- Singapore

- /

- Real Estate

- /

- SGX:F1E

China Shengmu Organic Milk Among 3 Promising Asian Penny Stocks

Reviewed by Simply Wall St

As global markets navigate a landscape of mixed economic signals, attention in Asia has turned to the potential of lesser-known stocks amid easing trade tensions between the U.S. and China. Penny stocks, often representing smaller or newer companies, continue to be an intriguing area for investors seeking growth opportunities at lower price points. Despite their historical connotations, these stocks can offer significant potential when backed by strong financials and sound fundamentals.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| JBM (Healthcare) (SEHK:2161) | HK$2.96 | HK$2.41B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.54 | HK$952.52M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.55 | HK$2.12B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.10 | SGD445.82M | ✅ 4 ⚠️ 2 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.80 | THB2.88B | ✅ 3 ⚠️ 3 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.101 | SGD52.87M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.52 | SGD13.85B | ✅ 5 ⚠️ 1 View Analysis > |

| Anton Oilfield Services Group (SEHK:3337) | HK$1.05 | HK$2.82B | ✅ 4 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$1.07 | NZ$152.31M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.48 | THB9.05B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 953 stocks from our Asian Penny Stocks screener.

Let's explore several standout options from the results in the screener.

China Shengmu Organic Milk (SEHK:1432)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: China Shengmu Organic Milk Limited is an investment holding company involved in producing and distributing raw milk and dairy products in China, with a market capitalization of HK$2.84 billion.

Operations: The company generates revenue primarily from its Dairy Farming Business, which amounted to CN¥3.08 billion.

Market Cap: HK$2.84B

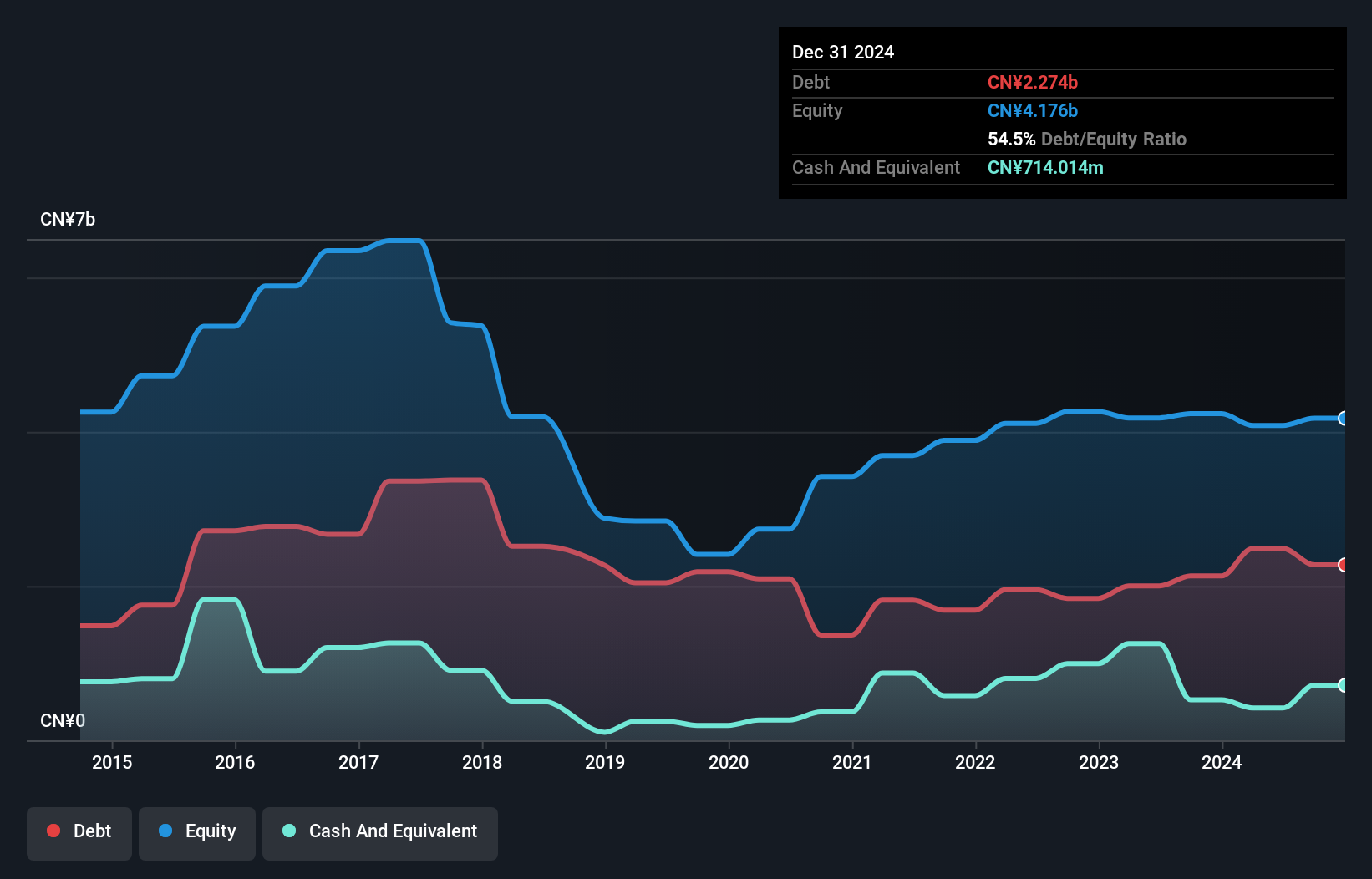

China Shengmu Organic Milk Limited has seen significant developments recently, including a proposed acquisition by China Modern Dairy Holdings Ltd. for HK$2 billion, which could impact its market presence and shareholder value. Despite becoming profitable this year, the company reported a net loss of CN¥48.32 million for the first half of 2025 due to previous large one-off losses. While its interest payments are well covered by EBIT and debt is satisfactorily managed with a net debt to equity ratio of 30.5%, short-term liabilities exceed short-term assets, indicating potential liquidity challenges amidst high share price volatility.

- Click to explore a detailed breakdown of our findings in China Shengmu Organic Milk's financial health report.

- Gain insights into China Shengmu Organic Milk's historical outcomes by reviewing our past performance report.

Low Keng Huat (Singapore) (SGX:F1E)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Low Keng Huat (Singapore) Limited is an investment holding company involved in property development, hotel, and investment businesses across Singapore, Australia, and Malaysia with a market cap of SGD509.78 million.

Operations: The company's revenue is primarily derived from property development at SGD197.27 million, followed by its hotel operations generating SGD49.62 million, and investments including construction contributing SGD47.87 million.

Market Cap: SGD509.78M

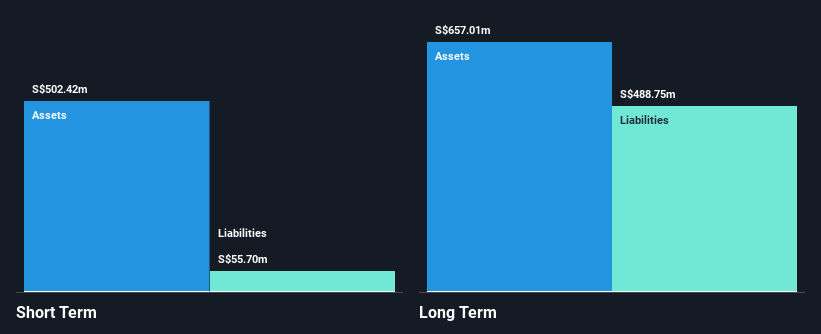

Low Keng Huat (Singapore) Limited has faced challenges recently, reporting a net loss of SGD10.17 million for the half year ended July 31, 2025, compared to a net income of SGD5.79 million the previous year. The company's revenue dropped significantly to SGD38.74 million from SGD257.93 million a year ago. Despite trading at nearly 95% below estimated fair value and having stable weekly volatility, it remains unprofitable with negative return on equity and insufficient interest coverage by EBIT. However, its debt management shows improvement with short-term assets exceeding both short-term and long-term liabilities, providing some financial stability amidst ongoing difficulties.

- Navigate through the intricacies of Low Keng Huat (Singapore) with our comprehensive balance sheet health report here.

- Assess Low Keng Huat (Singapore)'s previous results with our detailed historical performance reports.

Henan Rebecca Hair Products (SHSE:600439)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Henan Rebecca Hair Products Co., Ltd. is involved in the production and sale of hair products in China, with a market capitalization of CN¥3.52 billion.

Operations: Henan Rebecca Hair Products Co., Ltd. has not reported any revenue segments.

Market Cap: CN¥3.52B

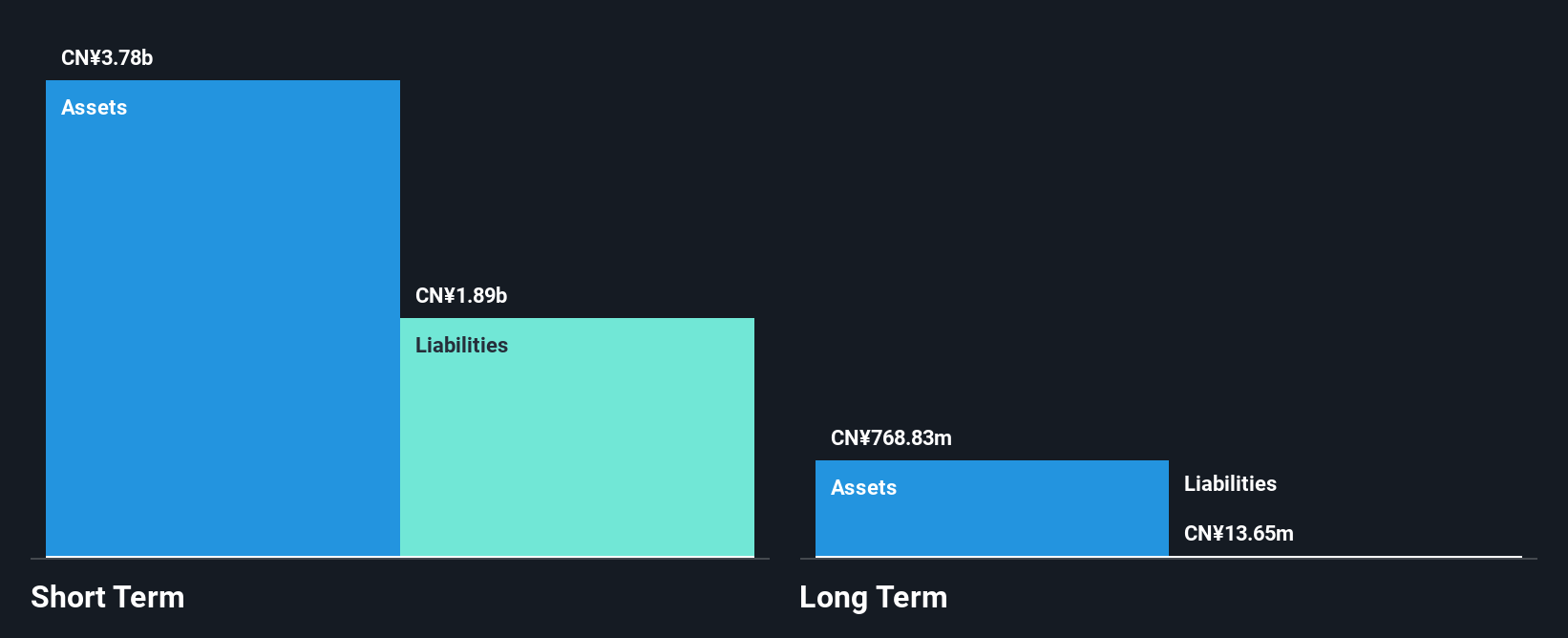

Henan Rebecca Hair Products Co., Ltd. recently reported sales of CN¥898.39 million for the nine months ending September 30, 2025, with a net income of CN¥11.71 million, reflecting modest growth from the previous year. The company's financial position is bolstered by short-term assets of CN¥3.8 billion exceeding both its short-term and long-term liabilities, providing some stability despite unprofitability and high debt levels relative to equity at 49.1%. While earnings have declined significantly over the past five years, management's experience and lack of shareholder dilution offer potential advantages in navigating future challenges within the penny stock landscape.

- Click here to discover the nuances of Henan Rebecca Hair Products with our detailed analytical financial health report.

- Learn about Henan Rebecca Hair Products' historical performance here.

Make It Happen

- Click here to access our complete index of 953 Asian Penny Stocks.

- Curious About Other Options? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:F1E

Low Keng Huat (Singapore)

An investment holding company, engages in property development, hotel, and investment business in Singapore, Australia, and Malaysia.

Excellent balance sheet and good value.

Market Insights

Community Narratives