Hanwell Holdings (SGX:DM0) Has A Pretty Healthy Balance Sheet

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Hanwell Holdings Limited (SGX:DM0) does carry debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Hanwell Holdings

What Is Hanwell Holdings's Net Debt?

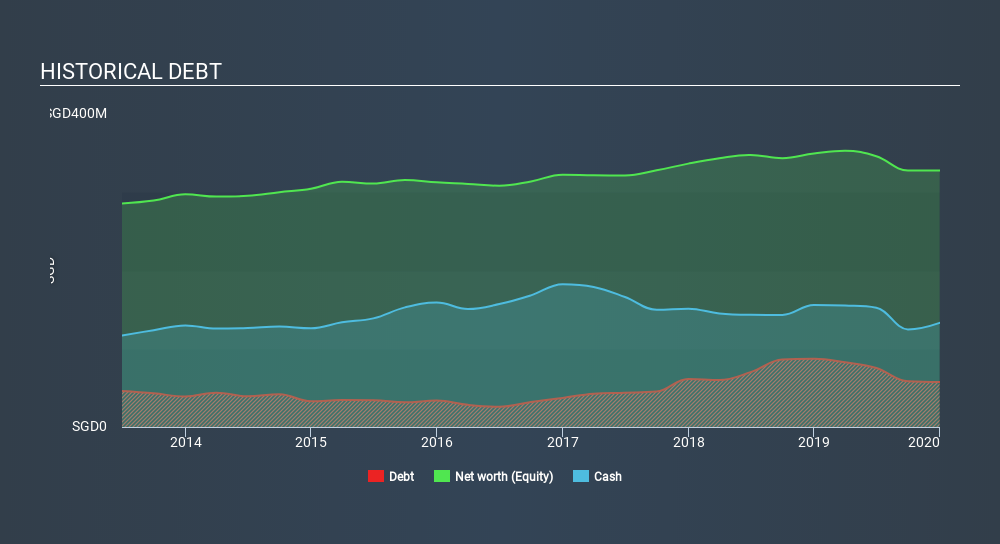

The image below, which you can click on for greater detail, shows that Hanwell Holdings had debt of S$57.5m at the end of December 2019, a reduction from S$87.2m over a year. However, its balance sheet shows it holds S$133.1m in cash, so it actually has S$75.6m net cash.

How Strong Is Hanwell Holdings's Balance Sheet?

According to the last reported balance sheet, Hanwell Holdings had liabilities of S$121.4m due within 12 months, and liabilities of S$38.9m due beyond 12 months. Offsetting this, it had S$133.1m in cash and S$129.8m in receivables that were due within 12 months. So it actually has S$102.5m more liquid assets than total liabilities.

This surplus liquidity suggests that Hanwell Holdings's balance sheet could take a hit just as well as Homer Simpson's head can take a punch. On this view, lenders should feel as safe as the beloved of a black-belt karate master. Succinctly put, Hanwell Holdings boasts net cash, so it's fair to say it does not have a heavy debt load!

On the other hand, Hanwell Holdings saw its EBIT drop by 8.4% in the last twelve months. If earnings continue to decline at that rate the company may have increasing difficulty managing its debt load. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Hanwell Holdings's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. Hanwell Holdings may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Over the last three years, Hanwell Holdings saw substantial negative free cash flow, in total. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Summing up

While we empathize with investors who find debt concerning, you should keep in mind that Hanwell Holdings has net cash of S$75.6m, as well as more liquid assets than liabilities. So we don't have any problem with Hanwell Holdings's use of debt. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 3 warning signs for Hanwell Holdings that you should be aware of.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About SGX:DM0

PSC

Supplies provisions and household consumer products in Singapore, Malaysia, China, and internationally.

Flawless balance sheet and fair value.

Market Insights

Community Narratives