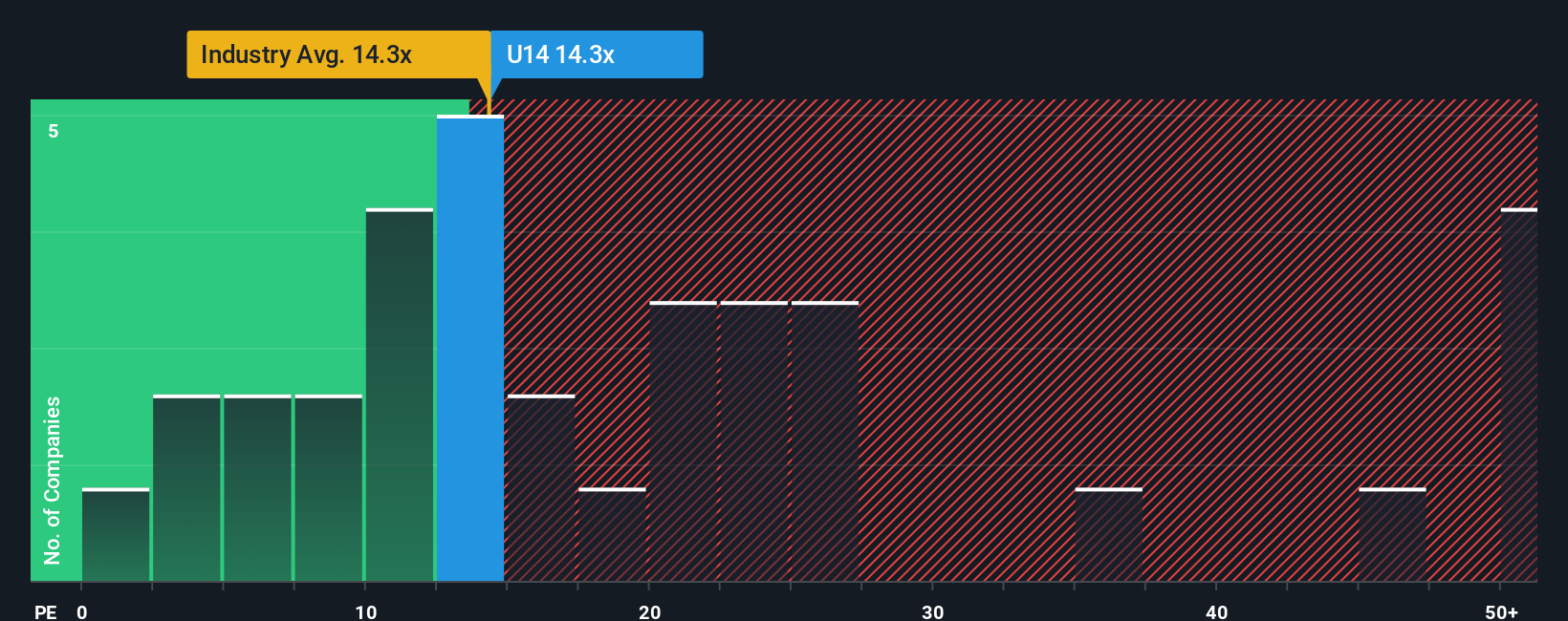

It's not a stretch to say that UOL Group Limited's (SGX:U14) price-to-earnings (or "P/E") ratio of 14.3x right now seems quite "middle-of-the-road" compared to the market in Singapore, where the median P/E ratio is around 13x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

While the market has experienced earnings growth lately, UOL Group's earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for UOL Group

Is There Some Growth For UOL Group?

UOL Group's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Retrospectively, the last year delivered a frustrating 49% decrease to the company's bottom line. Regardless, EPS has managed to lift by a handy 16% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

Looking ahead now, EPS is anticipated to climb by 3.5% per annum during the coming three years according to the seven analysts following the company. With the market predicted to deliver 9.8% growth per year, the company is positioned for a weaker earnings result.

With this information, we find it interesting that UOL Group is trading at a fairly similar P/E to the market. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Key Takeaway

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of UOL Group's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for UOL Group that you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:U14

UOL Group

UOL Group Limited (UOL) is a leading Singapore-listed property and hospitality group with total assets of about $23 billion.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives