As global markets navigate a landscape marked by easing monetary policies and trade tensions, investors are increasingly seeking opportunities in lesser-known segments. Penny stocks, often seen as relics of past market eras, continue to offer intriguing prospects for growth when backed by strong financials and robust fundamentals. In this article, we'll explore several high-quality Asian penny stocks that stand out for their potential to deliver impressive returns amidst current market dynamics.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| JBM (Healthcare) (SEHK:2161) | HK$2.92 | HK$2.38B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.50 | HK$927.78M | ✅ 4 ⚠️ 1 View Analysis > |

| Asia Medical and Agricultural Laboratory and Research Center (SET:AMARC) | THB2.96 | THB1.24B | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.54 | HK$2.11B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.16 | SGD470.14M | ✅ 4 ⚠️ 1 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.094 | SGD49.21M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.34 | SGD13.14B | ✅ 5 ⚠️ 1 View Analysis > |

| Anton Oilfield Services Group (SEHK:3337) | HK$1.11 | HK$3B | ✅ 4 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.97 | NZ$139.5M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.32 | THB8.73B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 953 stocks from our Asian Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Food Empire Holdings (SGX:F03)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Food Empire Holdings Limited is an investment holding company involved in the manufacturing and distribution of food and beverage products across Russia, Ukraine, Kazakhstan and CIS markets, South-East Asia, South Asia, and internationally with a market capitalization of SGD1.27 billion.

Operations: The company's revenue is primarily derived from South-East Asia ($225.94 million), Russia ($163.81 million), Ukraine, Kazakhstan and CIS ($135.79 million), and South Asia ($93.69 million).

Market Cap: SGD1.27B

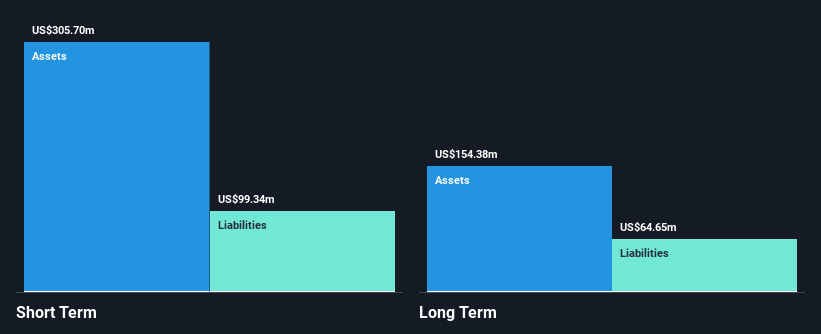

Food Empire Holdings, with a market cap of SGD 1.27 billion, has experienced fluctuating financial performance. Despite high-quality past earnings and a seasoned management team, the company recently reported a net loss of USD 1.45 million for H1 2025 compared to net income the previous year. Its debt is well-covered by operating cash flow and interest payments are comfortably managed by EBIT. However, profit margins have declined from last year and recent earnings growth was negative. The company completed a SGD 42.84 million follow-on equity offering in September 2025 and has initiated share buybacks authorized by shareholders earlier in the year.

- Click here and access our complete financial health analysis report to understand the dynamics of Food Empire Holdings.

- Examine Food Empire Holdings' earnings growth report to understand how analysts expect it to perform.

Yotrio Group (SZSE:002489)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Yotrio Group Co., Ltd. is engaged in the research, development, manufacturing, and sale of outdoor furniture products across China and various international markets, with a market cap of CN¥7.94 billion.

Operations: The company's revenue is primarily derived from Outdoor Leisure Home products, generating CN¥5.64 billion, followed by Metal products at CN¥234.18 million, and Travel and Consulting Services contributing CN¥0.61 million.

Market Cap: CN¥7.94B

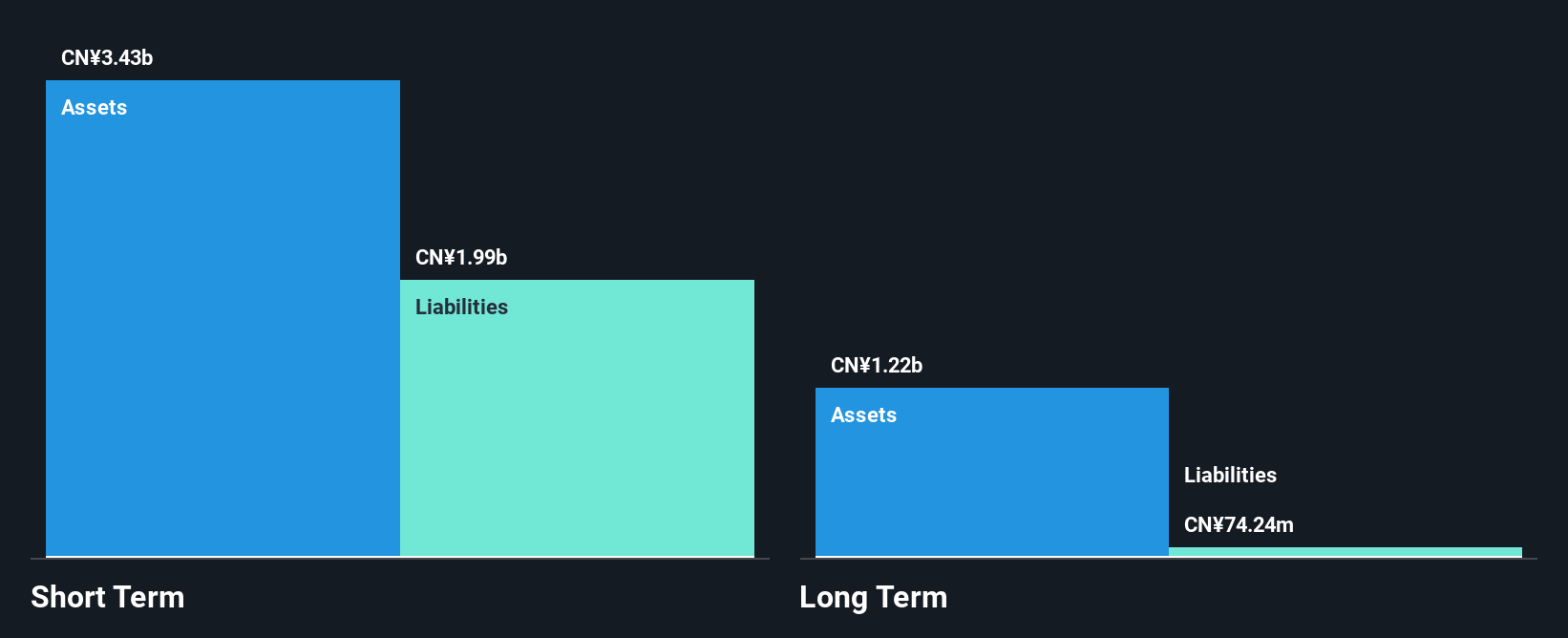

Yotrio Group, with a market cap of CN¥7.94 billion, has displayed mixed financial dynamics. The company reported revenue of CN¥3.08 billion for H1 2025, showing modest growth from the previous year. Despite earnings growth of 79.5% over the past year, this improvement was partly influenced by a large one-off gain of CN¥225.7 million. Yotrio's financial stability is supported by short-term assets exceeding liabilities and cash surpassing total debt, although its dividend track record remains unstable. Its price-to-earnings ratio (17x) suggests good value relative to the broader Chinese market average (44.9x).

- Click here to discover the nuances of Yotrio Group with our detailed analytical financial health report.

- Evaluate Yotrio Group's historical performance by accessing our past performance report.

Zhuzhou Tianqiao Crane (SZSE:002523)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhuzhou Tianqiao Crane Co., Ltd. manufactures and sells material handling equipment for the electrolytic aluminum, steel, construction machinery, and non-ferrous industries both in China and internationally, with a market cap of CN¥6.08 billion.

Operations: The company's revenue is primarily derived from its Material Handling Equipment segment, which generated CN¥1.67 billion, while the Accessories and Others segment contributed CN¥292.71 million.

Market Cap: CN¥6.08B

Zhuzhou Tianqiao Crane, with a market cap of CN¥6.08 billion, has shown a positive trajectory in recent performance, reporting H1 2025 revenue of CN¥795.49 million, up from the previous year. Earnings grew by 10% over the past year, surpassing industry growth rates despite a historical decline of 4.4% annually over five years. The company's financial health is robust with short-term assets covering both short and long-term liabilities and cash exceeding total debt. However, its Return on Equity remains low at 1.8%, and earnings were impacted by a significant one-off gain of CN¥13.8 million recently added to the S&P Global BMI Index.

- Jump into the full analysis health report here for a deeper understanding of Zhuzhou Tianqiao Crane.

- Gain insights into Zhuzhou Tianqiao Crane's past trends and performance with our report on the company's historical track record.

Turning Ideas Into Actions

- Investigate our full lineup of 953 Asian Penny Stocks right here.

- Seeking Other Investments? Uncover 16 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhuzhou Tianqiao Crane might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002523

Zhuzhou Tianqiao Crane

Manufactures and sells material handling equipment for electrolytic aluminum, steel, construction machinery, and non-ferrous industries in China and internationally.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives