- Singapore

- /

- Real Estate

- /

- SGX:H78

A Fresh Take on Hongkong Land (SGX:H78) Valuation After High-Profile Board Appointments

Reviewed by Simply Wall St

Hongkong Land Holdings (SGX:H78) has appointed Alan Miyasaki of Blackstone and Lincoln Pan, CEO-designate of Jardine Matheson Holdings, to its Board, effective November 1. Their extensive backgrounds could bring fresh strategic insights for investors watching closely.

See our latest analysis for Hongkong Land Holdings.

After a robust year, Hongkong Land Holdings has seen its share price climb over 39% year-to-date and deliver an impressive 47.5% total shareholder return for the past year. While momentum built steadily, recent leadership moves may be fueling renewed optimism among investors who are considering the company’s long-term trajectory.

If the latest board shakeup has you curious about new opportunities, now is a good time to broaden your search and discover fast growing stocks with high insider ownership

With shares up sharply this year and analyst price targets still indicating upside, the big question for investors is whether the current valuation leaves room for growth or if the market has already priced in these positive changes.

Most Popular Narrative: 9.9% Undervalued

Hongkong Land Holdings' most popular narrative estimates a fair value of $6.86, which is almost 10% above its last close of $6.18. This sets the stage for an optimistic outlook, driven by strategic moves and projected improvements.

Substantial investment and repositioning of marquee assets, such as "Tomorrow's CENTRAL" and the West Bund Central development, positions the company to benefit from strong demand for premium, high-quality, ESG-compliant integrated developments among blue-chip tenants and global luxury brands. This supports future rental income and net margin expansion.

Want to uncover what powers this compelling valuation? The heart of this narrative is a bold transformation plan built on higher margins and ambitious revenue goals. Find out which powerful earnings forecasts and quantitative assumptions could change the way you see Hongkong Land’s future value. The real drivers might surprise you.

Result: Fair Value of $6.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing challenges in Mainland China’s property market and volatile office demand in Hong Kong could still test Hongkong Land’s growth story in the future.

Find out about the key risks to this Hongkong Land Holdings narrative.

Another View: Multiples Say "Expensive"

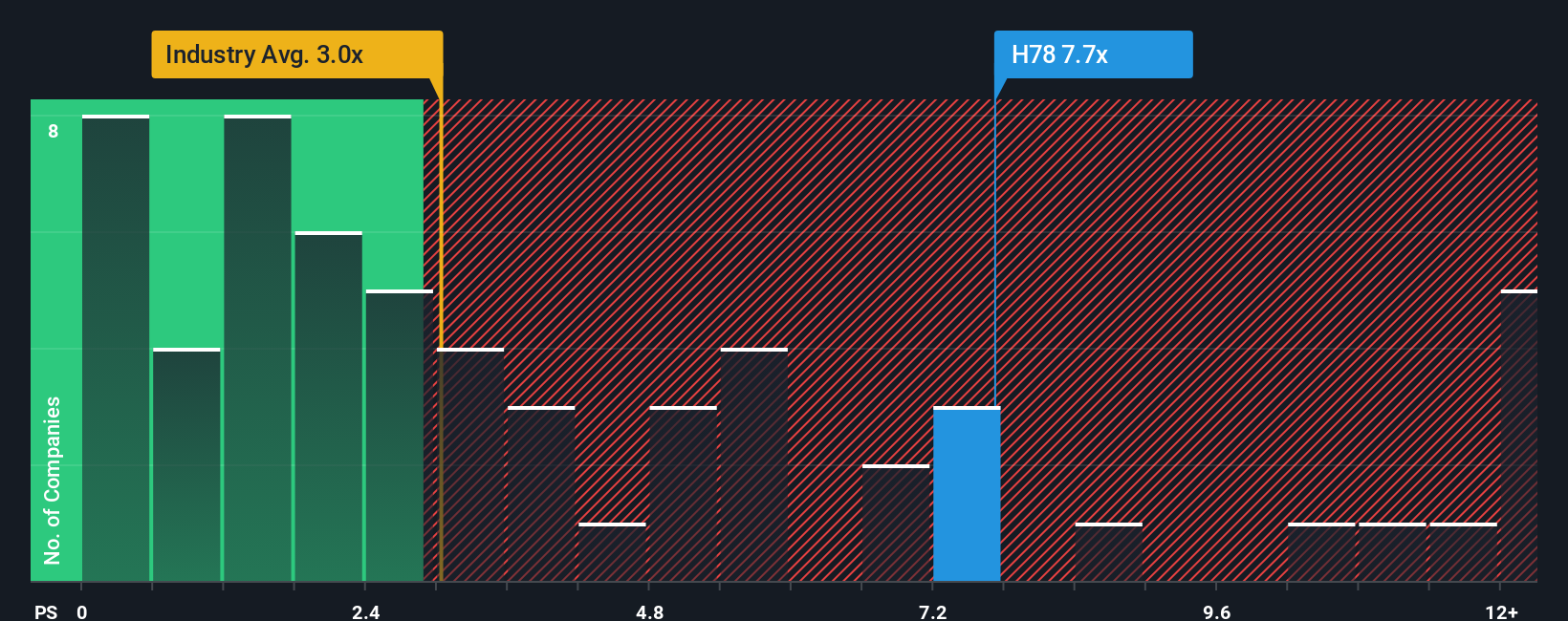

While the most popular view suggests Hongkong Land Holdings is undervalued, our comparison to peers tells a different story. Its price-to-sales ratio stands at 7.5x, much higher than both the Singapore Real Estate industry average (3.1x) and the peer average (5x), with a fair ratio of just 4.2x. This hefty gap points to valuation risk: is the recent optimism getting too far ahead of fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hongkong Land Holdings Narrative

Whether you’re driven by your own research or think a different story is unfolding, you can build your own Hongkong Land Holdings view in just a few minutes. Do it your way

A great starting point for your Hongkong Land Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t wait around while others spot new opportunities. Use these handpicked lists to jump on the next wave of performance and sharpen your portfolio edge.

- Grab the chance for steady income streams by checking out these 14 dividend stocks with yields > 3% offering yields above 3% from some of the market’s most reliable payers.

- Capitalize on the rise of artificial intelligence by selecting from these 25 AI penny stocks that are pioneering powerful technology with real-world potential.

- Ride early momentum by targeting these 3574 penny stocks with strong financials with robust fundamentals that stand out from the crowd and could fuel substantial gains.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hongkong Land Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:H78

Hongkong Land Holdings

Engages in the investment, development, and management of properties in Hong Kong, Macau, Mainland China, Southeast Asia, and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives