The Singapore market has been navigating a landscape marked by significant corporate collaborations, such as Citi's recent referral agreement with Network International to enhance payment services in the Middle East and Africa. In this evolving environment, dividend stocks can offer stability and consistent income, making them an attractive option for investors looking to enhance their portfolios.

Top 10 Dividend Stocks In Singapore

| Name | Dividend Yield | Dividend Rating |

| BRC Asia (SGX:BEC) | 7.37% | ★★★★★☆ |

| Bumitama Agri (SGX:P8Z) | 6.81% | ★★★★★☆ |

| China Sunsine Chemical Holdings (SGX:QES) | 6.32% | ★★★★★☆ |

| YHI International (SGX:BPF) | 6.56% | ★★★★★☆ |

| Civmec (SGX:P9D) | 5.50% | ★★★★★☆ |

| Singapore Exchange (SGX:S68) | 3.41% | ★★★★★☆ |

| Singapore Airlines (SGX:C6L) | 7.88% | ★★★★★☆ |

| Delfi (SGX:P34) | 7.11% | ★★★★☆☆ |

| UOB-Kay Hian Holdings (SGX:U10) | 6.57% | ★★★★☆☆ |

| Oversea-Chinese Banking (SGX:O39) | 6.12% | ★★★★☆☆ |

Click here to see the full list of 19 stocks from our Top SGX Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

BRC Asia (SGX:BEC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: BRC Asia Limited, with a market cap of SGD595.34 million, specializes in the prefabrication of steel reinforcement for concrete across various regions including Singapore, Australia, Brunei, Hong Kong, Indonesia, Malaysia, Thailand, India and internationally.

Operations: BRC Asia Limited generates revenue from two primary segments: Trading, which contributes SGD319.71 million, and Fabrication and Manufacturing, accounting for SGD1.35 billion.

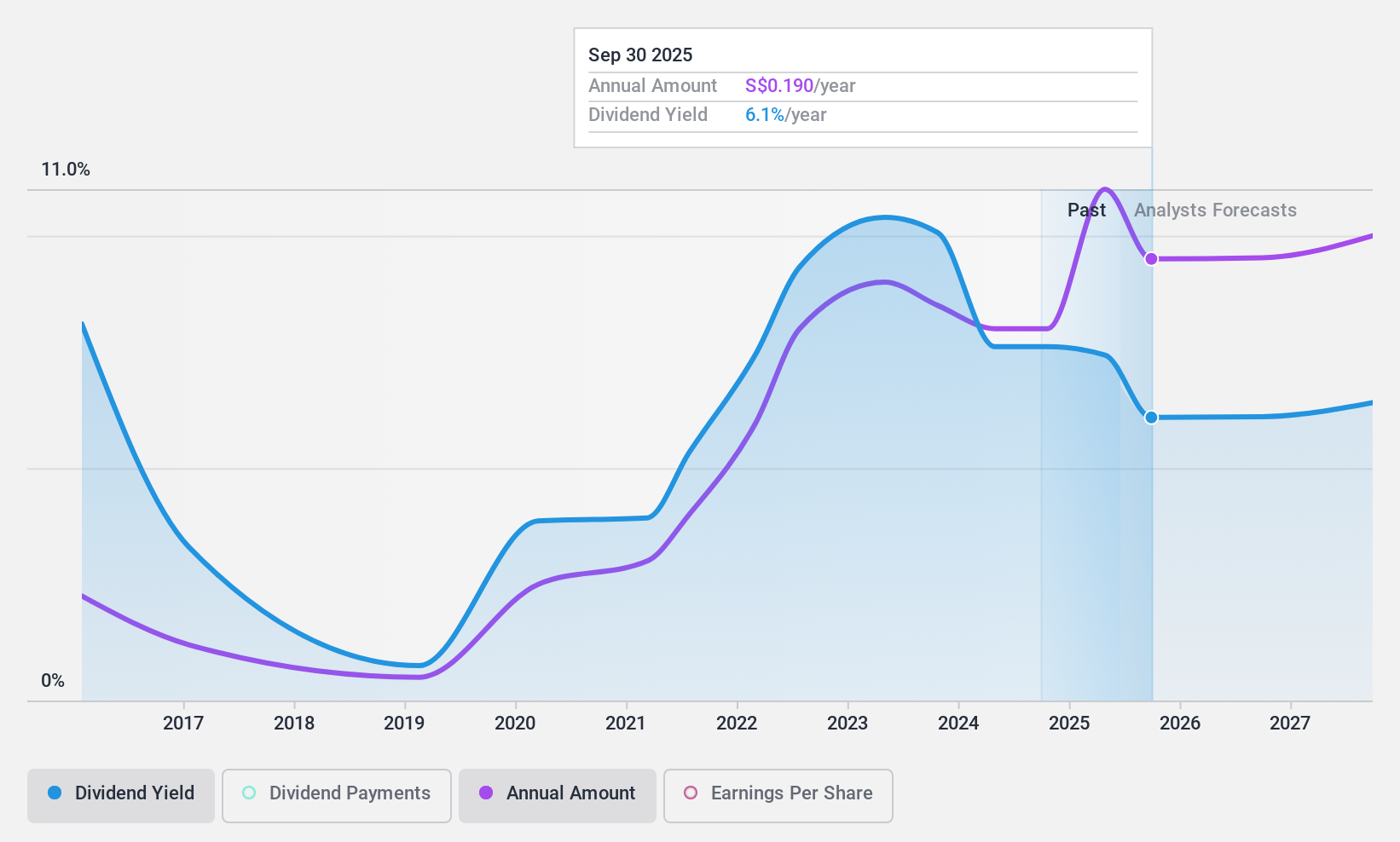

Dividend Yield: 7.4%

BRC Asia Limited has recently announced an interim tax-exempt dividend of S$0.06 per share, set to be paid on 15 November 2024. While its dividend yield is in the top 25% of Singapore's market, the company's dividend history has been volatile and unreliable over the past decade. However, current dividends are covered by earnings (35.9% payout ratio) and cash flows (85.3% cash payout ratio), suggesting a sustainable distribution for now despite past inconsistencies.

- Take a closer look at BRC Asia's potential here in our dividend report.

- The valuation report we've compiled suggests that BRC Asia's current price could be quite moderate.

Singapore Exchange (SGX:S68)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Singapore Exchange Limited operates an integrated securities and derivatives exchange, related clearing houses, and an electricity market in Singapore with a market cap of SGD11.09 billion.

Operations: Singapore Exchange Limited generates revenue from four primary segments: Equities - Cash (SGD334.94 million), Platform and Others (SGD240.20 million), Equities - Derivatives (SGD334.05 million), and Fixed Income, Currencies, and Commodities (SGD322.50 million).

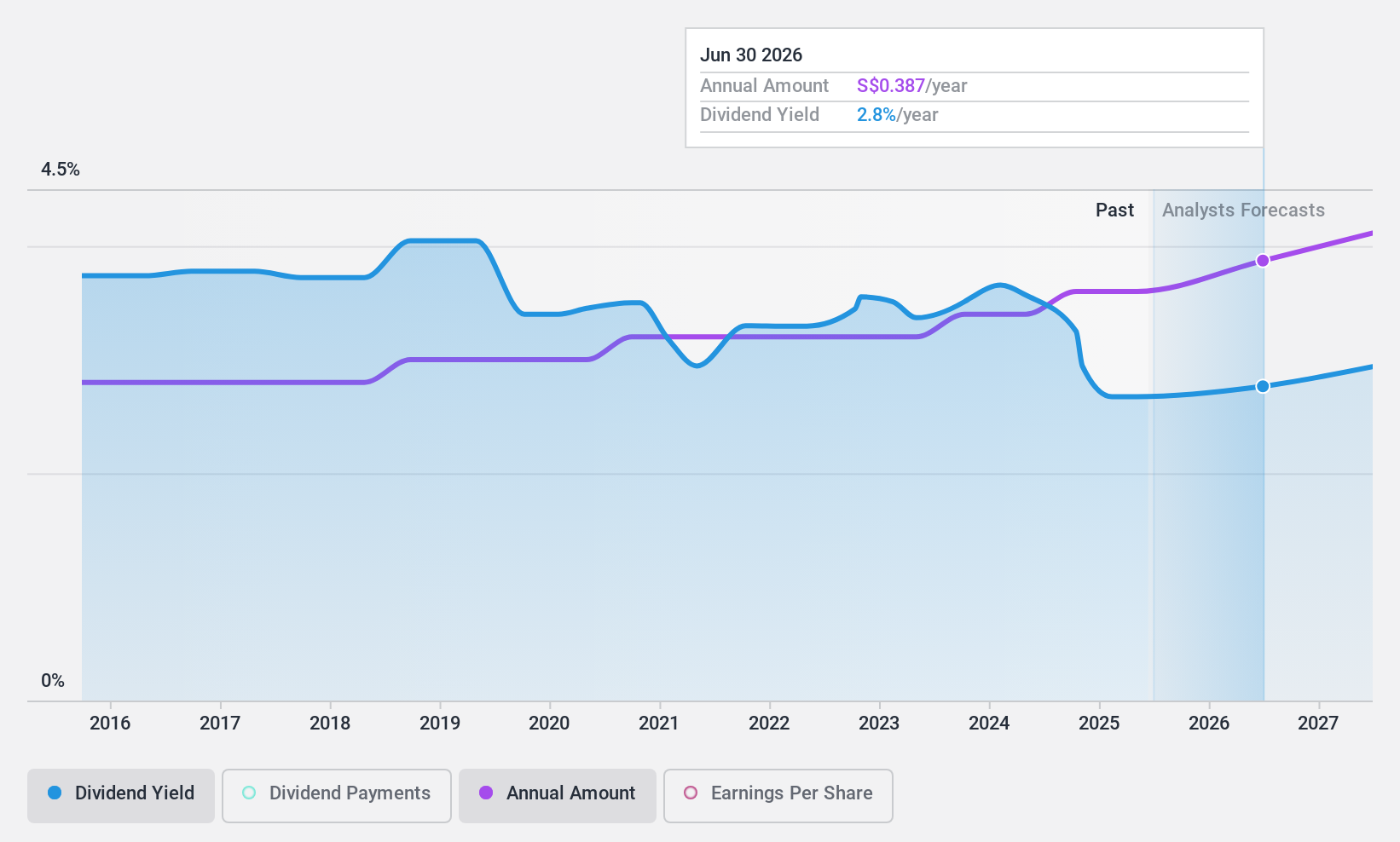

Dividend Yield: 3.4%

Singapore Exchange Limited reported revenue of S$1.23 billion and net income of S$597.91 million for the fiscal year ended June 30, 2024, reflecting stable growth. The company has maintained consistent dividend payments over the past decade, with a current payout ratio of 61.7% and cash payout ratio of 69.9%, indicating dividends are well-covered by earnings and cash flows. However, its dividend yield (3.41%) is lower compared to top-tier payers in Singapore's market.

- Delve into the full analysis dividend report here for a deeper understanding of Singapore Exchange.

- Our valuation report unveils the possibility Singapore Exchange's shares may be trading at a premium.

UOB-Kay Hian Holdings (SGX:U10)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: UOB-Kay Hian Holdings Limited is an investment holding company offering stockbroking, futures broking, structured lending, investment trading, margin financing, and nominee and research services across Singapore, Hong Kong, Thailand, Malaysia and internationally with a market cap of SGD1.32 billion.

Operations: UOB-Kay Hian Holdings Limited generates SGD581.07 million from its Securities and Futures Broking and other related services.

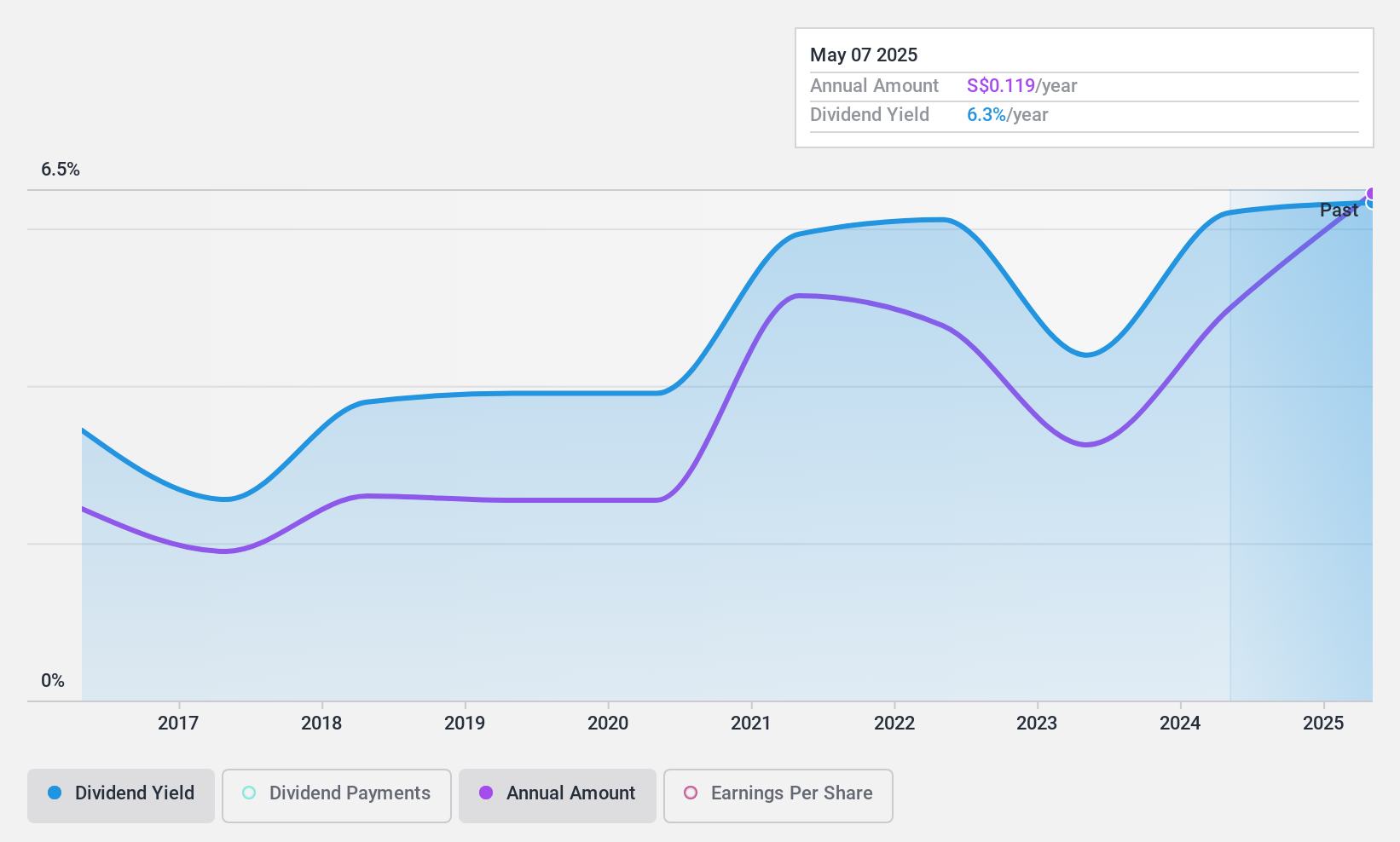

Dividend Yield: 6.6%

UOB-Kay Hian Holdings reported net income of S$113.91 million for the half year ended June 30, 2024, up from S$69.32 million a year ago. Despite this growth, its dividend payments have been volatile and not well covered by free cash flows due to a high cash payout ratio (100.1%). Significant insider selling over the past three months also raises concerns about dividend sustainability, although its current yield of 6.57% is among the top in Singapore's market.

- Click to explore a detailed breakdown of our findings in UOB-Kay Hian Holdings' dividend report.

- Our valuation report unveils the possibility UOB-Kay Hian Holdings' shares may be trading at a discount.

Key Takeaways

- Unlock our comprehensive list of 19 Top SGX Dividend Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BRC Asia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:BEC

BRC Asia

Engages in the prefabrication of steel reinforcement for use in concrete in Singapore, Australia, Brunei, Hong Kong, Indonesia, Malaysia, Thailand, India, and internationally.

Flawless balance sheet, undervalued and pays a dividend.