- Singapore

- /

- Professional Services

- /

- SGX:CHZ

3 SGX Dividend Stocks Yielding Up To 9.9%

Reviewed by Simply Wall St

As the Singapore market navigates through a period of economic uncertainty, investors are increasingly turning their attention to dividend stocks as a reliable source of income. In this environment, selecting dividend stocks with strong fundamentals and attractive yields can provide both stability and growth potential for portfolios.

Top 10 Dividend Stocks In Singapore

| Name | Dividend Yield | Dividend Rating |

| BRC Asia (SGX:BEC) | 6.96% | ★★★★★☆ |

| Bumitama Agri (SGX:P8Z) | 6.65% | ★★★★★☆ |

| Singapore Airlines (SGX:C6L) | 7.27% | ★★★★★☆ |

| YHI International (SGX:BPF) | 6.56% | ★★★★★☆ |

| Singapore Exchange (SGX:S68) | 3.19% | ★★★★★☆ |

| QAF (SGX:Q01) | 6.17% | ★★★★★☆ |

| Aztech Global (SGX:8AZ) | 10.00% | ★★★★☆☆ |

| UOB-Kay Hian Holdings (SGX:U10) | 6.13% | ★★★★☆☆ |

| Oversea-Chinese Banking (SGX:O39) | 5.63% | ★★★★☆☆ |

| Delfi (SGX:P34) | 6.64% | ★★★★☆☆ |

Click here to see the full list of 21 stocks from our Top SGX Dividend Stocks screener.

We'll examine a selection from our screener results.

Aztech Global (SGX:8AZ)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aztech Global Ltd. is involved in the research, development, engineering, and manufacturing of IoT devices, data-communication products, and LED lighting products across Singapore, North America, China, Europe, and other international markets with a market cap of SGD771.79 million.

Operations: Aztech Global Ltd. generates revenue from the development and production of IoT devices, data-communication products, and LED lighting products across various international markets.

Dividend Yield: 10%

Aztech Global's dividend payments have increased but remain unreliable, having only been paid for three years and showing volatility. The company's dividends are covered by earnings (74.4% payout ratio) and cash flows (62.1% cash payout ratio). Aztech trades at good value, 39.9% below its estimated fair value, with a top-tier dividend yield of 10%. Recent share repurchases and a $0.05 interim dividend reflect ongoing shareholder returns efforts amid growing earnings.

- Get an in-depth perspective on Aztech Global's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Aztech Global shares in the market.

HRnetGroup (SGX:CHZ)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: HRnetGroup Limited is an investment holding company involved in recruitment and staffing across several Asian countries, with a market cap of SGD657.02 million.

Operations: HRnetGroup Limited generates revenue from two primary segments: Flexible Staffing, which contributes SGD505.60 million, and Professional Recruitment, which adds SGD59.92 million.

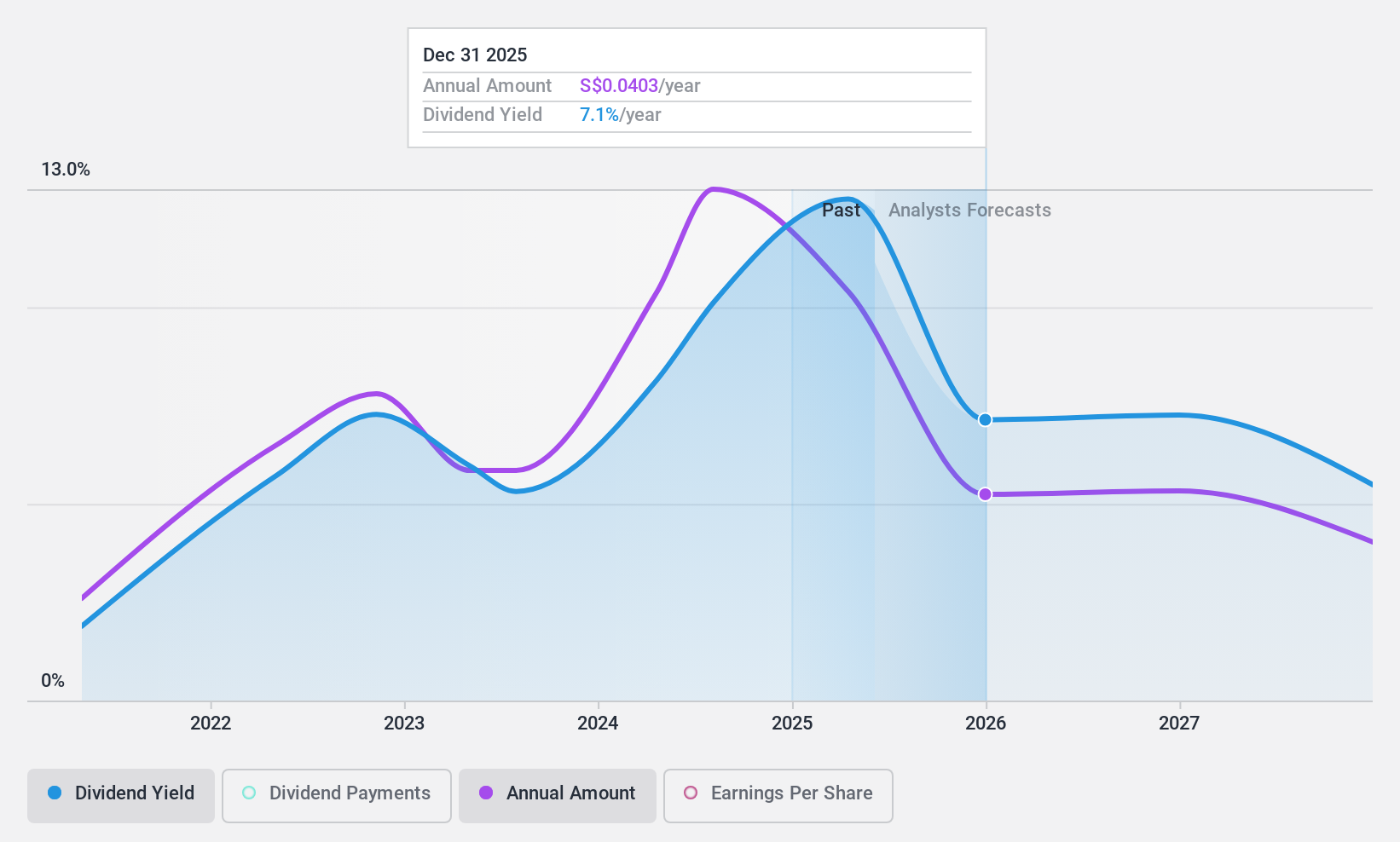

Dividend Yield: 6%

HRnetGroup's recent interim dividend of 1.87 Singapore cents per share, paid on 11 September 2024, highlights its commitment to shareholder returns. Despite a decline in half-year earnings to S$21.68 million from S$28.28 million the previous year, dividends remain covered by both earnings (69% payout ratio) and cash flows (74.5% cash payout ratio). While HRnetGroup's dividend history is under a decade long, payments have been stable and are considered reliable within the market context.

- Click here and access our complete dividend analysis report to understand the dynamics of HRnetGroup.

- According our valuation report, there's an indication that HRnetGroup's share price might be on the cheaper side.

Delfi (SGX:P34)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Delfi Limited, an investment holding company with a market cap of SGD513.37 million, manufactures, markets, distributes, and sells chocolate and consumer products in Indonesia, the Philippines, Malaysia, Singapore, and internationally.

Operations: Delfi Limited generates revenue of $349.57 million from Indonesia and $183.30 million from its regional markets.

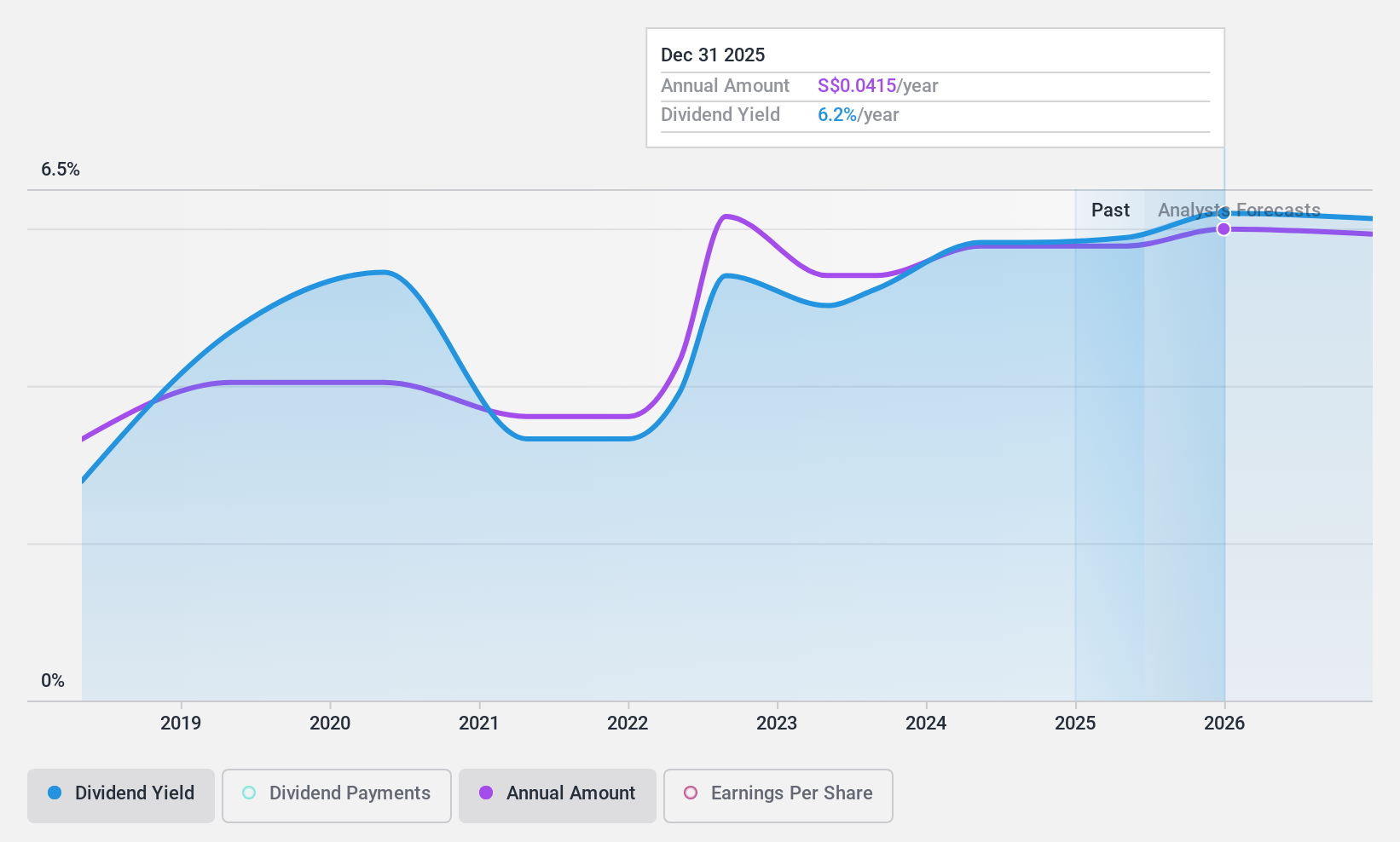

Dividend Yield: 6.6%

Delfi Limited's interim dividend for the first half of 2024 decreased slightly to 2.72 Singapore cents per share from 2.73 cents last year, reflecting a cautious approach amid declining earnings and sales. Despite its high dividend yield of 6.64%, the payout is not well covered by free cash flow or earnings, raising sustainability concerns. Additionally, Delfi's dividend history has been volatile over the past decade, making it less reliable for consistent income seekers.

- Take a closer look at Delfi's potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that Delfi is priced lower than what may be justified by its financials.

Make It Happen

- Click here to access our complete index of 21 Top SGX Dividend Stocks.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HRnetGroup might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:CHZ

HRnetGroup

An investment holding company, engages in the recruitment and staffing business in Singapore, Hong Kong, Taiwan, the People’s Republic of China, Japan, South Korea, Malaysia, Thailand, and Indonesia.

Flawless balance sheet, good value and pays a dividend.