Seatrium And 2 Additional SGX Stocks That May Be Trading Below Intrinsic Value

Reviewed by Simply Wall St

The Singapore market has been navigating a landscape marked by strategic corporate collaborations, such as Citi's recent partnership with Network International to enhance payment services across the Middle East and Africa. In this context, identifying undervalued stocks becomes crucial for investors looking to capitalize on intrinsic value amidst evolving economic conditions.

Top 5 Undervalued Stocks Based On Cash Flows In Singapore

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| LHN (SGX:41O) | SGD0.325 | SGD0.41 | 20.7% |

| Singapore Technologies Engineering (SGX:S63) | SGD4.59 | SGD9.00 | 49% |

| Winking Studios (Catalist:WKS) | SGD0.29 | SGD0.55 | 47.1% |

| Digital Core REIT (SGX:DCRU) | US$0.595 | US$0.84 | 29.3% |

| Seatrium (SGX:5E2) | SGD1.42 | SGD2.80 | 49.4% |

Let's uncover some gems from our specialized screener.

Seatrium (SGX:5E2)

Overview: Seatrium Limited offers engineering solutions to the offshore, marine, and energy industries with a market cap of SGD4.80 billion.

Operations: The company's revenue segments include Ship Chartering at SGD24.71 million and Rigs & Floaters, Repairs & Upgrades, Offshore Platforms, and Specialised Shipbuilding at SGD8.39 billion.

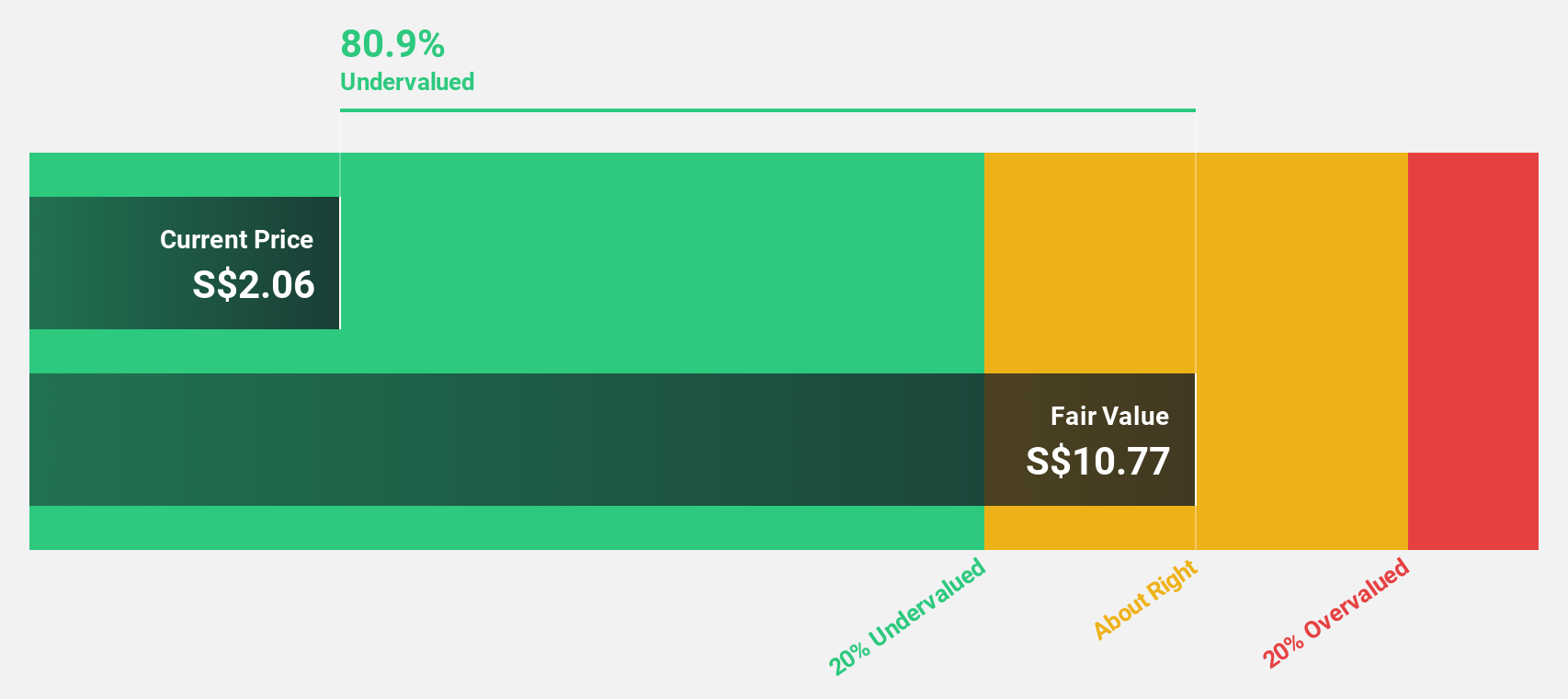

Estimated Discount To Fair Value: 49.4%

Seatrium Limited is trading at S$1.42, significantly below its estimated fair value of S$2.80, suggesting it may be undervalued based on cash flows. Despite a forecasted low return on equity (8%) in three years, the company's revenue is expected to grow at 7.1% annually, outpacing the market's 3.7%. Recent news includes successful project deliveries and a return to profitability with net income of S$35.97 million for H1 2024 compared to a loss last year.

- According our earnings growth report, there's an indication that Seatrium might be ready to expand.

- Navigate through the intricacies of Seatrium with our comprehensive financial health report here.

Digital Core REIT (SGX:DCRU)

Overview: Digital Core REIT (SGX: DCRU) is a leading pure-play data centre REIT listed in Singapore, sponsored by Digital Realty, with a market cap of approximately $773.77 million.

Operations: Digital Core REIT generates its revenue primarily from its commercial real estate segment, amounting to $70.76 million.

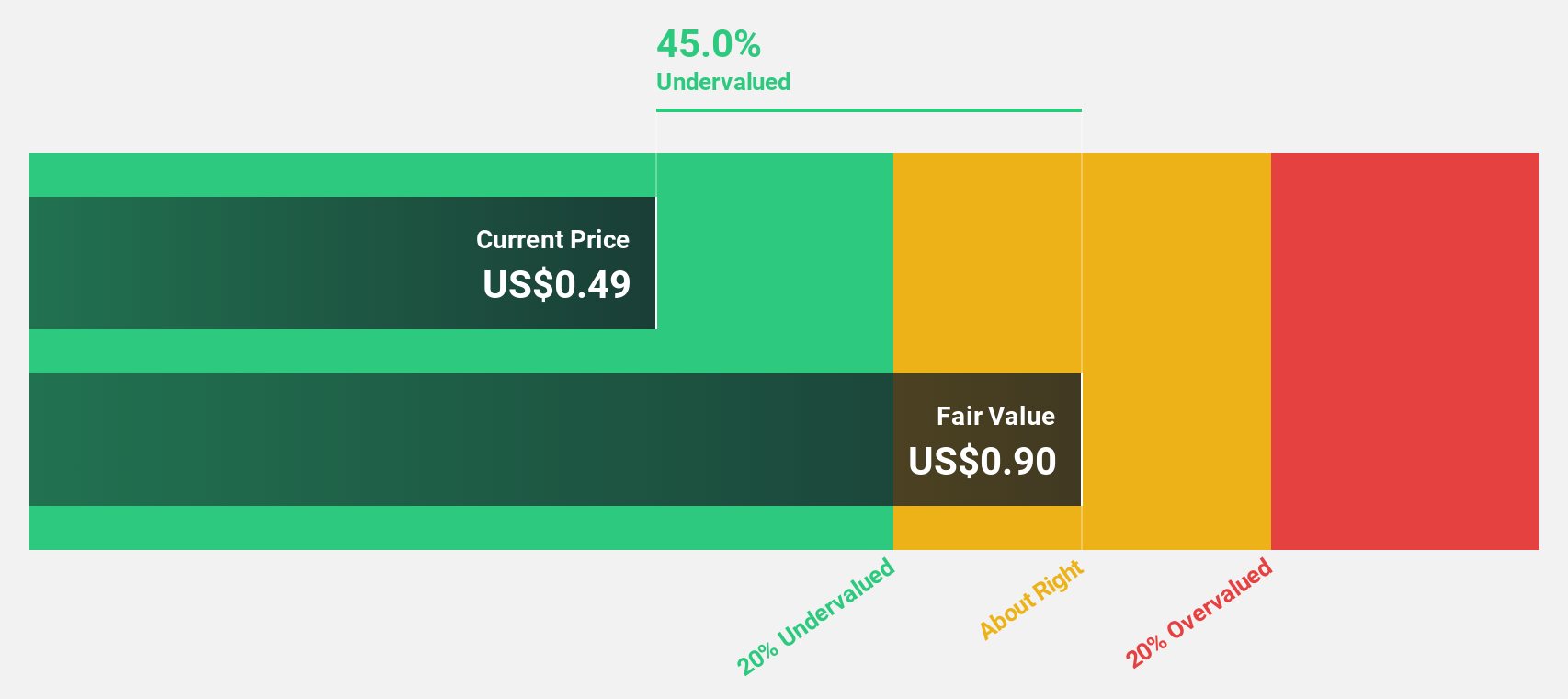

Estimated Discount To Fair Value: 29.3%

Digital Core REIT, trading at US$0.60, is significantly undervalued based on estimated fair value of US$0.84. Despite a recent dividend decrease and lower sales (US$33.5 million) and revenue (US$48.26 million) compared to last year, net income has more than doubled to US$18.63 million for H1 2024. Earnings per share also improved significantly from the previous year, while revenue growth is forecasted at 12% annually, outpacing the market's 3.7%.

- Our expertly prepared growth report on Digital Core REIT implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Digital Core REIT's balance sheet health report.

Singapore Technologies Engineering (SGX:S63)

Overview: Singapore Technologies Engineering Ltd operates as a global technology, defence, and engineering company with a market cap of SGD14.28 billion.

Operations: The company generates revenue from three main segments: Commercial Aerospace (SGD4.34 billion), Urban Solutions & Satcom (SGD2.01 billion), and Defence & Public Security (SGD4.54 billion).

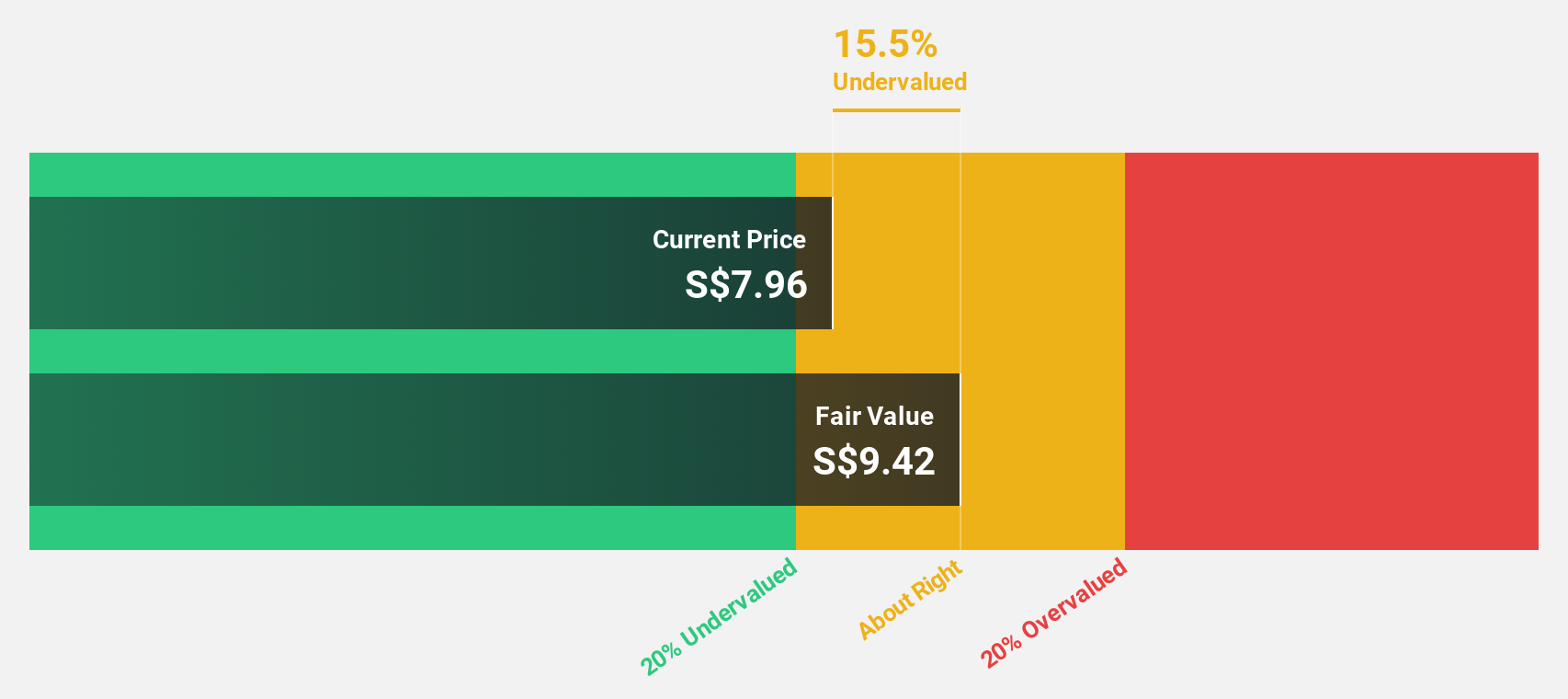

Estimated Discount To Fair Value: 49%

Singapore Technologies Engineering is trading at S$4.59, significantly below its estimated fair value of S$9. The company reported H1 2024 sales of S$5.52 billion and net income of S$336.53 million, reflecting solid growth from the previous year. Earnings are forecasted to grow annually by 11.05%, outpacing the Singapore market's 10.2%. However, debt coverage by operating cash flow remains a concern despite strong revenue and profit growth prospects.

- In light of our recent growth report, it seems possible that Singapore Technologies Engineering's financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of Singapore Technologies Engineering stock in this financial health report.

Seize The Opportunity

- Get an in-depth perspective on all 5 Undervalued SGX Stocks Based On Cash Flows by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:5E2

Seatrium

Provides engineering solutions to the offshore, marine, and energy industries.

Excellent balance sheet and good value.