Stock Analysis

- Singapore

- /

- Specialized REITs

- /

- SGX:DCRU

Exploring July 2024's SGX Stocks Estimated To Be Below Intrinsic Value

Reviewed by Simply Wall St

As of July 2024, the Singapore market continues to present varied opportunities for investors, with certain sectors showing resilience amidst global economic fluctuations. In this context, identifying stocks that are trading below their intrinsic value could offer potential for those looking to invest wisely in undervalued assets.

Top 5 Undervalued Stocks Based On Cash Flows In Singapore

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Singapore Technologies Engineering (SGX:S63) | SGD4.31 | SGD8.09 | 46.7% |

| LHN (SGX:41O) | SGD0.335 | SGD0.37 | 10.3% |

| Hongkong Land Holdings (SGX:H78) | US$3.25 | US$5.80 | 44% |

| Seatrium (SGX:5E2) | SGD1.44 | SGD2.59 | 44.4% |

| Frasers Logistics & Commercial Trust (SGX:BUOU) | SGD0.935 | SGD1.65 | 43.3% |

| Digital Core REIT (SGX:DCRU) | US$0.605 | US$1.12 | 46.2% |

| Nanofilm Technologies International (SGX:MZH) | SGD0.83 | SGD1.45 | 42.7% |

Below we spotlight a couple of our favorites from our exclusive screener

Seatrium (SGX:5E2)

Overview: Seatrium Limited specializes in engineering solutions for the offshore, marine, and energy sectors, with a market capitalization of approximately SGD 4.91 billion.

Operations: The company's revenue is primarily generated from rigs and floaters, repairs and upgrades, offshore platforms, and specialized shipbuilding, totaling SGD 7.26 billion, with an additional SGD 31.63 million from ship chartering.

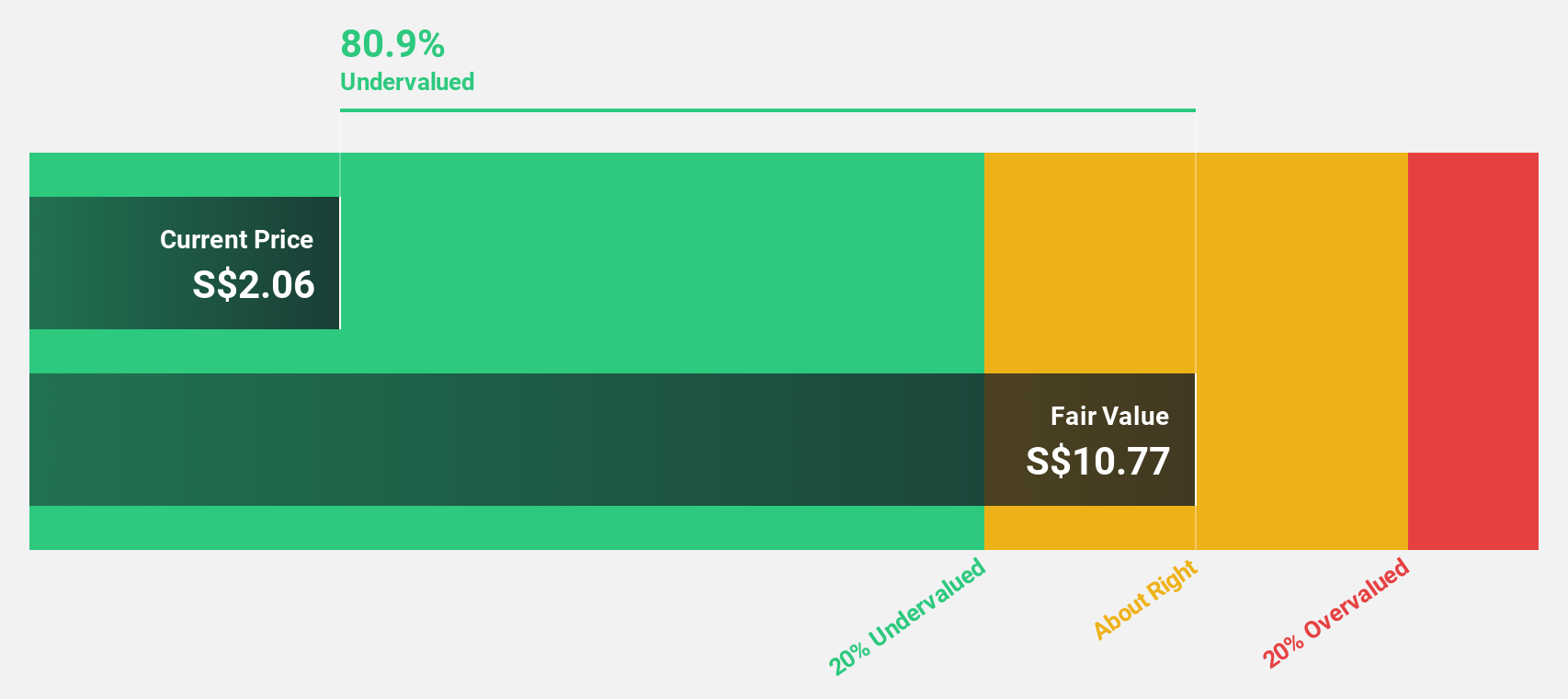

Estimated Discount To Fair Value: 44.4%

Seatrium Limited, trading at SGD 1.41, is significantly undervalued based on a DCF valuation with a fair value estimate of SGD 2.58. Analyst consensus suggests a potential price increase of 92.4%. Despite high revenue growth forecasts at 8.7% annually, profitability is expected only in the next three years with modest Return on Equity projections at 7.9%. Recent strategic contracts and executive changes signal active management and business expansion, though share price volatility remains a concern.

- Our comprehensive growth report raises the possibility that Seatrium is poised for substantial financial growth.

- Dive into the specifics of Seatrium here with our thorough financial health report.

Digital Core REIT (SGX:DCRU)

Overview: Digital Core REIT (SGX: DCRU) is a Singapore-listed real estate investment trust specializing in data centers, backed by Digital Realty, and has a market capitalization of approximately $0.79 billion.

Operations: The company generates its revenue primarily from its commercial REIT segment, totaling approximately $71.10 million.

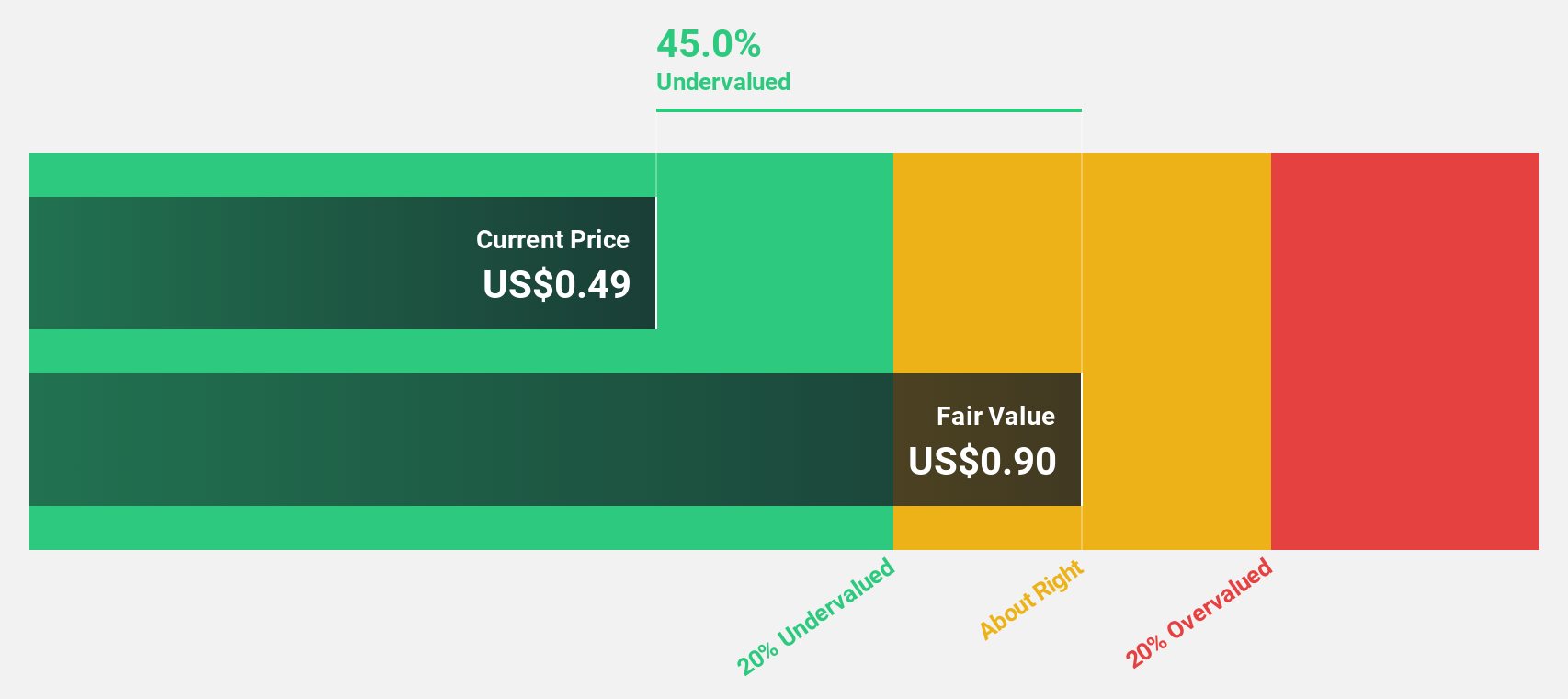

Estimated Discount To Fair Value: 46.2%

Digital Core REIT, priced at $0.61, is considerably undervalued with a DCF-based fair value of $1.12, reflecting a 46.2% discount. Despite recent drops from the S&P Global BMI Index and executive reshuffles, its financial outlook shows promise with earnings expected to grow substantially by 104.28% annually. However, challenges include an unstable dividend record and a low forecasted Return on Equity at 4.9%. Revenue growth projections are robust compared to the market but modest overall at 9.7% per year.

- Our expertly prepared growth report on Digital Core REIT implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on Digital Core REIT's balance sheet by reading our health report here.

Nanofilm Technologies International (SGX:MZH)

Overview: Nanofilm Technologies International Limited operates in the nanotechnology sector, offering solutions across Singapore, China, Japan, and Vietnam, with a market capitalization of approximately SGD 540.34 million.

Operations: Nanofilm Technologies International's revenue is primarily derived from four segments: Advanced Materials (SGD 141.54 million), Nanofabrication (SGD 16.05 million), Industrial Equipment (SGD 37.17 million), and Sydrogen (SGD 1.05 million).

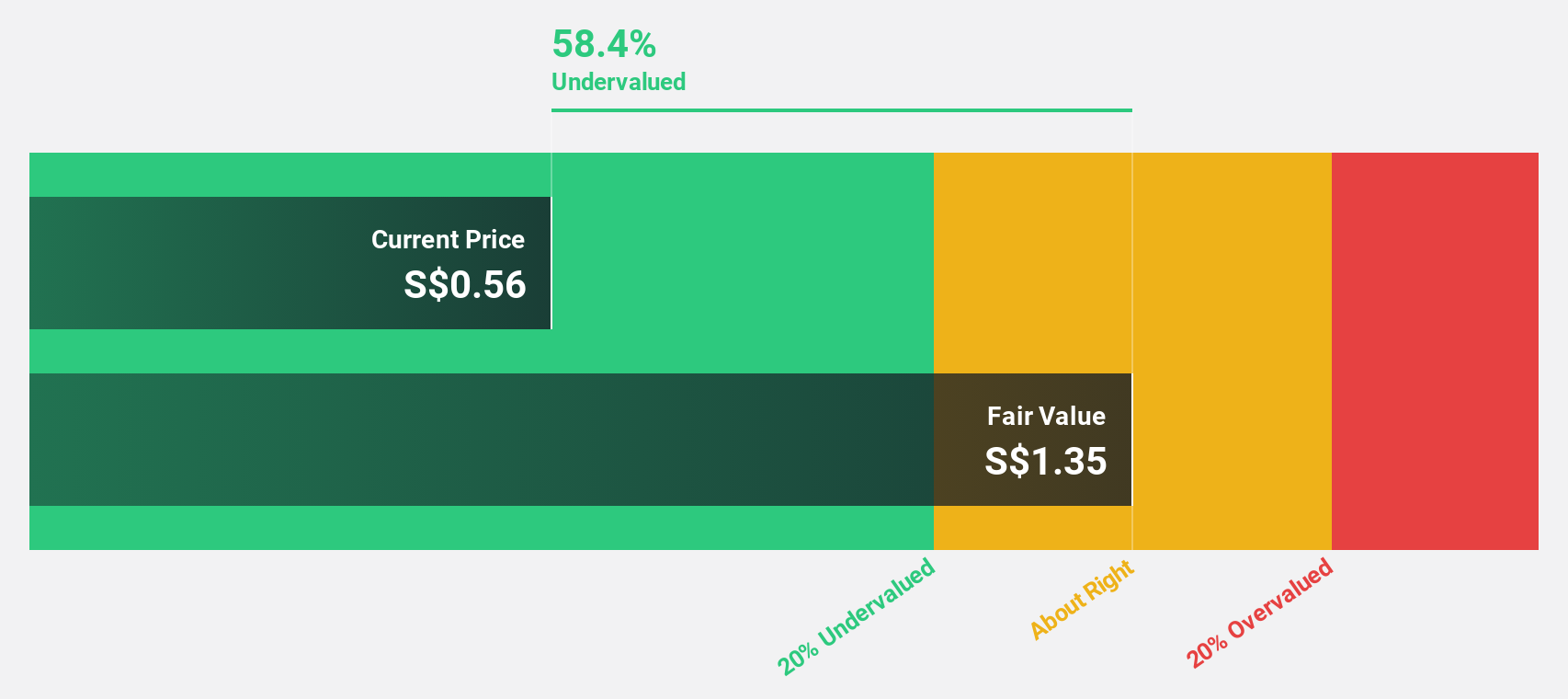

Estimated Discount To Fair Value: 42.7%

Nanofilm Technologies International, trading at SGD0.83, is significantly undervalued against a DCF-calculated fair value of SGD1.45. Despite a sharp decline in profit margins from 18.5% to 1.8% over the past year, earnings are expected to surge by very large amounts annually for the next three years, outpacing Singapore's market growth estimates significantly. Recent corporate guidance reinforces optimism for FY2024 with anticipated higher revenues and profits, supporting its potential recovery and growth trajectory despite current financial weaknesses.

- Upon reviewing our latest growth report, Nanofilm Technologies International's projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in Nanofilm Technologies International's balance sheet health report.

Where To Now?

- Unlock more gems! Our Undervalued SGX Stocks Based On Cash Flows screener has unearthed 4 more companies for you to explore.Click here to unveil our expertly curated list of 7 Undervalued SGX Stocks Based On Cash Flows.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Digital Core REIT is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:DCRU

Digital Core REIT

Digital Core REIT (SGX: DCRU) is a leading pure-play data centre REIT listed in Singapore and sponsored by Digital Realty, the largest global data centre owner and operator.

Reasonable growth potential and fair value.