- Singapore

- /

- Real Estate

- /

- SGX:Z59

Take Care Before Jumping Onto Yoma Strategic Holdings Ltd. (SGX:Z59) Even Though It's 25% Cheaper

The Yoma Strategic Holdings Ltd. (SGX:Z59) share price has fared very poorly over the last month, falling by a substantial 25%. For any long-term shareholders, the last month ends a year to forget by locking in a 53% share price decline.

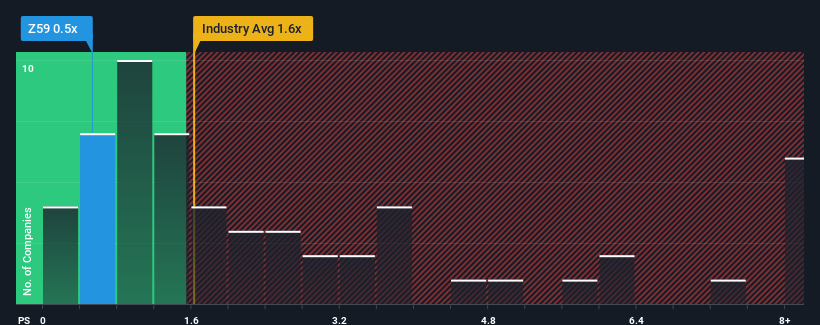

After such a large drop in price, Yoma Strategic Holdings may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.5x, considering almost half of all companies in the Real Estate industry in Singapore have P/S ratios greater than 1.6x and even P/S higher than 4x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Yoma Strategic Holdings

How Yoma Strategic Holdings Has Been Performing

Recent times have been quite advantageous for Yoma Strategic Holdings as its revenue has been rising very briskly. One possibility is that the P/S ratio is low because investors think this strong revenue growth might actually underperform the broader industry in the near future. Those who are bullish on Yoma Strategic Holdings will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Yoma Strategic Holdings' earnings, revenue and cash flow.How Is Yoma Strategic Holdings' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Yoma Strategic Holdings' is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 129%. Pleasingly, revenue has also lifted 85% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Weighing the recent medium-term upward revenue trajectory against the broader industry's one-year forecast for contraction of 0.4% shows it's a great look while it lasts.

In light of this, it's quite peculiar that Yoma Strategic Holdings' P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can maintain its recent positive growth rate in the face of a shrinking broader industry.

What Does Yoma Strategic Holdings' P/S Mean For Investors?

The southerly movements of Yoma Strategic Holdings' shares means its P/S is now sitting at a pretty low level. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Looking at the figures, it's surprising to see Yoma Strategic Holdings currently trades on a much lower than expected P/S since its recent three-year revenue growth is beating forecasts for a struggling industry. One assumption would be that there are some underlying risks to revenue that are keeping the P/S from rising to match the its strong performance. The most obvious risk is that its revenue trajectory may not keep outperforming under these tough industry conditions. While the chance of the share price dropping sharply is fairly remote, investors do seem to be anticipating future revenue instability.

It is also worth noting that we have found 2 warning signs for Yoma Strategic Holdings (1 makes us a bit uncomfortable!) that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:Z59

Yoma Strategic Holdings

An investment holding company, engages in the real estate, motor, leasing, mobile financial, food and beverages, and investment businesses in Singapore, Myanmar, and the People’s Republic of China.

Adequate balance sheet with very low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026