Stock Analysis

The Singapore stock market has shown resilience amidst global economic uncertainties, maintaining a steady trajectory that captures the attention of investors looking for stability. As the market navigates through these conditions, identifying undervalued stocks becomes crucial for those aiming to capitalize on potential opportunities for growth and value.

Top 5 Undervalued Stocks Based On Cash Flows In Singapore

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Singapore Technologies Engineering (SGX:S63) | SGD4.26 | SGD8.12 | 47.5% |

| LHN (SGX:41O) | SGD0.335 | SGD0.37 | 10.4% |

| Hongkong Land Holdings (SGX:H78) | US$3.19 | US$5.78 | 44.8% |

| Seatrium (SGX:5E2) | SGD1.40 | SGD2.57 | 45.6% |

| Frasers Logistics & Commercial Trust (SGX:BUOU) | SGD0.955 | SGD1.66 | 42.5% |

| Digital Core REIT (SGX:DCRU) | US$0.58 | US$1.11 | 47.9% |

| Nanofilm Technologies International (SGX:MZH) | SGD0.79 | SGD1.44 | 45.2% |

Let's take a closer look at a couple of our picks from the screened companies

Seatrium (SGX:5E2)

Overview: Seatrium Limited specializes in engineering solutions for the offshore, marine, and energy sectors with a market capitalization of SGD 4.77 billion.

Operations: The company generates revenue primarily through its Rigs & Floaters, Repairs & Upgrades, Offshore Platforms, and Specialised Shipbuilding segments which together total SGD 7.26 billion, alongside a smaller contribution from Ship Chartering at SGD 31.63 million.

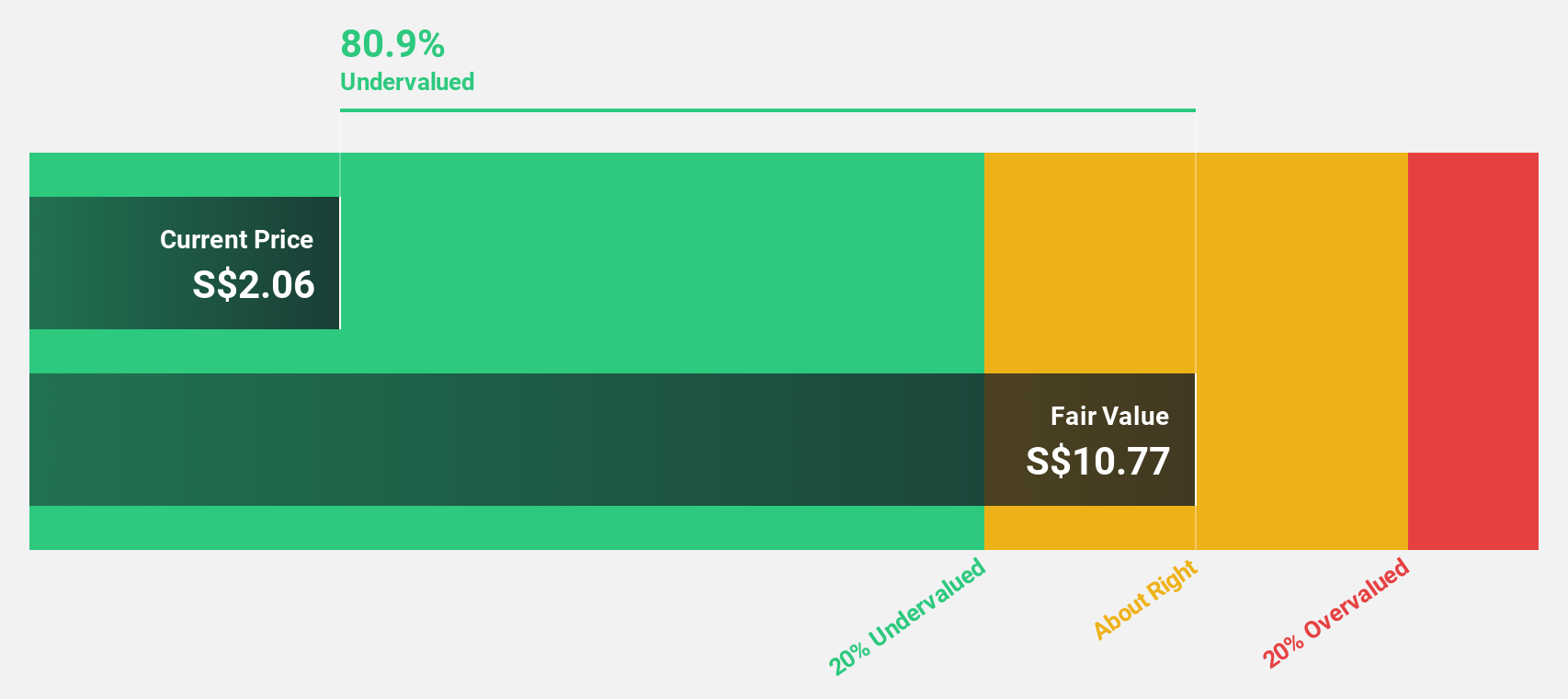

Estimated Discount To Fair Value: 45.6%

Seatrium Limited, trading at SGD 1.4, is currently valued below its estimated fair value of SGD 2.57, suggesting significant undervaluation based on discounted cash flow analysis. Despite a highly volatile share price recently, Seatrium's revenue growth at 8.7% annually is expected to outpace the Singapore market average of 3.6%. The company is also forecasted to become profitable within the next three years with earnings projected to grow substantially by 72.23% annually, aligning with expectations for above-market profit growth during this period.

- Our expertly prepared growth report on Seatrium implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on Seatrium's balance sheet by reading our health report here.

Nanofilm Technologies International (SGX:MZH)

Overview: Nanofilm Technologies International Limited operates in the field of nanotechnology solutions across Singapore, China, Japan, and Vietnam, with a market capitalization of approximately SGD 514.30 million.

Operations: The company generates revenue from four main segments: Sydrogen (SGD 1.05 million), Nanofabrication (SGD 16.05 million), Advanced Materials (SGD 141.54 million), and Industrial Equipment (SGd 37.17 million).

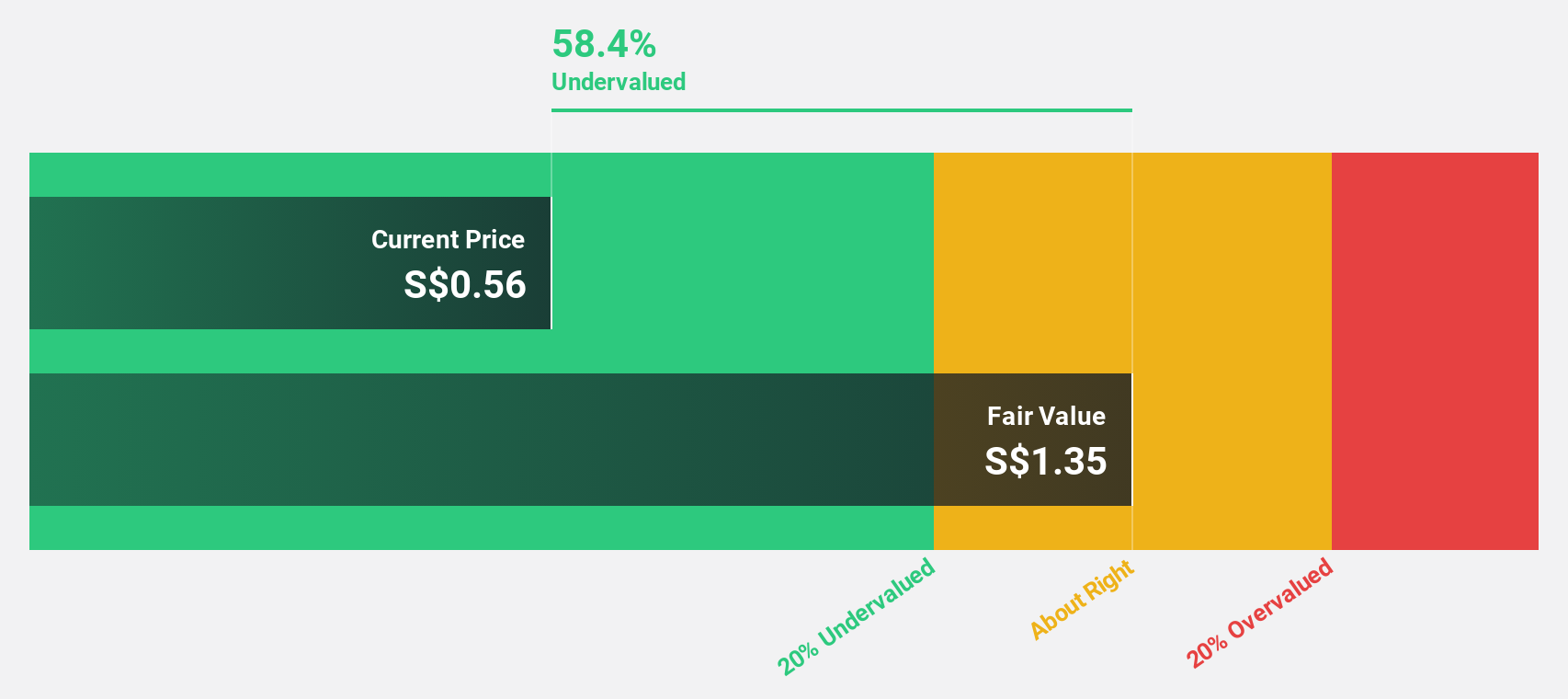

Estimated Discount To Fair Value: 45.2%

Nanofilm Technologies International, priced at SGD0.79, is significantly undervalued against a fair value estimate of SGD1.44, reflecting a promising investment based on cash flow metrics. Despite lower profit margins year-over-year and a modest return on equity projection, the company's revenue growth at 15.1% annually surpasses the Singapore market's 3.6%, with earnings expected to increase by 50.66% annually over the next three years, indicating robust potential for financial improvement and growth in shareholder value.

- Our earnings growth report unveils the potential for significant increases in Nanofilm Technologies International's future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Nanofilm Technologies International.

Singapore Technologies Engineering (SGX:S63)

Overview: Singapore Technologies Engineering Ltd is a global technology, defence, and engineering firm with a market capitalization of approximately SGD 13.29 billion.

Operations: The company's revenue is derived from three primary segments: Commercial Aerospace (SGD 3.97 billion), Urban Solutions & Satcom (SGD 1.98 billion), and Defence & Public Security (SGD 4.29 billion).

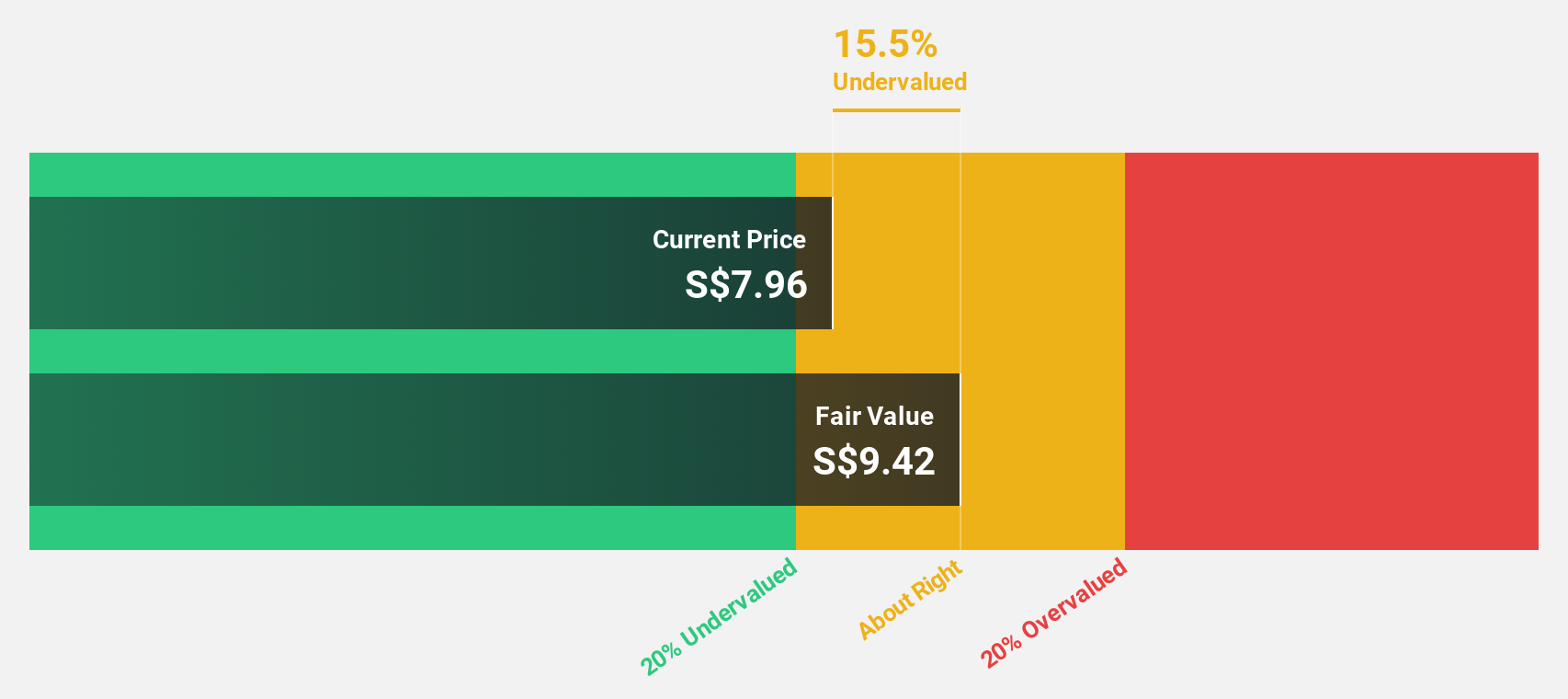

Estimated Discount To Fair Value: 47.5%

Singapore Technologies Engineering, trading at S$4.26, is positioned below its estimated fair value of S$8.12, suggesting a substantial undervaluation based on discounted cash flows. Despite a modest annual earnings growth of 1.1% over the past five years, projections indicate an uptick in revenue and earnings growth at 6.9% and 11.62% respectively per year, outpacing the broader Singapore market's averages. However, concerns include a high debt level and an unstable dividend track record which could affect future financial flexibility and shareholder returns.

- Insights from our recent growth report point to a promising forecast for Singapore Technologies Engineering's business outlook.

- Dive into the specifics of Singapore Technologies Engineering here with our thorough financial health report.

Key Takeaways

- Take a closer look at our Undervalued SGX Stocks Based On Cash Flows list of 7 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Seatrium is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:5E2

Seatrium

Provides engineering solutions to the offshore, marine, and energy industries.

Flawless balance sheet and good value.