- Singapore

- /

- Real Estate

- /

- SGX:O10

Asian Undervalued Small Caps With Insider Action In November 2025

Reviewed by Simply Wall St

As global markets navigate a landscape of mixed performances, with large-cap technology stocks driving gains in the U.S. while smaller-cap indexes face declines, Asia's small-cap sector presents intriguing opportunities amid evolving economic conditions. With the recent U.S.-China trade truce offering temporary relief and central banks maintaining steady interest rates, investors may find value in Asian small caps that exhibit strong fundamentals and insider activity, particularly as these companies often thrive on regional demand and local market dynamics.

Top 10 Undervalued Small Caps With Insider Buying In Asia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Security Bank | 4.6x | 1.0x | 24.29% | ★★★★★★ |

| East West Banking | 3.1x | 0.7x | 22.16% | ★★★★★☆ |

| Domino's Pizza Enterprises | NA | 0.8x | 26.19% | ★★★★★☆ |

| Ho Bee Land | 9.8x | 2.9x | 46.05% | ★★★★★☆ |

| Chinasoft International | 24.0x | 0.7x | -1325.54% | ★★★★☆☆ |

| BWP Trust | 10.3x | 13.4x | 17.16% | ★★★★☆☆ |

| Hung Hing Printing Group | NA | 0.4x | 44.84% | ★★★★☆☆ |

| Bumitama Agri | 11.6x | 1.7x | 44.99% | ★★★☆☆☆ |

| Ever Sunshine Services Group | 6.5x | 0.4x | -422.34% | ★★★☆☆☆ |

| Far East Orchard | 10.1x | 3.3x | 11.33% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

Chinasoft International (SEHK:354)

Simply Wall St Value Rating: ★★★★☆☆

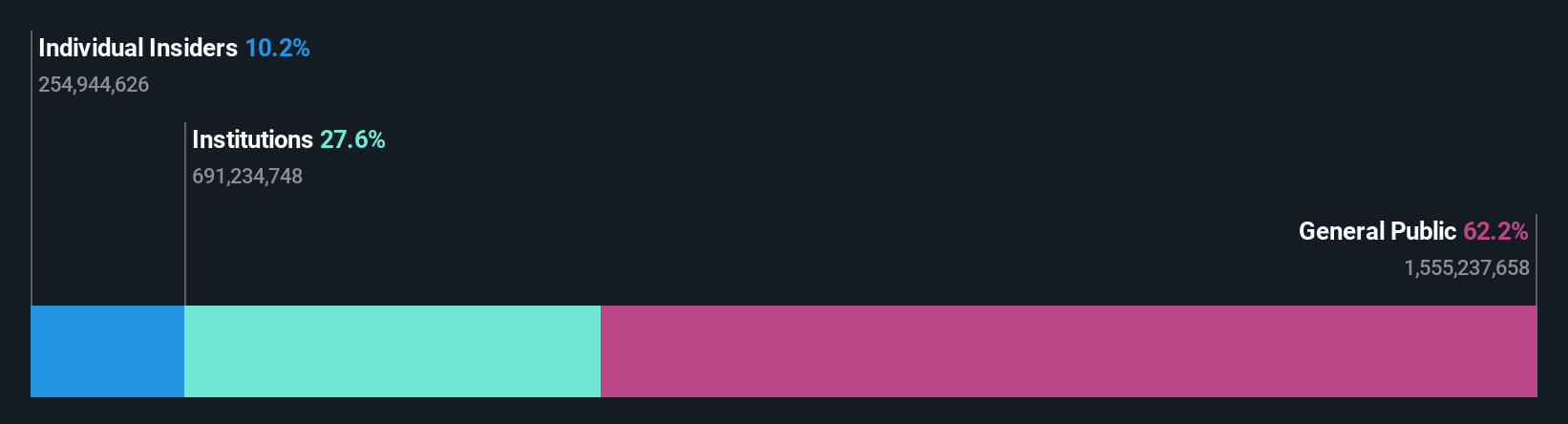

Overview: Chinasoft International is an IT services provider specializing in software development, cloud services, and digital transformation solutions with a market cap of approximately CN¥15.5 billion.

Operations: Chinasoft International's revenue is primarily driven by its service offerings, with a significant portion of costs attributed to COGS and operating expenses. The company's net income margin has shown fluctuations, reaching 4.17% as of December 2023. Notably, the gross profit margin has experienced a declining trend over recent periods, recorded at 21.59% in June 2025.

PE: 24.0x

Chinasoft International, a key player in Asia's small-cap segment, recently signed a three-year deal for the Wuhan Cybersecurity Base Intelligent Computing Center, bolstering its AI capabilities. Despite no recent share buybacks in 2025, insider confidence is evident with Yuhong Chen purchasing 2 million shares for CNY 11.22 million. The company reported half-year sales of CNY 8.51 billion and net income of CNY 315.56 million, showing growth from last year despite reliance on external borrowing for funding.

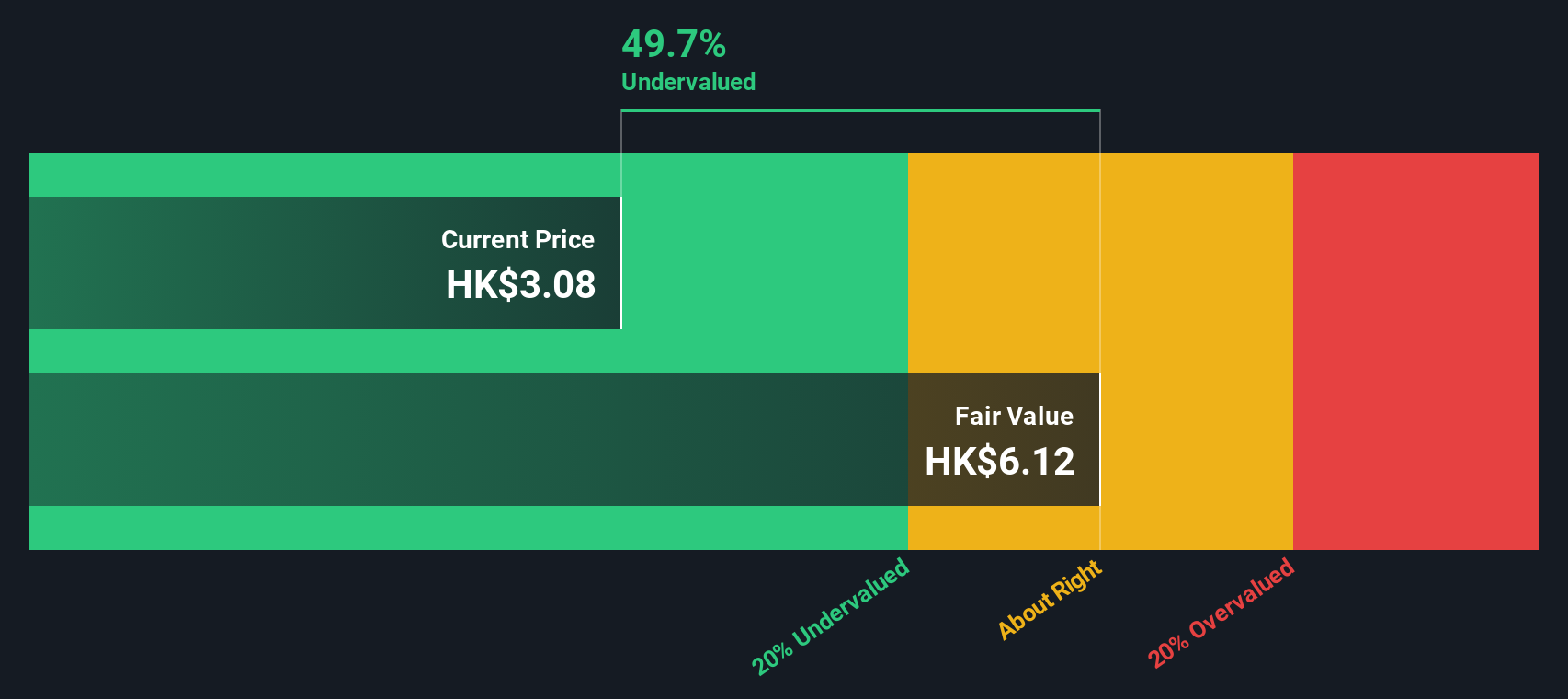

Greentown Management Holdings (SEHK:9979)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Greentown Management Holdings is a Chinese company specializing in project management services for property development, with a market capitalization of approximately CN¥6.74 billion.

Operations: The company generates revenue primarily from its core operations, with a notable increase in revenue from CN¥1.02 billion to CN¥3.44 billion over the observed periods. The cost of goods sold (COGS) has also risen, impacting gross profit margins, which have fluctuated between 52.94% and 44.37%. Operating expenses are largely driven by general and administrative costs, which have consistently been a significant component of total expenses.

PE: 10.2x

Greentown Management Holdings, a notable player in Asia's smaller market segment, is catching attention with its strategic moves amidst financial challenges. The company initiated a share repurchase program on August 29, 2025, aiming to enhance net asset value and earnings per share. Despite lower profit margins at 17.7% compared to last year's 29.2%, insider confidence is evident through board changes and executive appointments like Cheng Min's as an executive director on October 20, 2025. However, the company's reliance on external borrowing poses higher risk than customer deposits would offer. Recent earnings reported for the half-year ending June 30 showed sales of CNY1.37 billion and net income of CNY256 million, reflecting a decline from previous figures due to industry competition and real estate market downturns impacting short-term profitability.

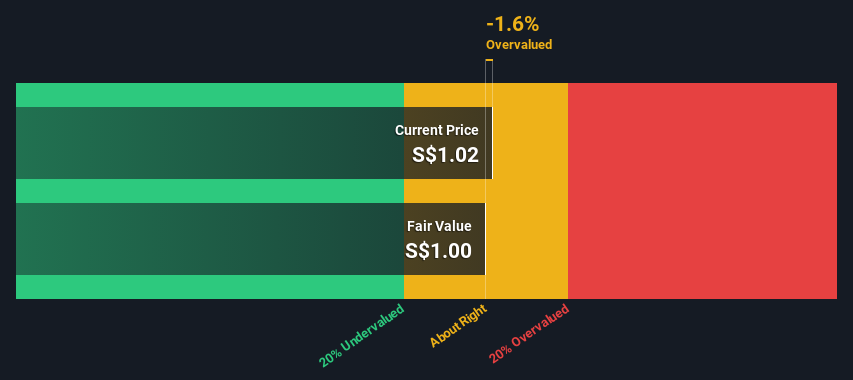

Far East Orchard (SGX:O10)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Far East Orchard is involved in property investment and hospitality operations, management services, and property ownership with a market capitalization of approximately SGD 0.98 billion.

Operations: Far East Orchard's revenue streams are primarily derived from Hospitality Operations, Hospitality Management Services, and Hospitality Property Ownership. The company has shown a notable trend in its gross profit margin, reaching 50.58% as of June 2025. Operating expenses are consistently significant, with General & Administrative Expenses being the largest component.

PE: 10.1x

Far East Orchard, known for its focus on hospitality and student accommodation, has been making strategic leadership changes to enhance growth prospects. With new senior appointments effective September 2025, including Mr. Yang Zejian as Managing Director of PBSA and Mr. Mark Rohner transitioning to lead Far East Hospitality, the company aims to strengthen its operational capabilities. Despite a slight dip in sales to S$91 million for H1 2025 compared to last year, net income improved marginally. The presence of insider confidence through stock purchases indicates positive sentiment towards future performance amidst these strategic shifts.

- Unlock comprehensive insights into our analysis of Far East Orchard stock in this valuation report.

Assess Far East Orchard's past performance with our detailed historical performance reports.

Next Steps

- Embark on your investment journey to our 39 Undervalued Asian Small Caps With Insider Buying selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:O10

Far East Orchard

An investment holding company, engages in the hotel operations and property investment activities in Singapore, Australia, the United Kingdom, Japan, Malaysia, Germany, and Denmark.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives