We Ran A Stock Scan For Earnings Growth And Mewah International (SGX:MV4) Passed With Ease

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Mewah International (SGX:MV4). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Mewah International with the means to add long-term value to shareholders.

Check out our latest analysis for Mewah International

How Fast Is Mewah International Growing Its Earnings Per Share?

Mewah International has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. As a result, we'll zoom in on growth over the last year, instead. Mewah International's EPS skyrocketed from US$0.053 to US$0.076, in just one year; a result that's bound to bring a smile to shareholders. That's a fantastic gain of 42%.

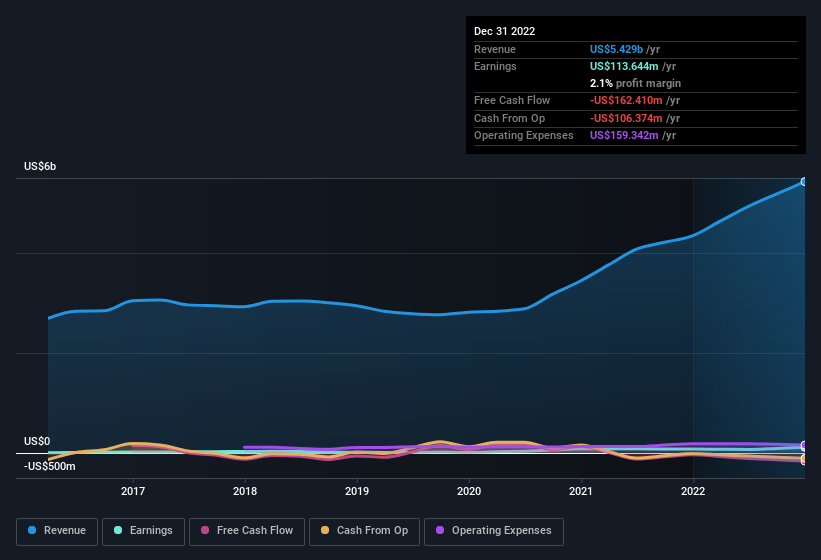

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Mewah International maintained stable EBIT margins over the last year, all while growing revenue 25% to US$5.4b. That's encouraging news for the company!

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Mewah International's balance sheet strength, before getting too excited.

Are Mewah International Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

First things first, there weren't any reports of insiders selling shares in Mewah International in the last 12 months. But the really good news is that COO, Head of Consumer Pack Segment & Executive Director Hui Hsin Cheo spent US$738k buying stock, at an average price of around US$0.43. Purchases like this can offer an insight into the faith of the company's management - and it seems to be all positive.

The good news, alongside the insider buying, for Mewah International bulls is that insiders (collectively) have a meaningful investment in the stock. With a whopping US$107m worth of shares as a group, insiders have plenty riding on the company's success. At 22% of the company, the co-investment by insiders fosters confidence that management will make long-term focussed decisions.

Does Mewah International Deserve A Spot On Your Watchlist?

You can't deny that Mewah International has grown its earnings per share at a very impressive rate. That's attractive. On top of that, insiders own a significant piece of the pie when it comes to the company's stock, and one has been buying more. So it's fair to say that this stock may well deserve a spot on your watchlist. However, before you get too excited we've discovered 3 warning signs for Mewah International (2 shouldn't be ignored!) that you should be aware of.

The good news is that Mewah International is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:MV4

Mewah International

An investment holding company, manufactures, refines, and sells vegetable oil products products in Malaysia, Singapore, rest of Asia, Africa, the Middle East, Pacific Oceania, the United States, and Europe.

Slight risk and slightly overvalued.

Market Insights

Community Narratives