SGX Dividend Stocks Spotlight Featuring Aztech Global And Two Others

Reviewed by Simply Wall St

As global financial landscapes evolve, the Singapore market remains a focal point for investors seeking stability and growth amidst innovations like the integration of traditional banking with digital assets. In this dynamic environment, understanding what constitutes a good dividend stock is crucial, especially considering factors such as company fundamentals, dividend history, and resilience in changing economic conditions.

Top 10 Dividend Stocks In Singapore

| Name | Dividend Yield | Dividend Rating |

| BRC Asia (SGX:BEC) | 7.02% | ★★★★★☆ |

| China Sunsine Chemical Holdings (SGX:QES) | 6.31% | ★★★★★☆ |

| Multi-Chem (SGX:AWZ) | 8.44% | ★★★★★☆ |

| UOL Group (SGX:U14) | 3.78% | ★★★★★☆ |

| Bumitama Agri (SGX:P8Z) | 6.78% | ★★★★★☆ |

| UOB-Kay Hian Holdings (SGX:U10) | 6.76% | ★★★★★☆ |

| Civmec (SGX:P9D) | 5.62% | ★★★★★☆ |

| Singapore Exchange (SGX:S68) | 3.55% | ★★★★★☆ |

| Singapore Airlines (SGX:C6L) | 6.90% | ★★★★★☆ |

| YHI International (SGX:BPF) | 6.77% | ★★★★★☆ |

Click here to see the full list of 21 stocks from our Top SGX Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Aztech Global (SGX:8AZ)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aztech Global Ltd. specializes in the design and manufacturing of IoT devices, data-communication products, and LED lighting, operating across Singapore, North America, China, Europe, and other international markets with a market capitalization of approximately SGD 0.79 billion.

Operations: Aztech Global Ltd. generates its revenue from the design and production of IoT devices, data-communication products, and LED lighting solutions.

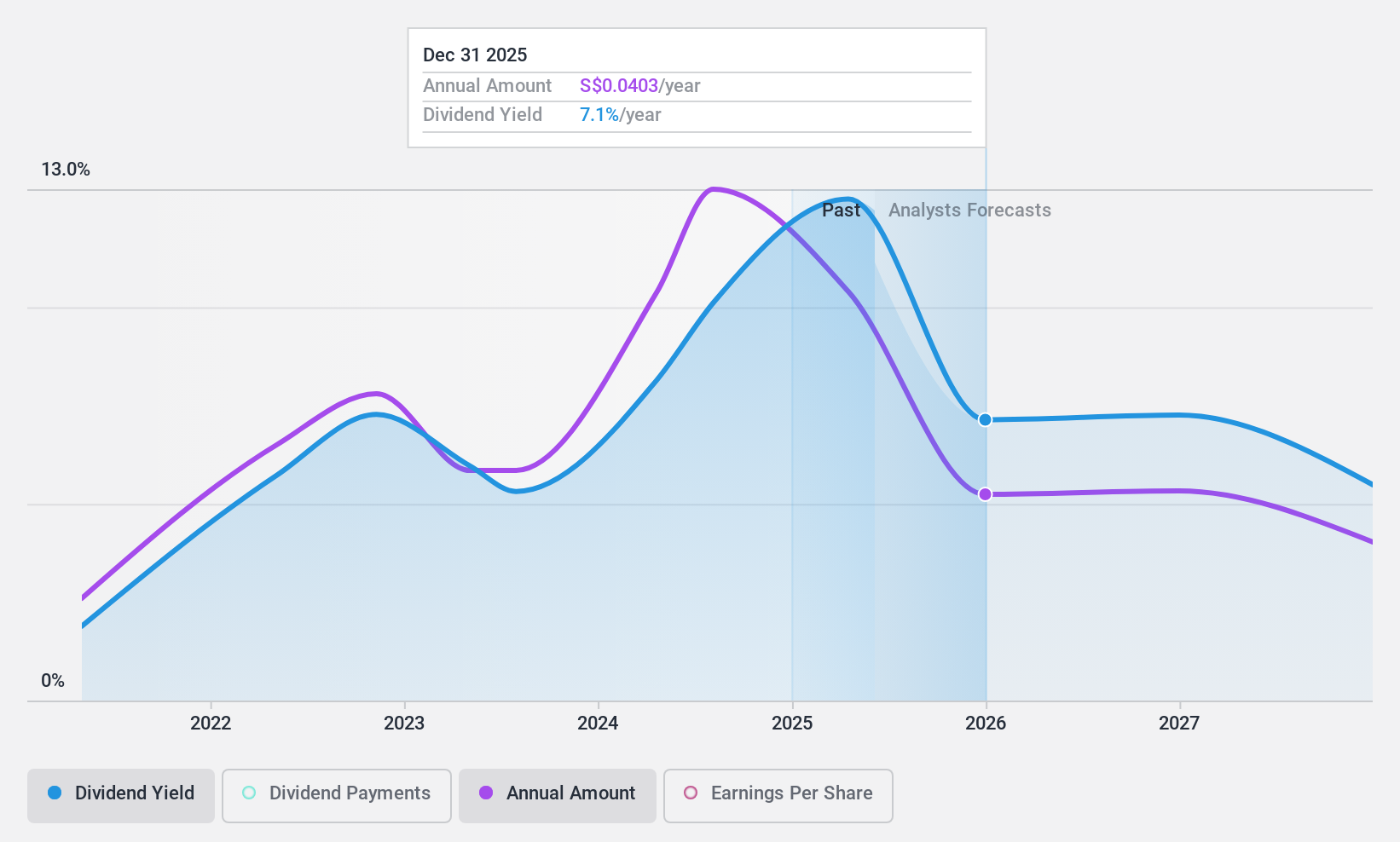

Dividend Yield: 7.8%

Aztech Global's dividend, while high at 7.84%, shows signs of volatility and unreliability over its short 3-year history of payouts. Despite trading at 65.7% below its estimated fair value and showing a strong earnings growth of 53.7% last year, the dividends are only moderately covered by earnings (61.7%) and cash flows (77.9%). Recent financials indicate a drop in sales to SGD 128.6 million from SGD 161.6 million year-over-year, although net income rose to SGD 15.9 million from SGD 13.4 million, suggesting some resilience.

- Unlock comprehensive insights into our analysis of Aztech Global stock in this dividend report.

- According our valuation report, there's an indication that Aztech Global's share price might be on the cheaper side.

Bumitama Agri (SGX:P8Z)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bumitama Agri Ltd. is an investment holding company that produces and trades crude palm oil, palm kernel, and related products in Indonesia, with a market capitalization of approximately SGD 1.21 billion.

Operations: Bumitama Agri Ltd. generates revenue primarily from its plantations and palm oil mills segment, which totaled IDR 15.44 billion.

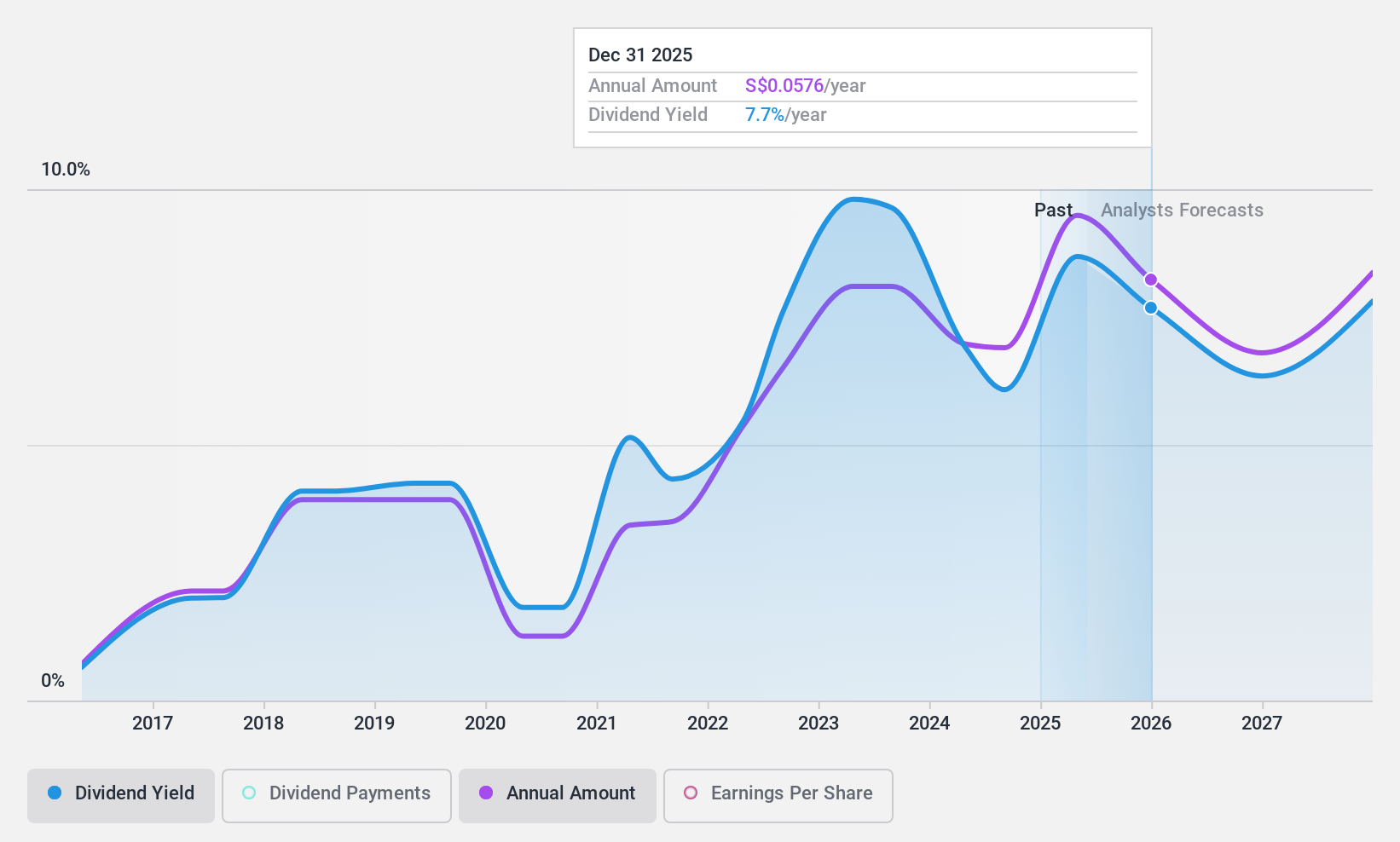

Dividend Yield: 6.8%

Bumitama Agri's dividend yield of 6.78% ranks in the top 25% for Singapore, supported by a moderate payout ratio of 40.4% and a cash payout ratio of 60.8%, indicating dividends are well-covered by both earnings and cash flow. However, its dividend history has been inconsistent over the past decade, reflecting some risk in its future payouts. The recent appointment of Ms Ng Yi Wayn as an Independent Non-Executive Director could bring fresh oversight to governance, potentially impacting future financial stability and dividend policies.

- Click here and access our complete dividend analysis report to understand the dynamics of Bumitama Agri.

- Our valuation report here indicates Bumitama Agri may be undervalued.

Civmec (SGX:P9D)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Civmec Limited is an investment holding company that offers construction and engineering services to sectors including energy, resources, infrastructure, and marine and defense in Australia, with a market capitalization of approximately SGD 451.76 million.

Operations: Civmec Limited generates revenue from three primary segments: Energy (A$46.02 million), Resources (A$752.82 million), and Infrastructure, Marine & Defence (A$105.52 million).

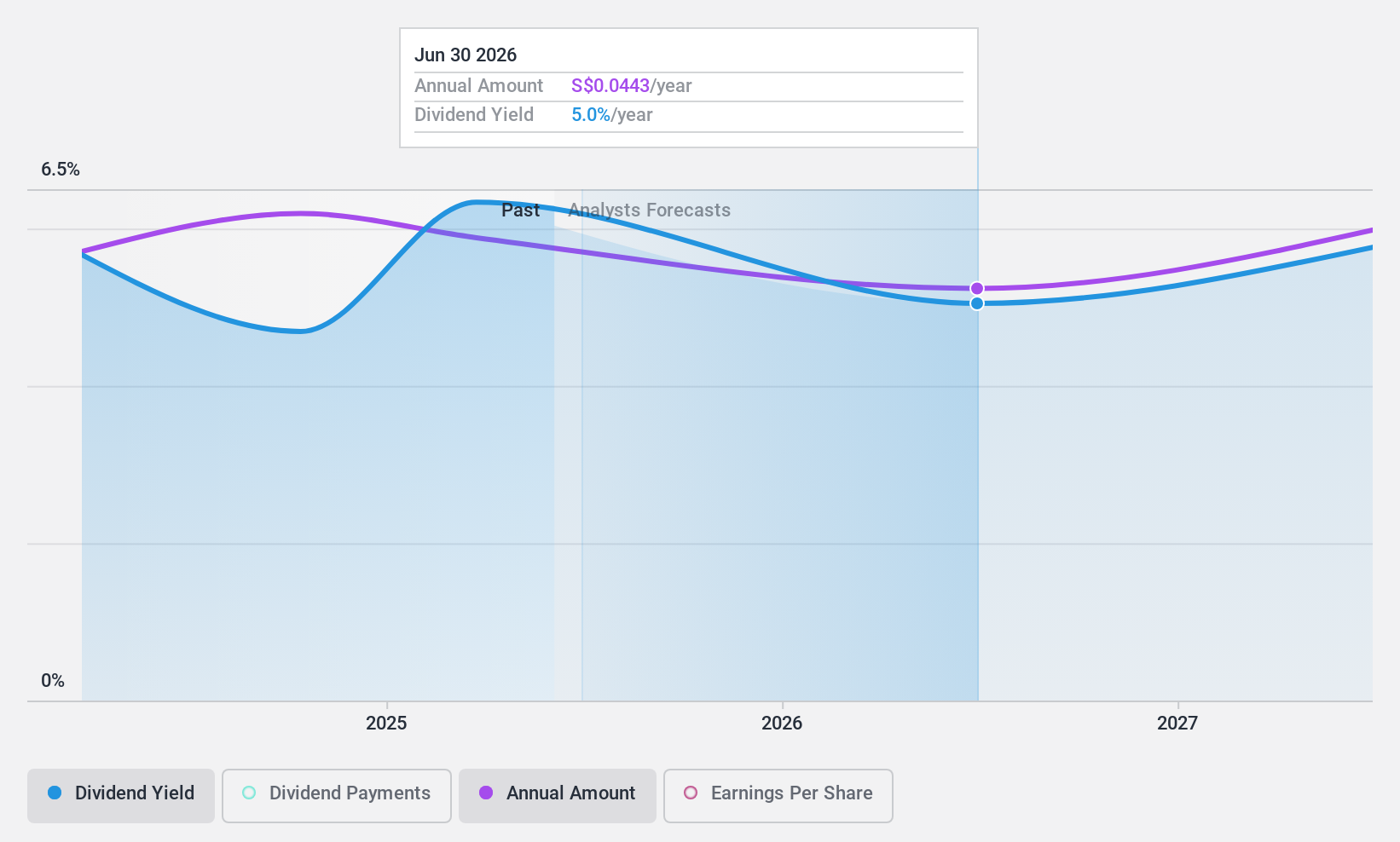

Dividend Yield: 5.6%

Civmec maintains a balanced approach to dividend sustainability, evidenced by a modest payout ratio of 45.4% and a cash payout ratio of 27%, ensuring dividends are well-supported by both earnings and cash flows. Despite its dividend yield of 5.62% being below the top quartile in Singapore's market, Civmec has demonstrated reliability with stable dividends over the past decade and consistent growth in earnings at an annual rate of 37.3%. Recent contracts totaling A$174 million across various sectors underscore ongoing business expansion, enhancing its financial stability.

- Dive into the specifics of Civmec here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Civmec is priced lower than what may be justified by its financials.

Make It Happen

- Embark on your investment journey to our 21 Top SGX Dividend Stocks selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bumitama Agri might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:P8Z

Bumitama Agri

An investment holding company, engages in the production of crude palm oil (CPO) and palm kernel (PK) in Indonesia.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives