- Singapore

- /

- Real Estate

- /

- SGX:CY6U

Ascendas India Trust (SGX:CY6U) Will Pay A Smaller Dividend Than Last Year

The board of Ascendas India Trust (SGX:CY6U) has announced that the dividend on 25th of August will be reduced by 9.5% to S$0.042. The yield is still above the industry average at 5.7%.

View our latest analysis for Ascendas India Trust

Ascendas India Trust's Payment Has Solid Earnings Coverage

A big dividend yield for a few years doesn't mean much if it can't be sustained. Before this announcement, Ascendas India Trust was paying out 74% of earnings, but a comparatively small 72% of free cash flows. Since the dividend is just paying out cash to shareholders, we care more about the cash payout ratio from which we can see plenty is being left over for reinvestment in the business.

Over the next year, EPS is forecast to fall by 0.4%. Assuming the dividend continues along recent trends, we think the payout ratio could reach 82%, which is definitely on the higher side.

Dividend Volatility

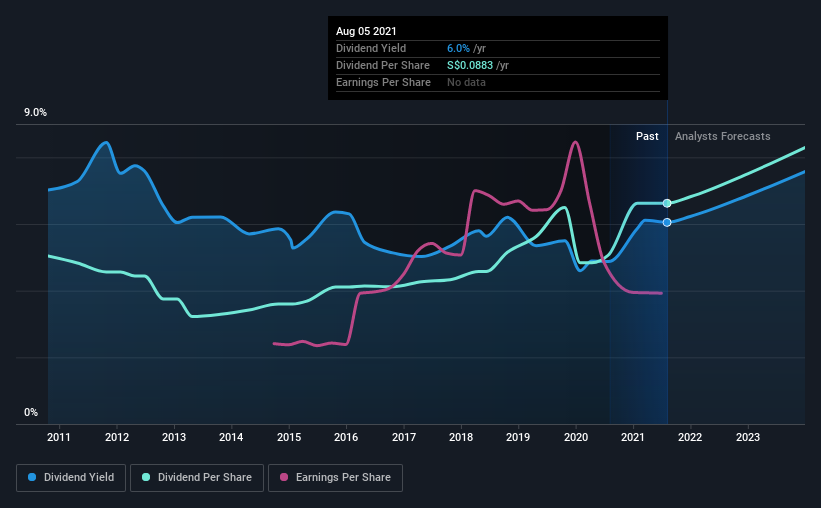

The company has a long dividend track record, but it doesn't look great with cuts in the past. The dividend has gone from S$0.067 in 2011 to the most recent annual payment of S$0.088. This means that it has been growing its distributions at 2.8% per annum over that time. We're glad to see the dividend has risen, but with a limited rate of growth and fluctuations in the payments the total shareholder return may be limited.

Dividend Growth May Be Hard To Achieve

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. Ascendas India Trust hasn't seen much change in its earnings per share over the last five years.

Our Thoughts On Ascendas India Trust's Dividend

In summary, dividends being cut isn't ideal, however it can bring the payment into a more sustainable range. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. We would be a touch cautious of relying on this stock primarily for the dividend income.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Just as an example, we've come across 3 warning signs for Ascendas India Trust you should be aware of, and 1 of them makes us a bit uncomfortable. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

When trading Ascendas India Trust or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SGX:CY6U

CapitaLand India Trust

CapitaLand India Trust (CLINT) was listed on the Singapore Exchange Securities Trading Limited (SGX-ST) in August 2007 as the first Indian property trust in Asia.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives