIT operations, generating $70.76 million.

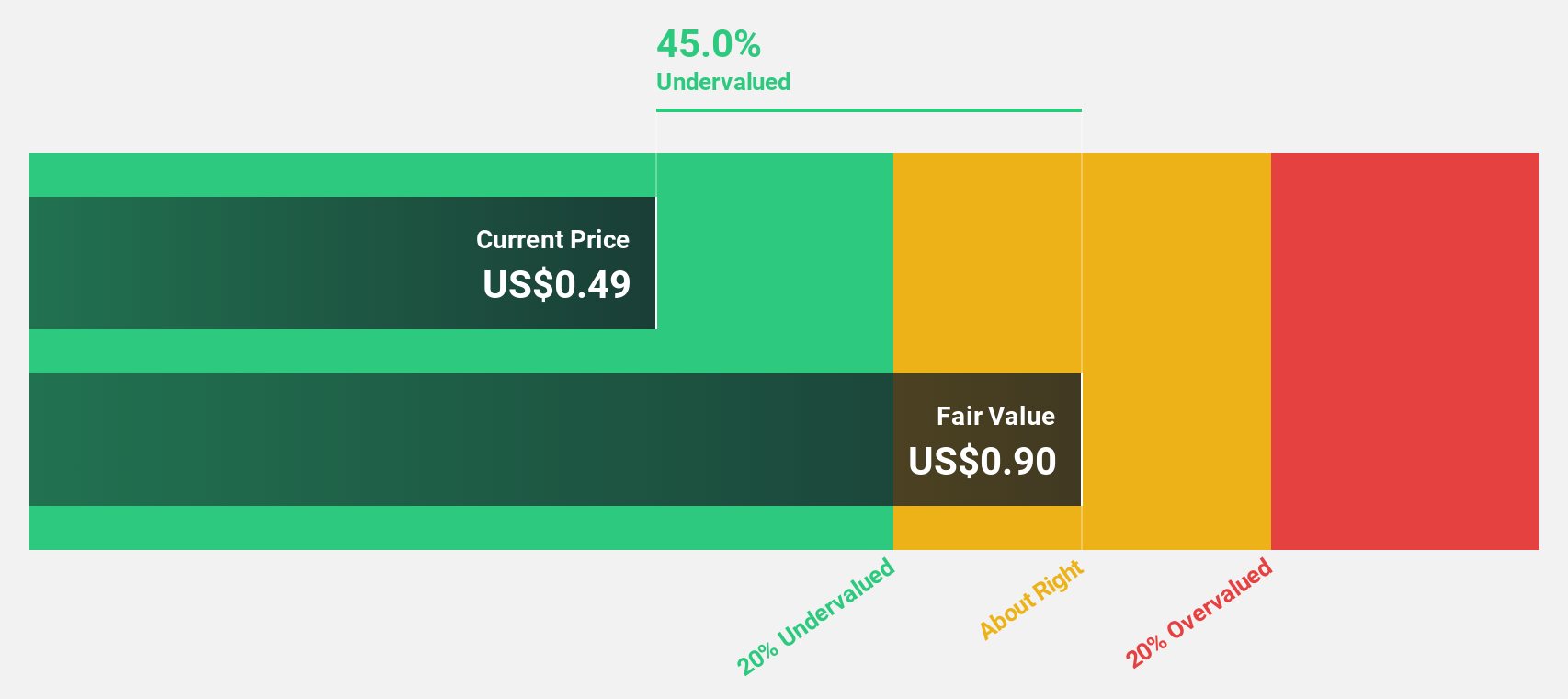

Estimated Discount To Fair Value: 29.0%

Digital Core REIT, trading at US$0.60, is undervalued by 29% relative to its fair value of US$0.84. Despite a drop in revenue to US$48.26 million for H1 2024 from US$53.39 million last year, net income more than doubled to US$18.63 million. Analysts forecast annual profit growth above market averages over the next three years, though recent dividend decreases and shareholder dilution may concern investors seeking stability in payouts.

- In light of our recent growth report, it seems possible that Digital Core REIT's financial performance will exceed current levels.

- Dive into the specifics of Digital Core REIT here with our thorough financial health report.

Singapore Technologies Engineering (SGX:S63)

Overview: Singapore Technologies Engineering Ltd is a global technology, defense, and engineering company with a market cap of SGD14.22 billion.

Operations: The company generates revenue from three main segments: Commercial Aerospace (SGD4.34 billion), Urban Solutions & Satcom (SGD2.01 billion), and Defence & Public Security (SGD4.54 billion).

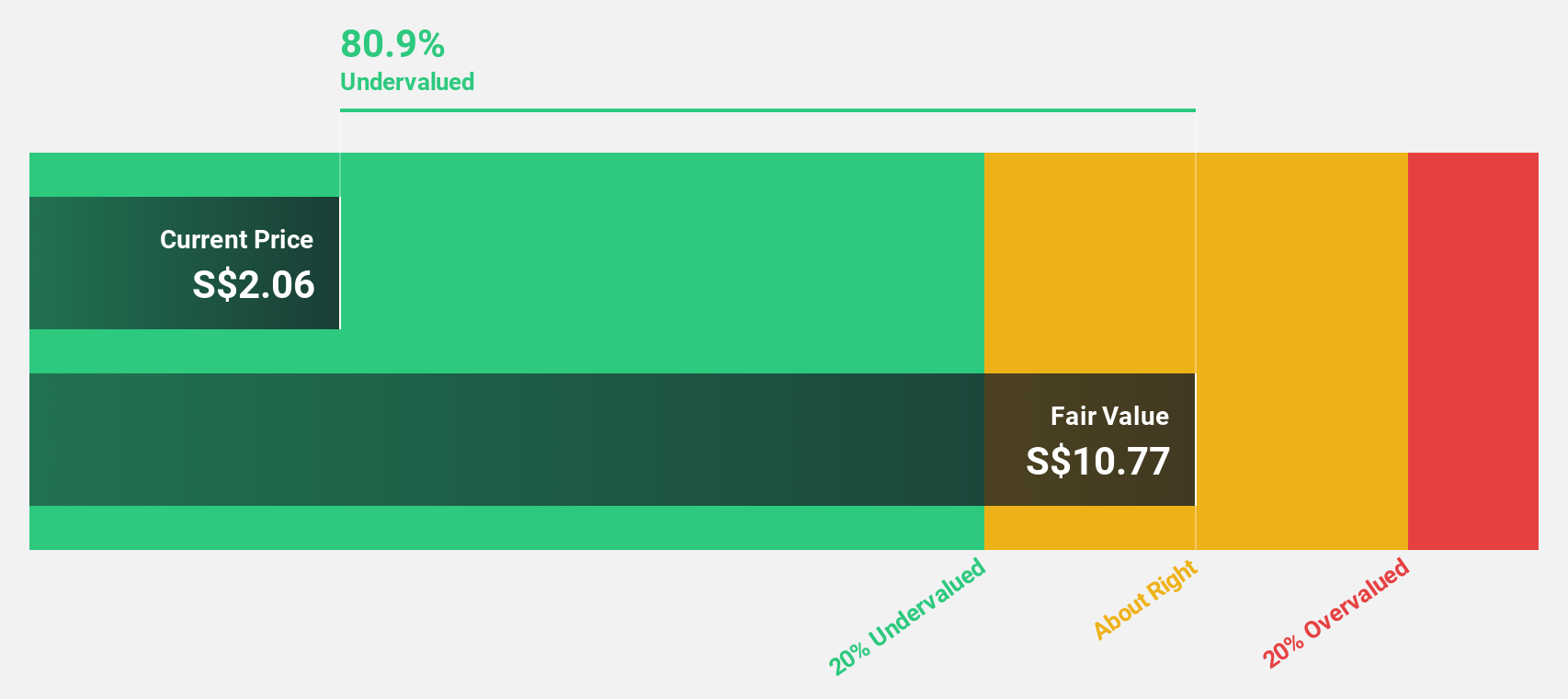

Estimated Discount To Fair Value: 49.4%

Singapore Technologies Engineering (SGD4.56) is trading at 49.4% below its estimated fair value of SGD9, suggesting it is significantly undervalued based on cash flows. The company reported strong earnings growth for H1 2024, with sales rising to SGD5.52 billion from SGD4.86 billion and net income increasing to SGD336.53 million from SGD280.62 million a year ago. However, debt coverage by operating cash flow remains a concern despite the forecasted revenue and profit growth exceeding market averages.

- Our expertly prepared growth report on Singapore Technologies Engineering implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Singapore Technologies Engineering stock in this financial health report.

Where To Now?

- Unlock our comprehensive list of 5 Undervalued SGX Stocks Based On Cash Flows by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:S63

Singapore Technologies Engineering

Operates as a technology, defence, and engineering company worldwide.

Solid track record, good value and pays a dividend.