Asian Market Spotlight: Be Friends Holding Among 3 Prominent Penny Stocks

Reviewed by Simply Wall St

As concerns over artificial intelligence valuations and economic uncertainties weigh on global markets, investors are seeking opportunities in less conventional spaces. Penny stocks, a term that may seem outdated but remains relevant, represent smaller or newer companies that can offer significant growth potential when backed by strong financials. In this context, we explore three penny stocks in Asia that combine balance sheet strength with promising prospects for those looking to uncover hidden value.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.53 | HK$946.34M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.48 | HK$2.06B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.04 | SGD421.5M | ✅ 4 ⚠️ 2 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.92 | THB2.95B | ✅ 3 ⚠️ 3 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.098 | SGD51.3M | ✅ 2 ⚠️ 4 View Analysis > |

| Gunkul Engineering (SET:GUNKUL) | THB1.89 | THB16.26B | ✅ 4 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.36 | SGD13.22B | ✅ 5 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$1.03 | NZ$146.62M | ✅ 2 ⚠️ 5 View Analysis > |

| ITE (Holdings) (SEHK:8092) | HK$0.029 | HK$26.84M | ✅ 2 ⚠️ 5 View Analysis > |

| Scott Technology (NZSE:SCT) | NZ$2.80 | NZ$235.47M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 959 stocks from our Asian Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Be Friends Holding (SEHK:1450)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Be Friends Holding Limited, with a market cap of HK$1.66 billion, is an investment holding company that offers all-media services in the People’s Republic of China.

Operations: The company generates revenue through its New Media Services segment, which amounts to CN¥1.19 billion.

Market Cap: HK$1.66B

Be Friends Holding Limited, with a market cap of HK$1.66 billion, presents a mixed picture for investors interested in penny stocks. The company has shown profitability growth over the past five years and maintains strong financial health with more cash than total debt and well-covered interest payments. However, recent earnings have declined significantly, with net profit margins dropping to 3.7% from 13.7% last year despite revenue growth to CN¥618.86 million for the half-year ended June 2025. The management team is experienced, yet challenges remain as earnings volatility persists amid industry headwinds.

- Jump into the full analysis health report here for a deeper understanding of Be Friends Holding.

- Assess Be Friends Holding's previous results with our detailed historical performance reports.

China Wantian Holdings (SEHK:1854)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: China Wantian Holdings Limited operates in the green food supply, catering chain, and environmental protection and technology sectors within the People’s Republic of China and Hong Kong, with a market cap of HK$2.20 billion.

Operations: The company's revenue is primarily derived from its food supply segment, which generated HK$1.09 billion, followed by its catering services at HK$59.04 million, and environmental protection and technology services contributing HK$0.96 million.

Market Cap: HK$2.2B

China Wantian Holdings Limited, with a market cap of HK$2.20 billion, operates in the green food supply and related sectors but remains unprofitable with increasing losses over the past five years. Despite revenue growth to HK$614.89 million for the half-year ended June 2025, net losses widened to HK$46.74 million from HK$17.22 million a year prior. The company faces financial challenges, including high share price volatility and a cash runway of less than one year if current free cash flow trends persist. Recent board changes highlight potential strategic shifts amid its exclusion from the S&P Global BMI Index in September 2025.

- Click here and access our complete financial health analysis report to understand the dynamics of China Wantian Holdings.

- Examine China Wantian Holdings' past performance report to understand how it has performed in prior years.

Food Empire Holdings (SGX:F03)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Food Empire Holdings Limited is an investment holding company that manufactures and distributes food and beverage products in Russia, Ukraine, Kazakhstan and CIS markets, South-East Asia, South Asia, and internationally with a market cap of SGD1.44 billion.

Operations: The company's revenue is primarily generated from South-East Asia ($225.94 million), Russia ($163.81 million), Ukraine, Kazakhstan and CIS ($135.79 million), and South Asia ($93.69 million).

Market Cap: SGD1.44B

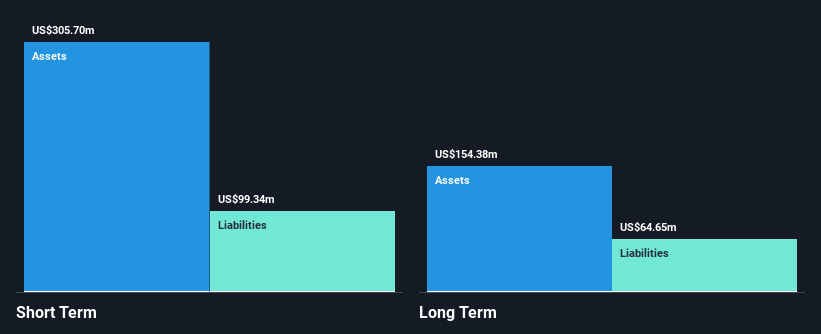

Food Empire Holdings Limited, with a market cap of SGD1.44 billion, demonstrates strong financial stability as its short-term assets significantly exceed liabilities. Recent revenue growth is notable, with a 28.3% quarterly increase to US$152.6 million and a 23.9% rise over nine months to US$426.7 million year-on-year. Despite the positive sales trajectory, the company faces challenges such as declining profit margins and negative earnings growth over the past year. However, it maintains high-quality earnings and sufficient cash flow to cover debt obligations while engaging in strategic share buybacks authorized by shareholders earlier this year.

- Take a closer look at Food Empire Holdings' potential here in our financial health report.

- Assess Food Empire Holdings' future earnings estimates with our detailed growth reports.

Seize The Opportunity

- Discover the full array of 959 Asian Penny Stocks right here.

- Curious About Other Options? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:F03

Food Empire Holdings

An investment holding company, operates as a food and beverage manufacturing and distribution company in Russia, Ukraine, Kazakhstan and CIS markets, South-East Asia, South Asia, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success