- Singapore

- /

- Real Estate

- /

- SGX:TQ5

Frasers Property Limited's (SGX:TQ5) Price Is Right But Growth Is Lacking

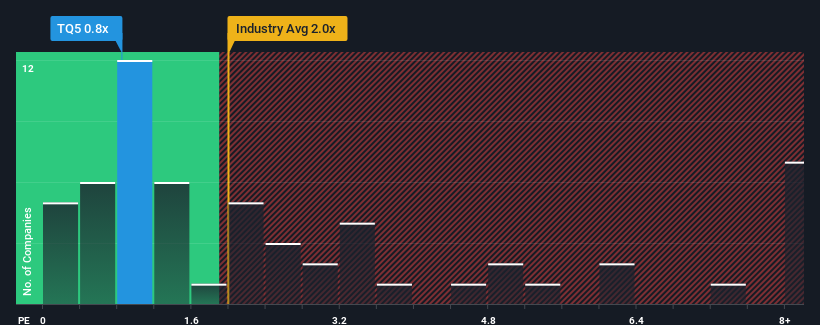

You may think that with a price-to-sales (or "P/S") ratio of 0.8x Frasers Property Limited (SGX:TQ5) is a stock worth checking out, seeing as almost half of all the Real Estate companies in Singapore have P/S ratios greater than 2x and even P/S higher than 4x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Frasers Property

How Frasers Property Has Been Performing

Frasers Property could be doing better as it's been growing revenue less than most other companies lately. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Frasers Property's future stacks up against the industry? In that case, our free report is a great place to start.How Is Frasers Property's Revenue Growth Trending?

In order to justify its P/S ratio, Frasers Property would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Still, the latest three year period was better as it's delivered a decent 9.7% overall rise in revenue. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Looking ahead now, revenue is anticipated to slump, contracting by 8.4% each year during the coming three years according to the three analysts following the company. With the industry predicted to deliver 2.6% growth each year, that's a disappointing outcome.

In light of this, it's understandable that Frasers Property's P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On Frasers Property's P/S

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Frasers Property's P/S is on the lower end of the spectrum. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

It is also worth noting that we have found 4 warning signs for Frasers Property (1 is significant!) that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:TQ5

Frasers Property

An investment holding company, develops, invests in, and manages a portfolio of real estate assets in Singapore, Australia, Europe, China, Thailand, and internationally.

Proven track record and fair value.

Market Insights

Community Narratives