- Singapore

- /

- Entertainment

- /

- SGX:1B0

It's Down 31% But mm2 Asia Ltd. (SGX:1B0) Could Be Riskier Than It Looks

mm2 Asia Ltd. (SGX:1B0) shareholders that were waiting for something to happen have been dealt a blow with a 31% share price drop in the last month. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 56% loss during that time.

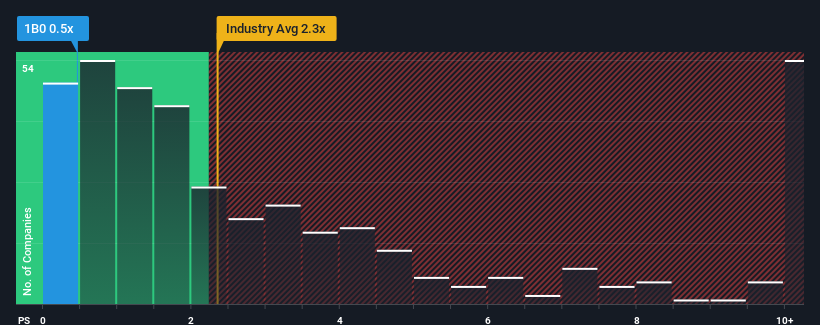

Since its price has dipped substantially, when close to half the companies operating in Singapore's Entertainment industry have price-to-sales ratios (or "P/S") above 2.4x, you may consider mm2 Asia as an enticing stock to check out with its 0.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for mm2 Asia

How Has mm2 Asia Performed Recently?

For instance, mm2 Asia's receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. Those who are bullish on mm2 Asia will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on mm2 Asia will help you shine a light on its historical performance.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like mm2 Asia's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 25%. Still, the latest three year period has seen an excellent 55% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 15% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

In light of this, it's peculiar that mm2 Asia's P/S sits below the majority of other companies. Apparently some shareholders are more bearish than recent times would indicate and have been accepting lower selling prices.

The Key Takeaway

The southerly movements of mm2 Asia's shares means its P/S is now sitting at a pretty low level. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of mm2 Asia revealed its three-year revenue trends looking similar to current industry expectations hasn't given the P/S the boost we expected, given that it's lower than the wider industry P/S, When we see industry-like revenue growth but a lower than expected P/S, we assume potential risks are what might be placing downward pressure on the share price. revenue trends suggest that the risk of a price decline is low, investors appear to perceive a possibility of revenue volatility in the future.

You should always think about risks. Case in point, we've spotted 3 warning signs for mm2 Asia you should be aware of, and 1 of them is potentially serious.

If these risks are making you reconsider your opinion on mm2 Asia, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:1B0

mm2 Asia

Produces, distributes, and sponsors films, television (TV), and online content in Singapore, Malaysia, Hong Kong, Taiwan, China, and internationally.

Moderate risk and slightly overvalued.

Market Insights

Community Narratives