Even With A 27% Surge, Cautious Investors Are Not Rewarding Bumitama Agri Ltd.'s (SGX:P8Z) Performance Completely

Despite an already strong run, Bumitama Agri Ltd. (SGX:P8Z) shares have been powering on, with a gain of 27% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 86% in the last year.

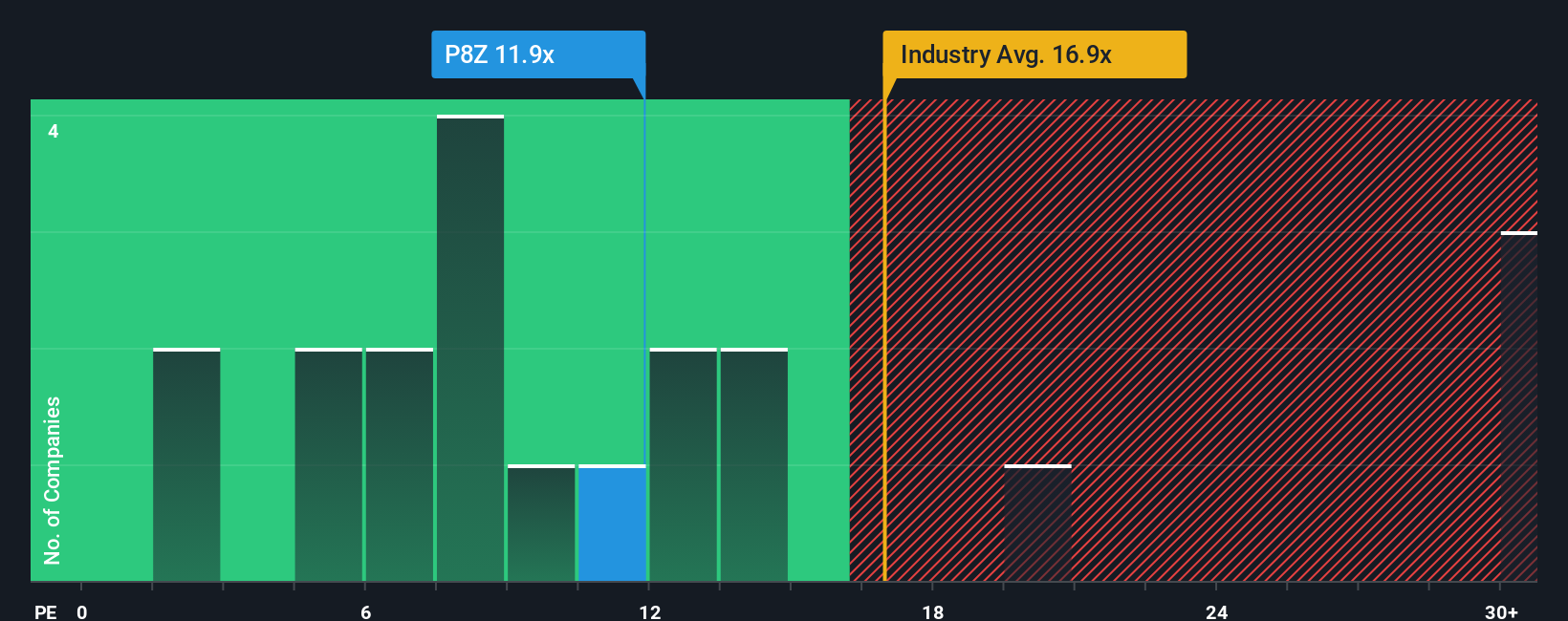

Although its price has surged higher, Bumitama Agri's price-to-earnings (or "P/E") ratio of 11.9x might still make it look like a buy right now compared to the market in Singapore, where around half of the companies have P/E ratios above 15x and even P/E's above 25x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

With earnings growth that's superior to most other companies of late, Bumitama Agri has been doing relatively well. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Bumitama Agri

Does Growth Match The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Bumitama Agri's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 27% last year. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 21% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 9.0% each year as estimated by the five analysts watching the company. With the market predicted to deliver 9.7% growth per year, the company is positioned for a comparable earnings result.

With this information, we find it odd that Bumitama Agri is trading at a P/E lower than the market. It may be that most investors are not convinced the company can achieve future growth expectations.

The Bottom Line On Bumitama Agri's P/E

The latest share price surge wasn't enough to lift Bumitama Agri's P/E close to the market median. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Bumitama Agri currently trades on a lower than expected P/E since its forecast growth is in line with the wider market. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Bumitama Agri, and understanding should be part of your investment process.

If you're unsure about the strength of Bumitama Agri's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Bumitama Agri might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:P8Z

Bumitama Agri

An investment holding company, engages in the production and trading of crude palm oil (CPO) and palm kernel (PK) in Indonesia.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives