As Asian markets continue to navigate a complex global economic landscape, investors are increasingly looking for opportunities beyond the traditional blue-chip stocks. Penny stocks, often representing smaller or newer companies, remain an intriguing investment area despite their somewhat outdated label. In this article, we explore three promising penny stocks that combine strong financials with potential for significant growth, offering investors a chance to uncover hidden value in the Asian market.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| JBM (Healthcare) (SEHK:2161) | HK$2.96 | HK$2.41B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.51 | HK$933.97M | ✅ 4 ⚠️ 1 View Analysis > |

| Asia Medical and Agricultural Laboratory and Research Center (SET:AMARC) | THB2.74 | THB1.15B | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.61 | HK$2.17B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.12 | SGD453.92M | ✅ 4 ⚠️ 2 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.098 | SGD51.3M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.55 | SGD13.97B | ✅ 5 ⚠️ 1 View Analysis > |

| Anton Oilfield Services Group (SEHK:3337) | HK$1.09 | HK$2.94B | ✅ 4 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.97 | NZ$139.5M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.30 | THB8.69B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 950 stocks from our Asian Penny Stocks screener.

Let's dive into some prime choices out of the screener.

EROAD (NZSE:ERD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: EROAD Limited offers electronic on-board units and software as a service to the transport industry across New Zealand, the United States, and Australia, with a market cap of NZ$389.13 million.

Operations: The company's revenue segments consist of NZ$103.9 million from New Zealand, NZ$81.2 million from North America, NZ$13.7 million from Australia, and NZ$72.5 million attributed to Corporate & Development activities.

Market Cap: NZ$389.13M

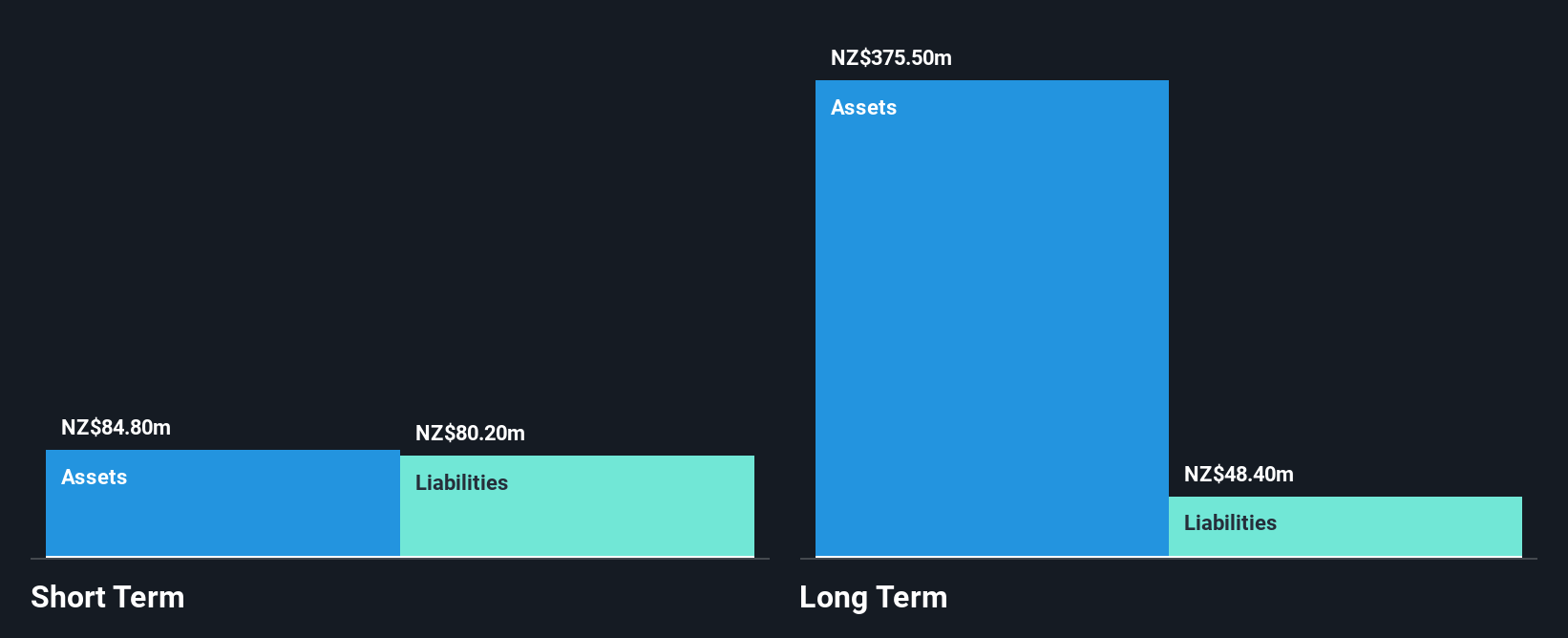

EROAD Limited, with a market cap of NZ$389.13 million, is navigating significant leadership shifts as Mark Heine assumes the CEO role and John Scott becomes Executive Chair. The company has lowered its 2026 revenue guidance to between $197 million and $203 million. EROAD's strategic alliances, such as those with Geotab and Whip Around, enhance its telematics offerings for fleet management in Australia and New Zealand. Despite recent profitability, challenges include low return on equity at 0.4% and high share price volatility. However, debt management appears sound with a satisfactory net debt to equity ratio of 4%.

- Click here to discover the nuances of EROAD with our detailed analytical financial health report.

- Explore EROAD's analyst forecasts in our growth report.

Be Friends Holding (SEHK:1450)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Be Friends Holding Limited, with a market cap of HK$1.58 billion, operates as an investment holding company providing all-media services in the People’s Republic of China.

Operations: The company's revenue from New Media Services is CN¥1.19 billion.

Market Cap: HK$1.58B

Be Friends Holding Limited, with a market cap of HK$1.58 billion, has shown mixed financial performance recently. The company reported revenue of CN¥618.86 million for the first half of 2025, an increase from the previous year, but net income declined to CN¥57.37 million from CN¥85.08 million. Despite stable weekly volatility and experienced management and board teams, profit margins have decreased significantly to 3.7% from last year's 13.7%. Positively, the company's debt is well covered by operating cash flow and interest payments are adequately managed with EBIT coverage at 6.8 times interest repayments.

- Navigate through the intricacies of Be Friends Holding with our comprehensive balance sheet health report here.

- Assess Be Friends Holding's previous results with our detailed historical performance reports.

China Sunsine Chemical Holdings (SGX:QES)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: China Sunsine Chemical Holdings Ltd. is an investment holding company that manufactures and sells specialty chemicals globally, with a market cap of SGD705.50 million.

Operations: The company's revenue is primarily derived from its Rubber Chemicals segment, which generated CN¥4.32 billion, followed by Heating Power at CN¥194.94 million and Waste Treatment at CN¥27.89 million.

Market Cap: SGD705.5M

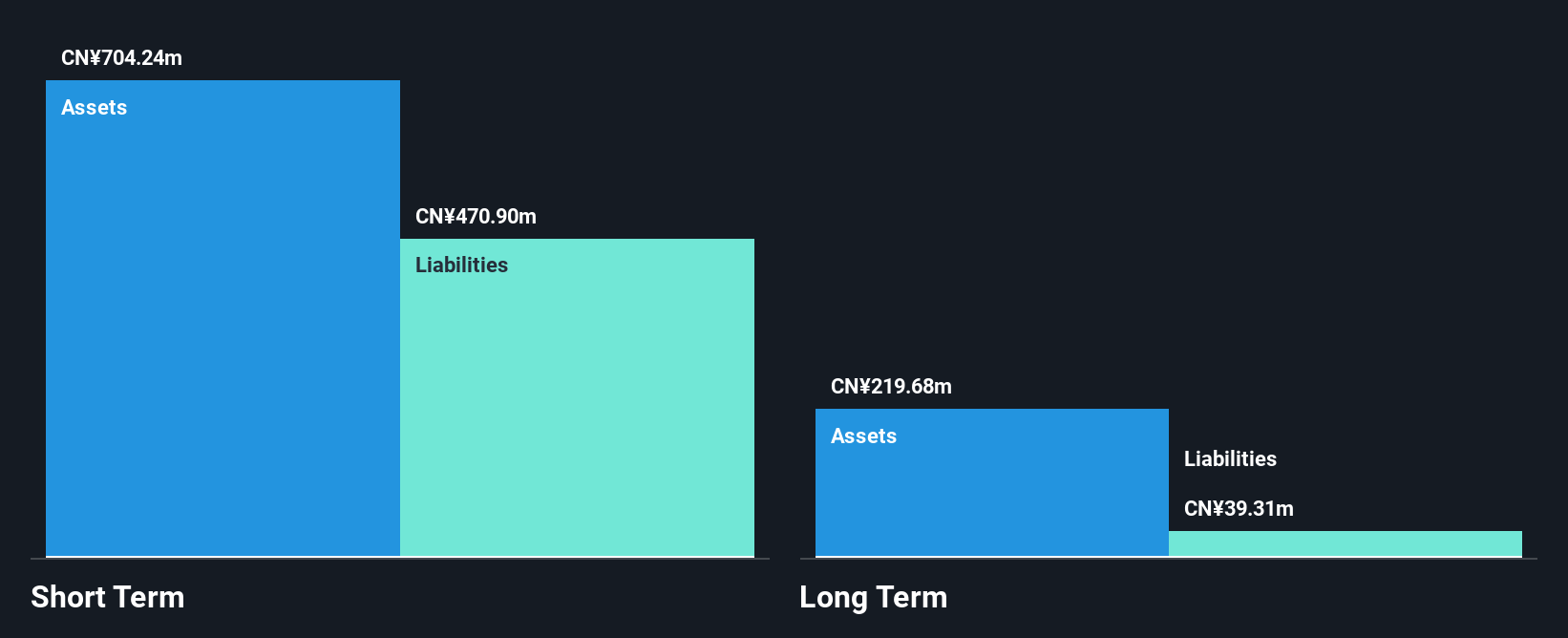

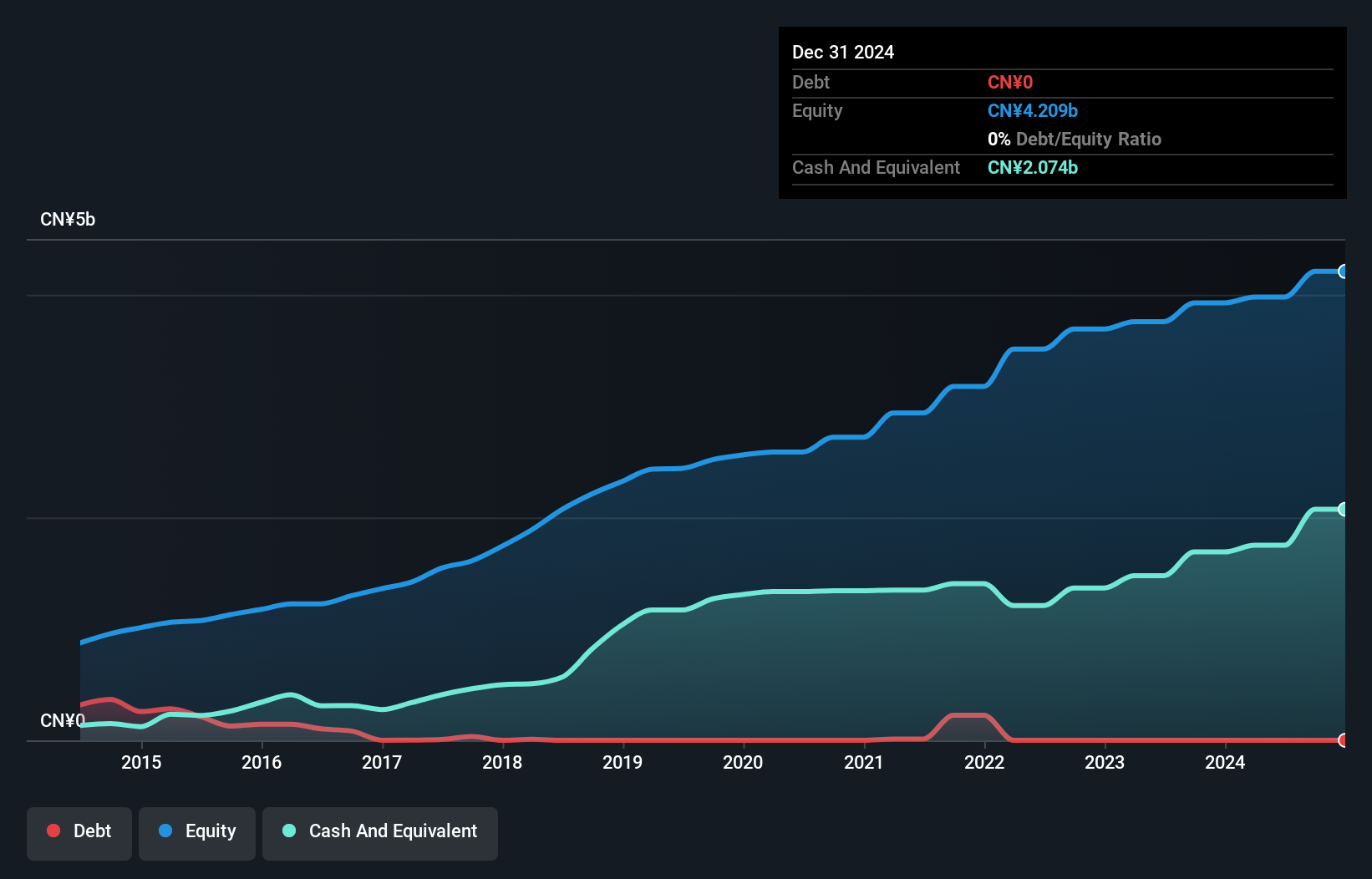

China Sunsine Chemical Holdings Ltd., with a market cap of SGD705.50 million, demonstrates strong financial health, having no debt and sufficient short-term assets (CN¥3.6 billion) to cover liabilities (CN¥479.6 million). The company’s earnings growth of 30.3% over the past year surpasses its five-year average and the industry growth rate, although its return on equity remains low at 11.1%. Recent financial results show increased net income despite a slight decline in sales for H1 2025 compared to last year. The company has announced both regular and special dividends, rewarding shareholders amid an unstable dividend history.

- Click here and access our complete financial health analysis report to understand the dynamics of China Sunsine Chemical Holdings.

- Understand China Sunsine Chemical Holdings' earnings outlook by examining our growth report.

Key Takeaways

- Unlock our comprehensive list of 950 Asian Penny Stocks by clicking here.

- Contemplating Other Strategies? Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EROAD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:ERD

EROAD

Provides electronic on-board units and software as a service to the transport industry in New Zealand, the United States, and Australia.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives