- Hong Kong

- /

- Real Estate

- /

- SEHK:88

3 Penny Stocks With Market Caps Larger Than US$100M To Watch

Reviewed by Simply Wall St

Global markets have experienced notable fluctuations recently, with U.S. stocks retracting some gains amid uncertainty surrounding the incoming administration's policies and potential impacts on corporate earnings. In this context, investors are increasingly looking for opportunities that balance risk and reward, such as those found in penny stocks. Although the term "penny stock" may seem outdated, these smaller or newer companies can offer substantial growth potential when supported by robust financials. We'll explore three penny stocks that stand out for their financial strength and potential to provide significant returns for investors seeking hidden value in quality companies.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.21 | MYR340.59M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.48 | MYR2.39B | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.77 | MYR133.38M | ★★★★★★ |

| Kelington Group Berhad (KLSE:KGB) | MYR3.40 | MYR2.35B | ★★★★★☆ |

| Seafco (SET:SEAFCO) | THB1.99 | THB1.61B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.60 | A$70.33M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.875 | MYR290.45M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$539.57M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.76 | £373.95M | ★★★★☆☆ |

| Embark Early Education (ASX:EVO) | A$0.81 | A$148.62M | ★★★★☆☆ |

Click here to see the full list of 5,802 stocks from our Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Daphne International Holdings (SEHK:210)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Daphne International Holdings Limited is an investment holding company involved in the distribution, retailing, and licensing of footwear and accessories in Mainland China, with a market cap of HK$494.65 million.

Operations: The company generates revenue of CN¥322.15 million from its Footwear Products and Accessories segment.

Market Cap: HK$494.65M

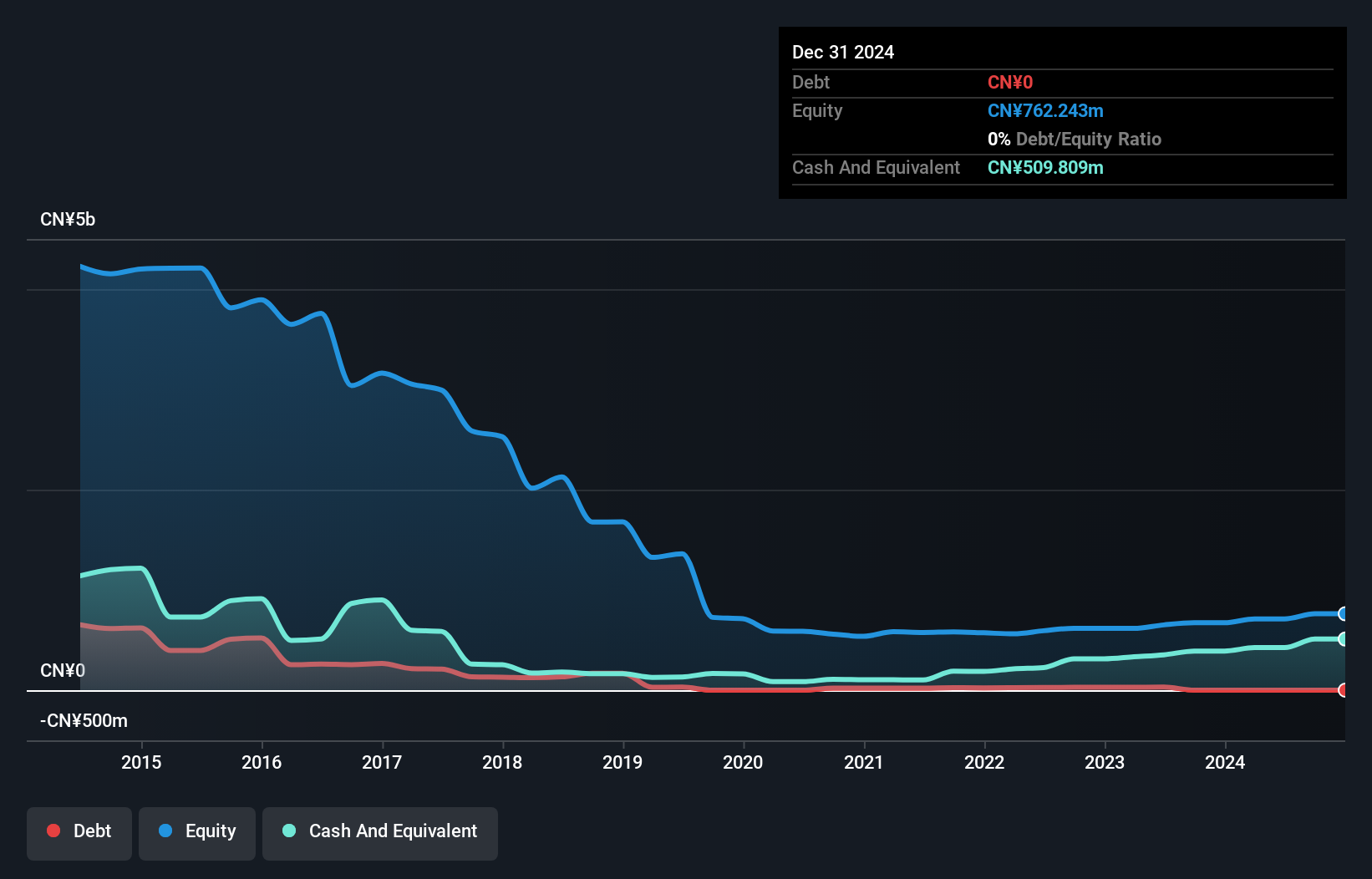

Daphne International Holdings Limited has demonstrated significant financial improvement, with recent earnings growth of 75.1% over the past year and a net profit margin increase from 21.5% to 27.3%. The company reported half-year sales of CN¥168.8 million, up from CN¥109.29 million the previous year, alongside a net income rise to CN¥56.06 million. Daphne is debt-free, enhancing its financial stability and reducing risk exposure for investors interested in penny stocks. Despite trading at a substantial discount to its estimated fair value, it maintains high-quality earnings and has not diluted shareholders recently.

- Click to explore a detailed breakdown of our findings in Daphne International Holdings' financial health report.

- Evaluate Daphne International Holdings' historical performance by accessing our past performance report.

Tai Cheung Holdings (SEHK:88)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tai Cheung Holdings Limited is an investment holding company involved in property investment, development, and management in Hong Kong and the United States, with a market cap of HK$1.88 billion.

Operations: The company's revenue is primarily derived from Property Development and Leasing, contributing HK$111.8 million, followed by Property Management at HK$9.9 million.

Market Cap: HK$1.88B

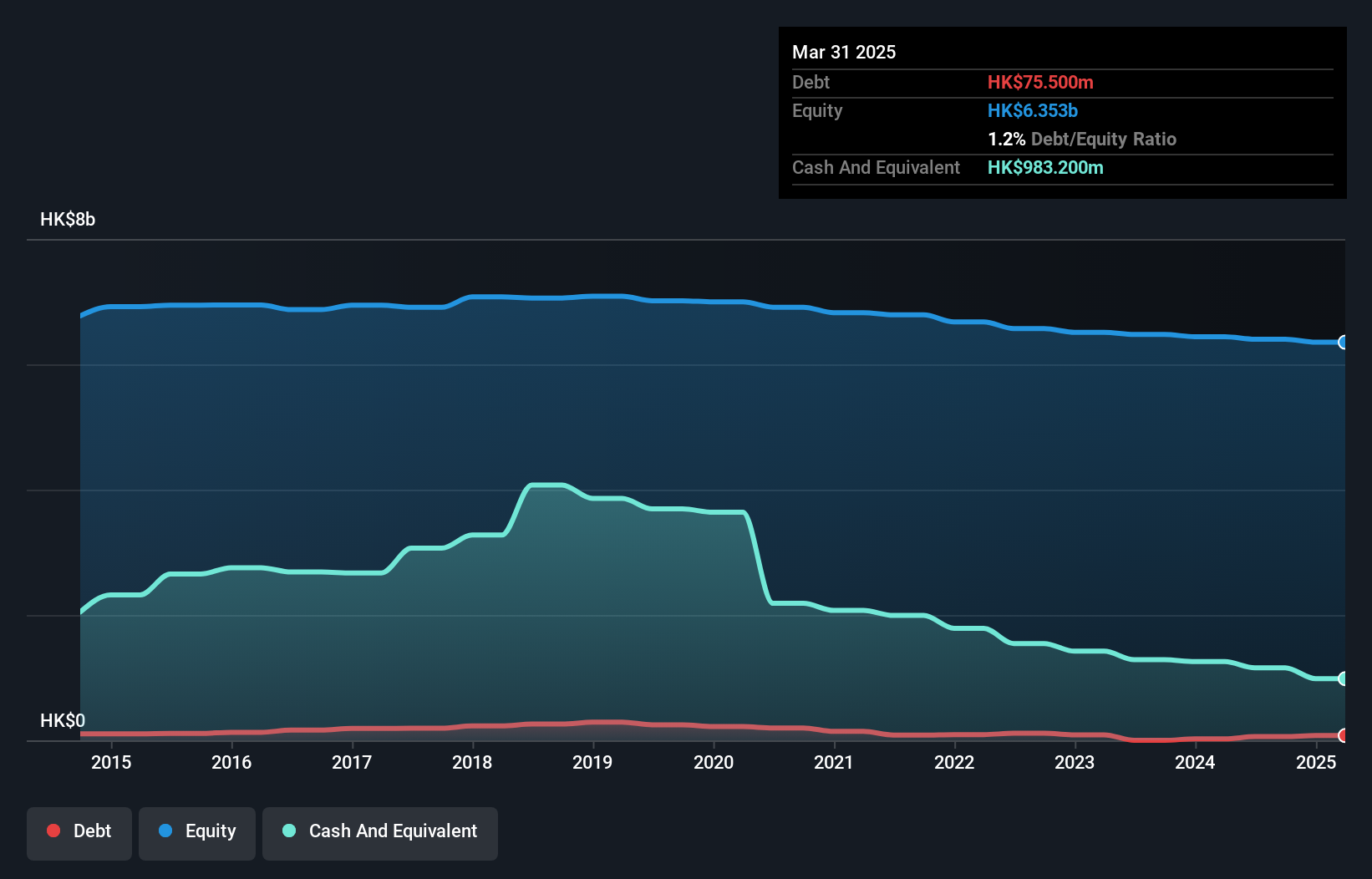

Tai Cheung Holdings Limited, with a market cap of HK$1.88 billion, has shown financial resilience by becoming profitable recently despite past earnings declines averaging 51.1% annually over five years. The company generates significant revenue from Property Development and Leasing (HK$111.8 million) and maintains a strong balance sheet with short-term assets of HK$6.4 billion exceeding both short-term (HK$191 million) and long-term liabilities (HK$32.5 million). However, its dividend yield of 7.89% is not well covered by earnings or free cash flows, reflecting potential sustainability issues for income-focused investors in penny stocks.

- Take a closer look at Tai Cheung Holdings' potential here in our financial health report.

- Examine Tai Cheung Holdings' earnings growth report to understand how analysts expect it to perform.

RH PetroGas (SGX:T13)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: RH PetroGas Limited is an investment holding company involved in the exploration, development, and production of oil and gas resources in Indonesia, with a market cap of SGD135.30 million.

Operations: No revenue segments have been reported for RH PetroGas Limited.

Market Cap: SGD135.3M

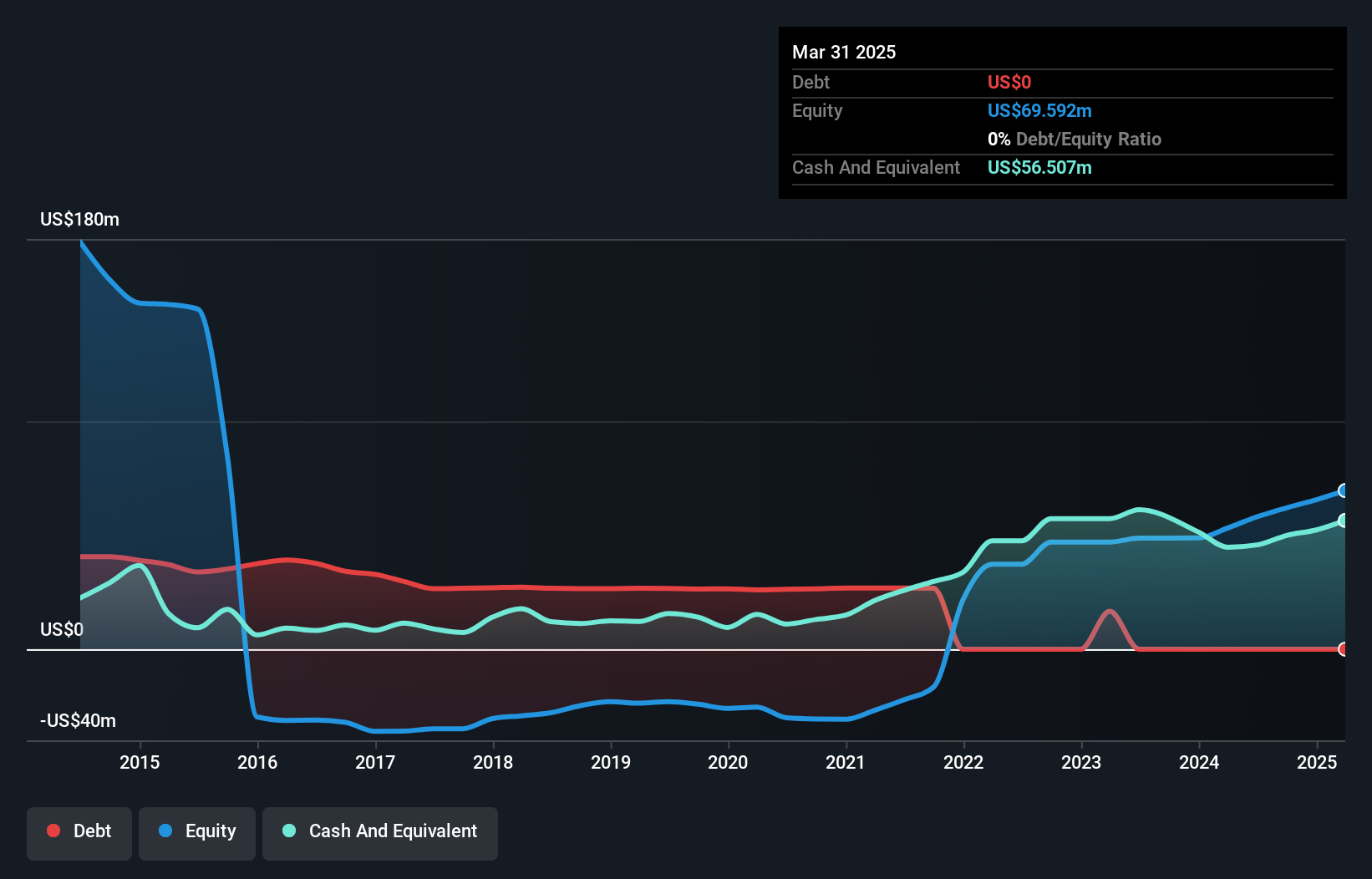

RH PetroGas Limited, with a market cap of SGD135.30 million, has demonstrated significant earnings growth, reporting net income of US$10.46 million for the first nine months of 2024 compared to US$3.36 million the previous year. The company's financial health is underscored by its debt-free status and strong asset position, with short-term assets significantly exceeding liabilities. Despite a large one-off loss impacting recent results, RH PetroGas achieved a higher profit margin this year and is trading well below estimated fair value. Recent developments include successful testing at the Piarawi-1 exploration well in Indonesia, expected to commence production soon.

- Unlock comprehensive insights into our analysis of RH PetroGas stock in this financial health report.

- Gain insights into RH PetroGas' outlook and expected performance with our report on the company's earnings estimates.

Summing It All Up

- Unlock our comprehensive list of 5,802 Penny Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tai Cheung Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:88

Tai Cheung Holdings

An investment holding company, engages in property investment, development, and management businesses in Hong Kong and the United States.

High growth potential with proven track record.

Market Insights

Community Narratives