- Singapore

- /

- Healthcare Services

- /

- SGX:QC7

3 Asian Penny Stocks With Market Caps Up To US$600M

Reviewed by Simply Wall St

As global markets respond to evolving economic data and geopolitical developments, investors are increasingly attentive to opportunities in diverse regions, including Asia. Penny stocks, while often seen as a throwback term, remain an intriguing option for those interested in smaller or newer companies with the potential for growth. By focusing on firms with strong financials and clear growth paths, investors can uncover valuable opportunities within this segment of the market.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Food Moments (SET:FM) | THB3.98 | THB3.93B | ✅ 4 ⚠️ 0 View Analysis > |

| JBM (Healthcare) (SEHK:2161) | HK$2.92 | HK$2.38B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.55 | HK$958.71M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.58 | HK$2.15B | ✅ 3 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.635 | SGD257.36M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.16 | HK$1.94B | ✅ 4 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.87 | SGD11.3B | ✅ 5 ⚠️ 1 View Analysis > |

| Ekarat Engineering (SET:AKR) | THB0.94 | THB1.38B | ✅ 2 ⚠️ 2 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.95 | NZ$135.23M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.68 | THB9.46B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 974 stocks from our Asian Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

China Financial International Investments (SEHK:721)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: China Financial International Investments Limited is a publicly owned investment manager focusing on listed and unlisted companies in Hong Kong and China, with a market cap of HK$1.03 billion.

Operations: The company's revenue segments include Clean Energy with -HK$39.31 million and Real Estate and Natural Gas with -HK$6.11 million.

Market Cap: HK$1.03B

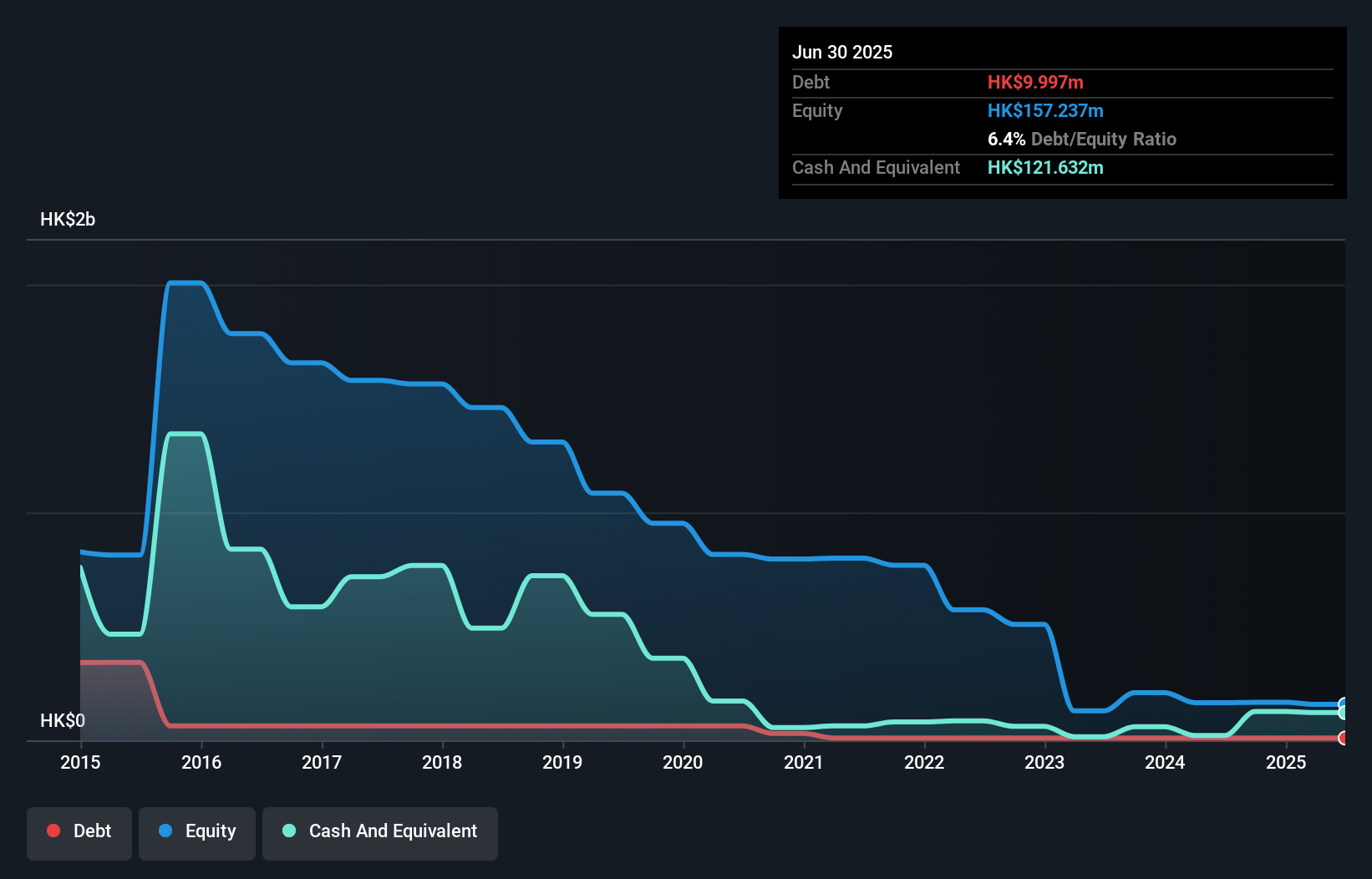

China Financial International Investments Limited, with a market cap of HK$1.03 billion, operates as a pre-revenue entity focused on investments in Hong Kong and China. Despite being unprofitable, the company has managed to reduce its losses by 14.3% annually over the past five years and maintains a strong cash position exceeding its total debt. Recent board changes bring seasoned expertise in energy and technology sectors, potentially enhancing strategic direction. However, significant insider selling raises concerns about internal confidence. The company's short-term assets comfortably cover both long-term and short-term liabilities, providing financial stability amidst volatility.

- Get an in-depth perspective on China Financial International Investments' performance by reading our balance sheet health report here.

- Gain insights into China Financial International Investments' past trends and performance with our report on the company's historical track record.

Jiumaojiu International Holdings (SEHK:9922)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Jiumaojiu International Holdings Limited operates Chinese cuisine restaurant brands across several countries, including China, Singapore, Canada, Malaysia, the United States, Thailand and Indonesia with a market cap of HK$4.08 billion.

Operations: The company's revenue is primarily generated from its Tai Er segment with CN¥4.41 billion, followed by Song Hot Pot at CN¥894.97 million and Jiu Mao Jiu at CN¥546.18 million.

Market Cap: HK$4.08B

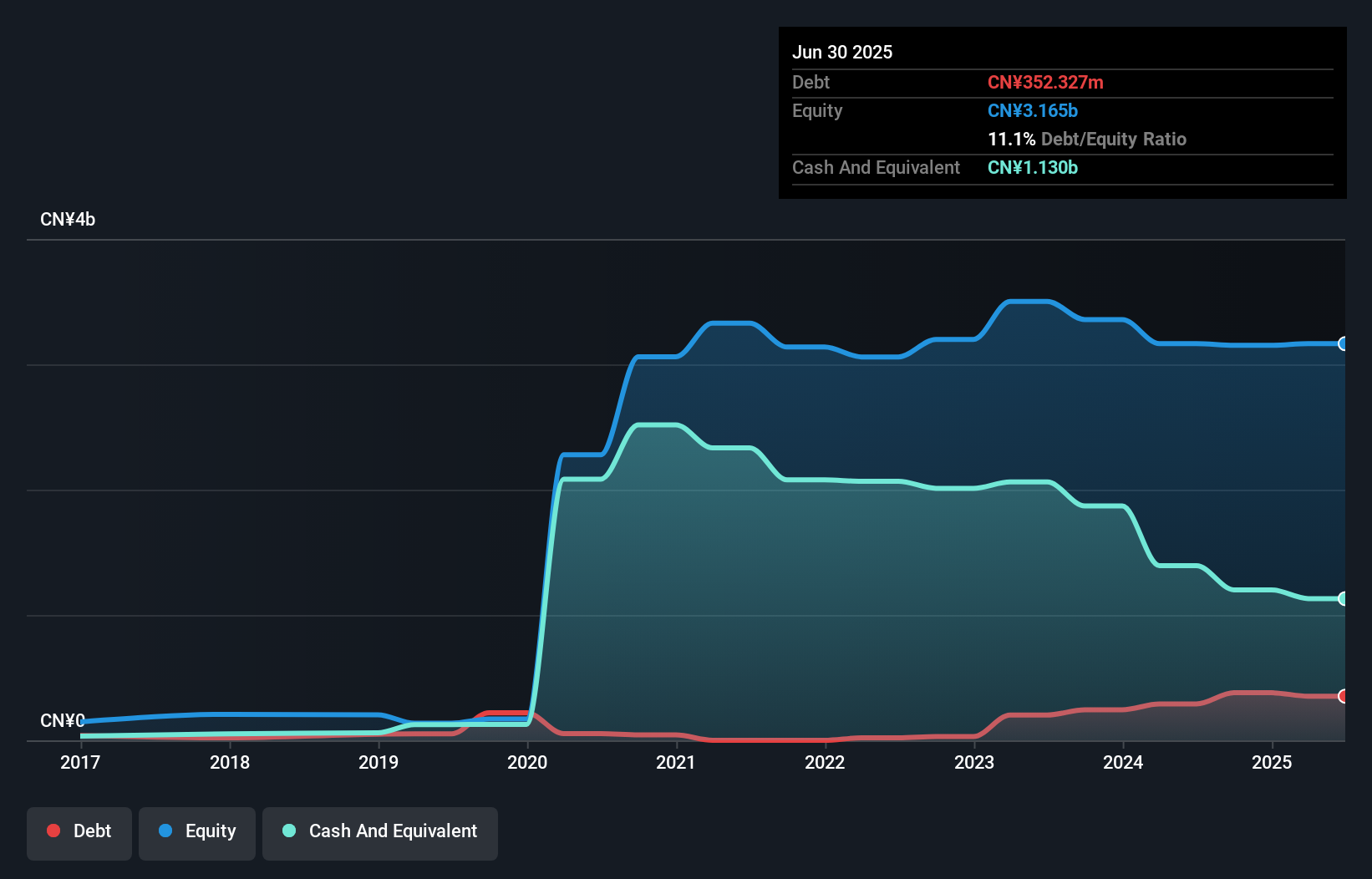

Jiumaojiu International Holdings, with a market cap of HK$4.08 billion, primarily generates revenue from its Tai Er segment (CN¥4.41 billion). Despite recent dividend announcements, the company faces challenges with declining profit margins at 0.9% compared to 7.6% last year and negative earnings growth of -87.7%. However, it maintains financial resilience through more cash than total debt and operating cash flow covering debt by 257.2%. The board is experienced with an average tenure of 4.3 years, though management is relatively new at 1.8 years on average, which may impact strategic continuity amidst high volatility reduction from 11% to 6%.

- Dive into the specifics of Jiumaojiu International Holdings here with our thorough balance sheet health report.

- Examine Jiumaojiu International Holdings' earnings growth report to understand how analysts expect it to perform.

Q & M Dental Group (Singapore) (SGX:QC7)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Q & M Dental Group (Singapore) Limited is an investment holding company that offers private dental healthcare services across Singapore, Malaysia, China, and internationally, with a market cap of S$439.94 million.

Operations: The company's revenue primarily comes from its core dental business, which generated S$176.77 million.

Market Cap: SGD439.94M

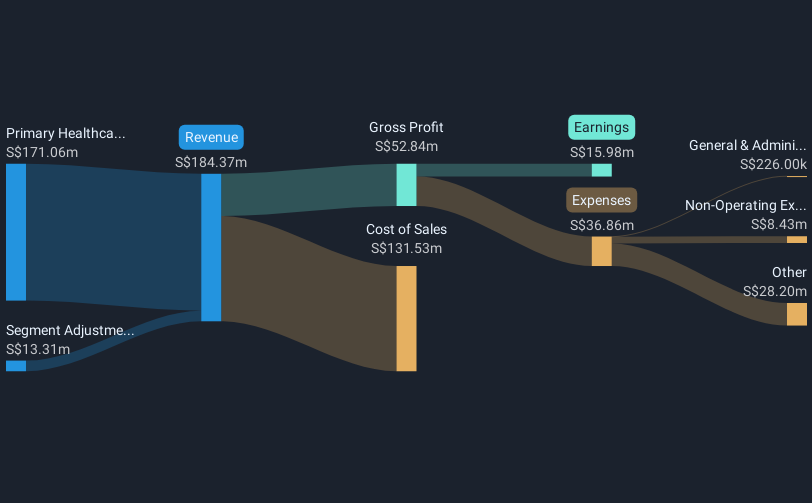

Q & M Dental Group (Singapore) Limited, with a market cap of S$439.94 million, primarily derives revenue from its dental services, reporting S$176.77 million in sales. Recent earnings showed a decline in net income to SGD 3.86 million for the half year ended June 2025, down from SGD 9.65 million the previous year. The company recently completed a SGD 130 million fixed-income offering at a rate of 3.95%, enhancing its financial flexibility despite lower profit margins and negative earnings growth over the past year. While short-term liabilities are well covered by assets, long-term liabilities remain uncovered by current assets.

- Jump into the full analysis health report here for a deeper understanding of Q & M Dental Group (Singapore).

- Evaluate Q & M Dental Group (Singapore)'s prospects by accessing our earnings growth report.

Seize The Opportunity

- Discover the full array of 974 Asian Penny Stocks right here.

- Interested In Other Possibilities? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Q & M Dental Group (Singapore) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:QC7

Q & M Dental Group (Singapore)

An investment holding company, provides private dental healthcare services in Singapore, Malaysia, China, and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives