- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:1833

3 Asian Stocks Estimated To Be Trading At Discounts Of Up To 30.4%

Reviewed by Simply Wall St

As global markets face a mix of challenges, including concerns over elevated valuations and geopolitical tensions, Asian markets have shown resilience with Chinese stocks gaining ground amid easing trade tensions. In this environment, identifying undervalued stocks can be particularly appealing to investors seeking opportunities to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zhejiang Century Huatong GroupLtd (SZSE:002602) | CN¥18.51 | CN¥36.85 | 49.8% |

| Yonghui Superstores (SHSE:601933) | CN¥4.61 | CN¥9.13 | 49.5% |

| Wuhan Guide Infrared (SZSE:002414) | CN¥12.78 | CN¥25.25 | 49.4% |

| Tibet Tianlu (SHSE:600326) | CN¥12.14 | CN¥24.19 | 49.8% |

| TESEC (TSE:6337) | ¥2080.00 | ¥4137.61 | 49.7% |

| Mobvista (SEHK:1860) | HK$19.19 | HK$37.72 | 49.1% |

| LianChuang Electronic TechnologyLtd (SZSE:002036) | CN¥9.97 | CN¥19.91 | 49.9% |

| IbidenLtd (TSE:4062) | ¥13705.00 | ¥27290.25 | 49.8% |

| East Buy Holding (SEHK:1797) | HK$20.26 | HK$39.94 | 49.3% |

| Andes Technology (TWSE:6533) | NT$256.00 | NT$507.58 | 49.6% |

We'll examine a selection from our screener results.

Ping An Healthcare and Technology (SEHK:1833)

Overview: Ping An Healthcare and Technology Company Limited operates an online healthcare services platform in China, with a market cap of HK$30.91 billion.

Operations: The company's revenue is derived from Health Services (CN¥2.43 billion), Medical Services (CN¥2.38 billion), and Senior Care Services (CN¥407.65 million).

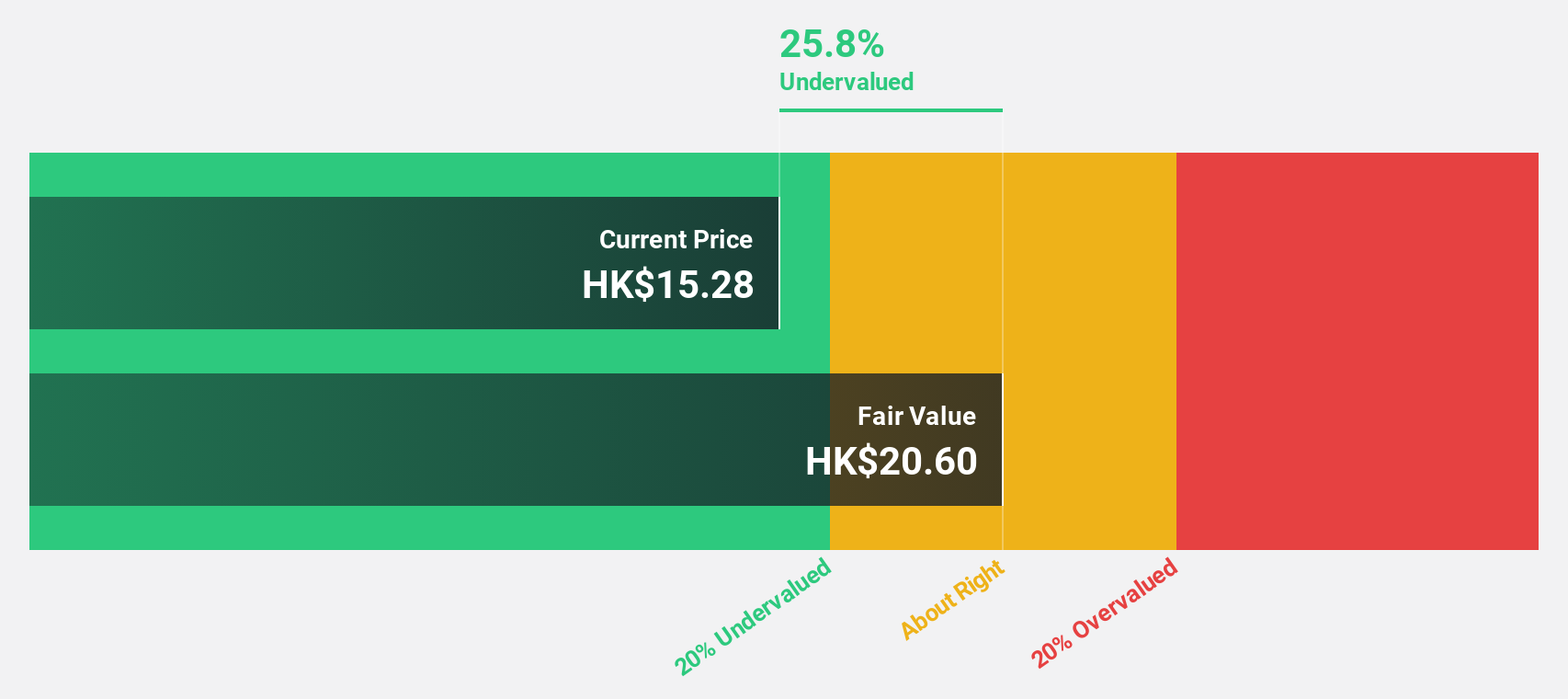

Estimated Discount To Fair Value: 30.4%

Ping An Healthcare and Technology is trading at HK$14.3, significantly below its estimated fair value of HK$20.54, indicating potential undervaluation based on cash flows. The company's earnings are expected to grow at a robust 33.6% annually over the next three years, outpacing the Hong Kong market's growth rate. Despite recent management changes with new leadership appointments, these transitions are not anticipated to disrupt operations or strategic initiatives focused on health and senior care services.

- In light of our recent growth report, it seems possible that Ping An Healthcare and Technology's financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Ping An Healthcare and Technology's balance sheet health report.

Xiaocaiyuan International Holding (SEHK:999)

Overview: Xiaocaiyuan International Holding Ltd. is an investment holding company operating in the restaurant business in the People's Republic of China, with a market cap of HK$13.09 billion.

Operations: The company generates revenue primarily through its restaurant operations, amounting to CN¥3.23 billion, and its delivery business, contributing CN¥2.13 billion.

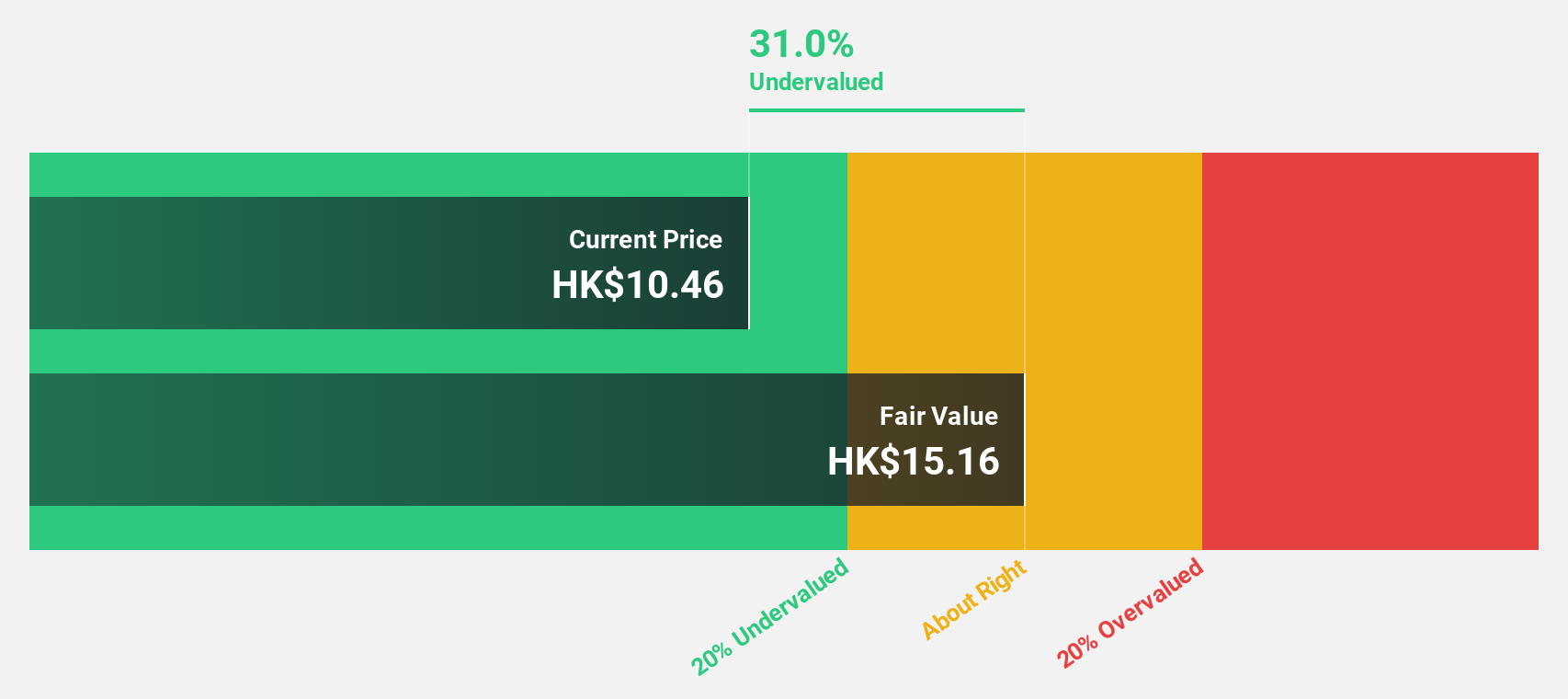

Estimated Discount To Fair Value: 24.1%

Xiaocaiyuan International Holding is trading at HK$11.13, over 24% below its estimated fair value of HK$14.66, highlighting potential undervaluation based on cash flows. Earnings are projected to grow significantly at 24.5% annually, outpacing the Hong Kong market's 11.7%. Despite recent insider selling, analysts agree on a potential price rise of 22.7%. The company recently revised its dividend policy to distribute 50-60% of profits to shareholders.

- According our earnings growth report, there's an indication that Xiaocaiyuan International Holding might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of Xiaocaiyuan International Holding.

City Developments (SGX:C09)

Overview: City Developments Limited (CDL) is a prominent global real estate company operating in 168 locations across 29 countries and regions, with a market cap of SGD6.62 billion.

Operations: The company's revenue segments include Hotel Operations at SGD1.61 billion, Property Development at SGD1.05 billion, and Investment Properties at SGD511.08 million.

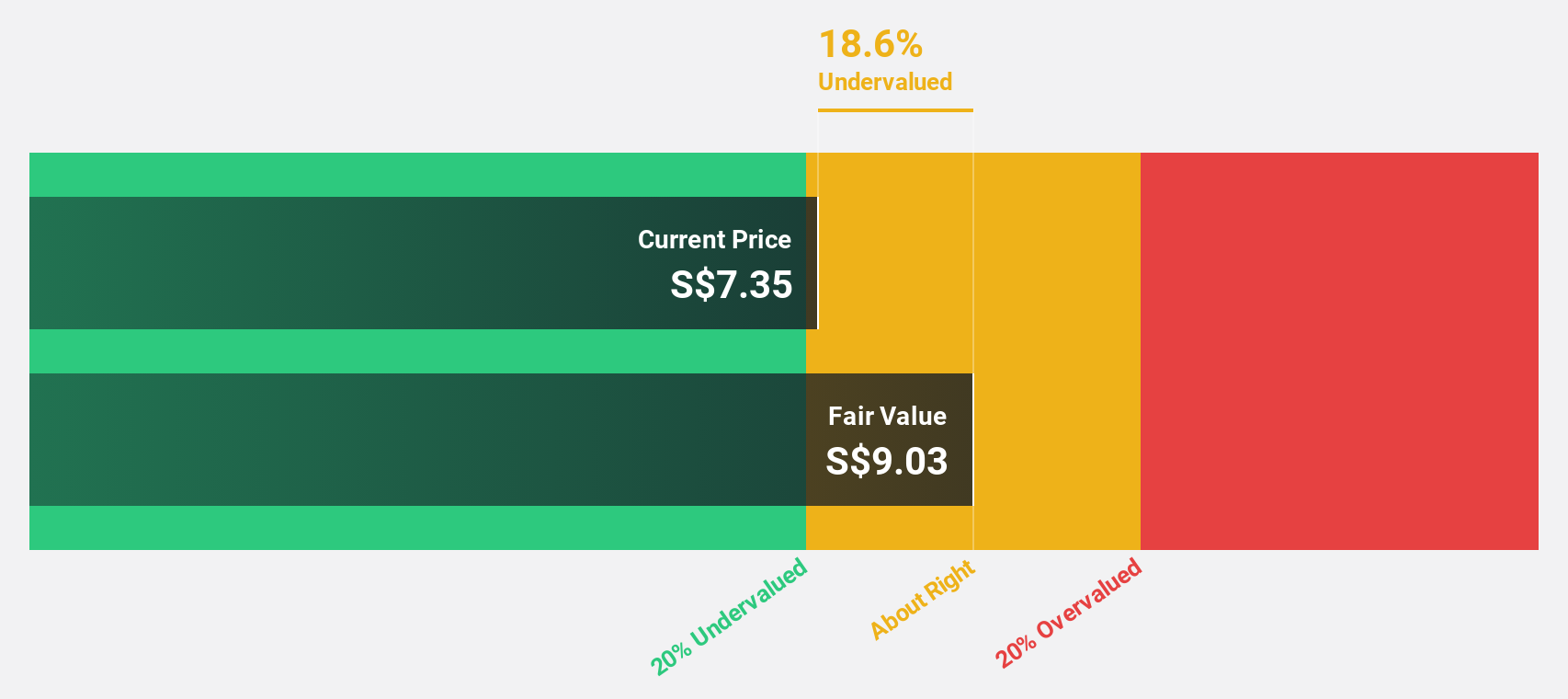

Estimated Discount To Fair Value: 18%

City Developments Limited is trading at S$7.41, approximately 18% below its estimated fair value of S$9.03, indicating potential undervaluation based on cash flows. The company reported half-year sales of S$1.69 billion and net income of S$91.17 million, showing growth from the previous year. Earnings are forecast to grow significantly at 21.8% annually, surpassing the Singapore market's average growth rate, though profit margins have decreased compared to last year and interest payments remain poorly covered by earnings.

- The analysis detailed in our City Developments growth report hints at robust future financial performance.

- Navigate through the intricacies of City Developments with our comprehensive financial health report here.

Seize The Opportunity

- Click this link to deep-dive into the 272 companies within our Undervalued Asian Stocks Based On Cash Flows screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1833

Ping An Healthcare and Technology

Operates an online healthcare services platform in China.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives